Are Cathay Chemical Works Inc.'s (TPE:1713) Mixed Financials Driving The Negative Sentiment?

With its stock down 6.1% over the past month, it is easy to disregard Cathay Chemical Works (TPE:1713). We, however decided to study the company's financials to determine if they have got anything to do with the price decline. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. In this article, we decided to focus on Cathay Chemical Works' ROE.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. Put another way, it reveals the company's success at turning shareholder investments into profits.

View our latest analysis for Cathay Chemical Works

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Cathay Chemical Works is:

3.2% = NT$72m ÷ NT$2.3b (Based on the trailing twelve months to September 2020).

The 'return' refers to a company's earnings over the last year. So, this means that for every NT$1 of its shareholder's investments, the company generates a profit of NT$0.03.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Cathay Chemical Works' Earnings Growth And 3.2% ROE

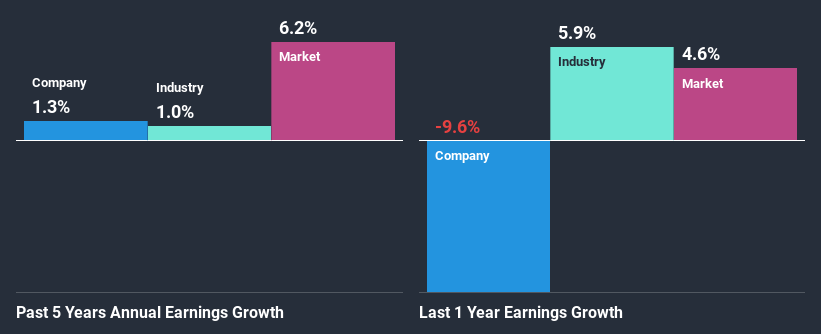

At first glance, Cathay Chemical Works' ROE doesn't look very promising. Next, when compared to the average industry ROE of 7.7%, the company's ROE leaves us feeling even less enthusiastic. As a result, Cathay Chemical Works' flat net income growth over the past five years doesn't come as a surprise given its lower ROE.

We then compared Cathay Chemical Works' net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 1.0% in the same period.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. Doing so will help them establish if the stock's future looks promising or ominous. Is Cathay Chemical Works fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Cathay Chemical Works Making Efficient Use Of Its Profits?

The high three-year median payout ratio of 94% (meaning, the company retains only 5.9% of profits) for Cathay Chemical Works suggests that the company's earnings growth was miniscule as a result of paying out a majority of its earnings.

Additionally, Cathay Chemical Works has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Conclusion

In total, we're a bit ambivalent about Cathay Chemical Works' performance. Although the company has shown a pretty impressive growth in earnings, yet the low ROE and the low rate of reinvestment makes us skeptical about the continuity of that growth, especially when or if the business comes to face any threats. So far, we've only made a quick discussion around the company's earnings growth. To gain further insights into Cathay Chemical Works' past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you decide to trade Cathay Chemical Works, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1713

Cathay Chemical Works

Manufactures and sells specialty and fine chemicals under the CATHAY brand in Taiwan.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives