Here's Why Shuang-Bang Industrial (GTSM:6506) Has A Meaningful Debt Burden

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Shuang-Bang Industrial Corp. (GTSM:6506) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Shuang-Bang Industrial

What Is Shuang-Bang Industrial's Net Debt?

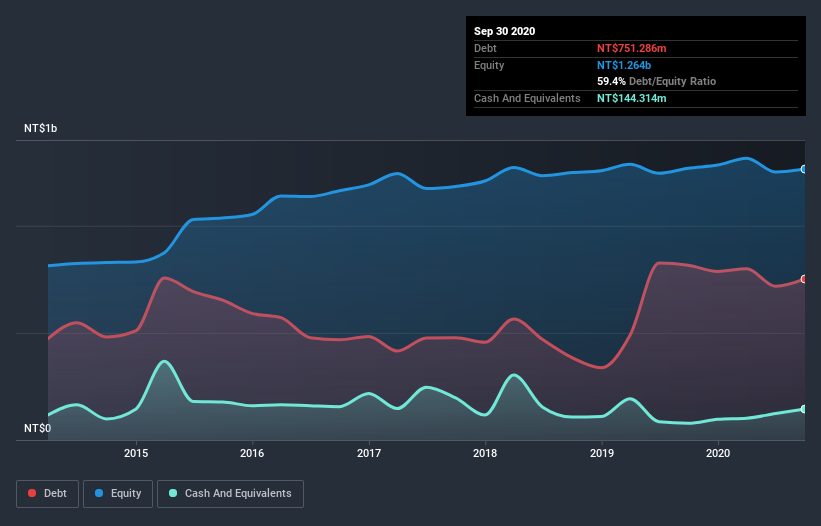

The image below, which you can click on for greater detail, shows that Shuang-Bang Industrial had debt of NT$751.3m at the end of September 2020, a reduction from NT$815.8m over a year. However, because it has a cash reserve of NT$144.3m, its net debt is less, at about NT$607.0m.

How Strong Is Shuang-Bang Industrial's Balance Sheet?

We can see from the most recent balance sheet that Shuang-Bang Industrial had liabilities of NT$472.2m falling due within a year, and liabilities of NT$627.4m due beyond that. Offsetting this, it had NT$144.3m in cash and NT$295.5m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$659.8m.

While this might seem like a lot, it is not so bad since Shuang-Bang Industrial has a market capitalization of NT$1.31b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Shuang-Bang Industrial has a debt to EBITDA ratio of 3.8 and its EBIT covered its interest expense 6.1 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Importantly, Shuang-Bang Industrial's EBIT fell a jaw-dropping 44% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. There's no doubt that we learn most about debt from the balance sheet. But it is Shuang-Bang Industrial's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. During the last three years, Shuang-Bang Industrial burned a lot of cash. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Shuang-Bang Industrial's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. Having said that, its ability to cover its interest expense with its EBIT isn't such a worry. Overall, it seems to us that Shuang-Bang Industrial's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 4 warning signs for Shuang-Bang Industrial (of which 1 is significant!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Shuang-Bang Industrial, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6506

Shuang-Bang Industrial

Develops and manufactures polyurethane (PU) resins for shoes, synthetic leather cross linkers, and polyol resins in Taiwan.

Slight with mediocre balance sheet.