As global markets navigate a landscape of easing inflation and robust bank earnings, major U.S. stock indices have rebounded, with value stocks notably outperforming growth shares, particularly in the energy sector. Amid this backdrop of economic optimism and market resilience, identifying stocks with strong fundamentals becomes crucial for investors seeking potential opportunities in small-cap sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Great Giant Fibre Garment (TPEX:4441)

Simply Wall St Value Rating: ★★★★★★

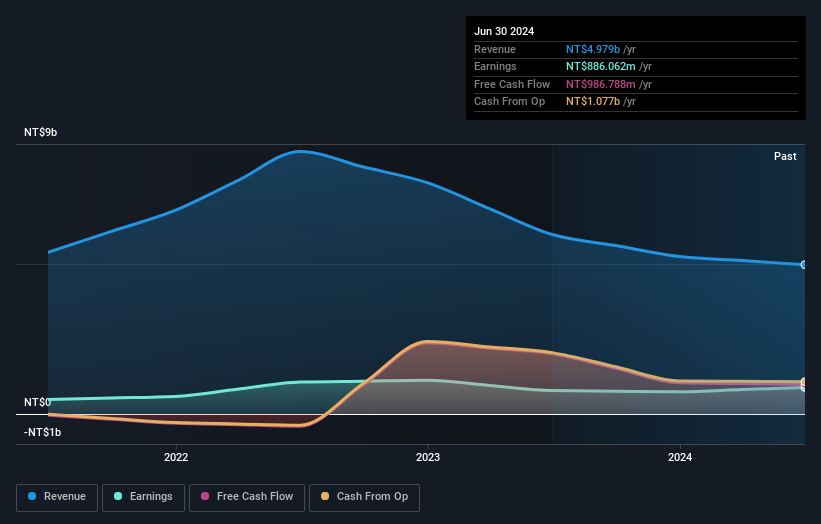

Overview: Great Giant Fibre Garment Co., Ltd. is a Taiwanese company that focuses on manufacturing and selling garments and textiles, with a market capitalization of NT$16.28 billion.

Operations: Great Giant Fibre Garment generates revenue primarily from its clothing business sales and manufacturing, amounting to NT$5.74 billion.

Great Giant Fibre Garment, a smaller player in the luxury sector, has shown impressive financial health with no debt currently compared to a 31.4% debt-to-equity ratio five years ago. Its earnings have increased by 18.4% annually over the past five years, although last year's growth of 13.4% lagged slightly behind the industry rate of 13.9%. The company demonstrates high-quality earnings and trades at a price-to-earnings ratio of 18.4x, undercutting the TW market average of 20.5x, suggesting potential value for investors seeking opportunities in lesser-known stocks within this segment.

SKY Perfect JSAT Holdings (TSE:9412)

Simply Wall St Value Rating: ★★★★★★

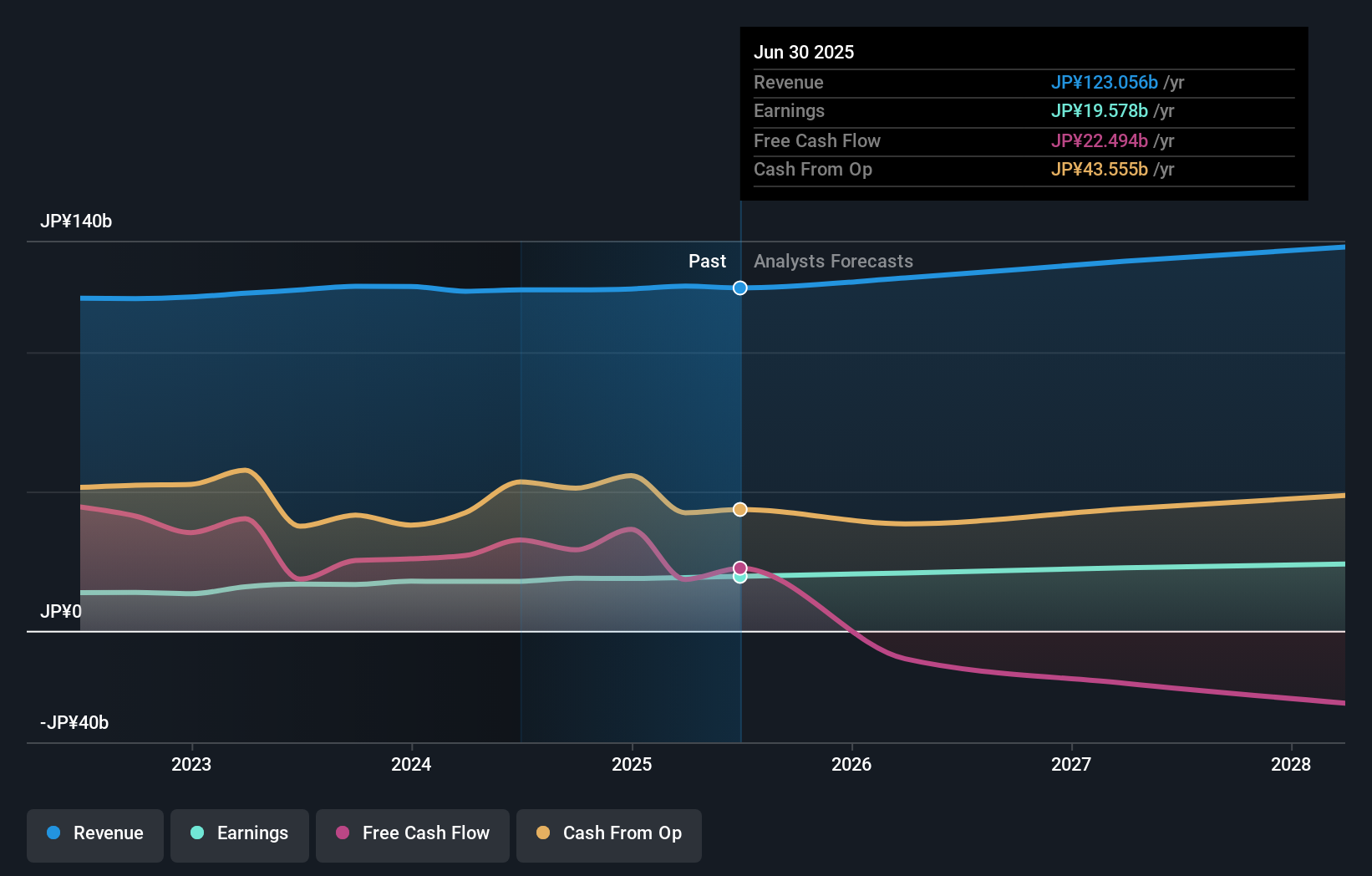

Overview: SKY Perfect JSAT Holdings Inc. offers satellite-based multichannel pay TV and satellite communications services mainly in Asia, with a market cap of ¥256.44 billion.

Operations: SKY Perfect JSAT Holdings generates revenue from satellite-based multichannel pay TV and satellite communications services. The company focuses on these core areas to drive its income streams.

With a market position that seems undervalued, SKY Perfect JSAT Holdings is trading at 38.3% below its estimated fair value, suggesting potential for appreciation. Over the past year, earnings have grown by 13.4%, outpacing the Media industry's 8.4% growth rate, highlighting robust performance in a competitive sector. The company's debt to equity ratio has impressively decreased from 46.7% to 21.7% over five years, indicating improved financial health and reduced leverage risk. Additionally, it maintains high-quality earnings and positive free cash flow, reinforcing its stability and attractiveness as an investment prospect in the satellite communication space.

- Unlock comprehensive insights into our analysis of SKY Perfect JSAT Holdings stock in this health report.

Understand SKY Perfect JSAT Holdings' track record by examining our Past report.

Greatek Electronics (TWSE:2441)

Simply Wall St Value Rating: ★★★★★★

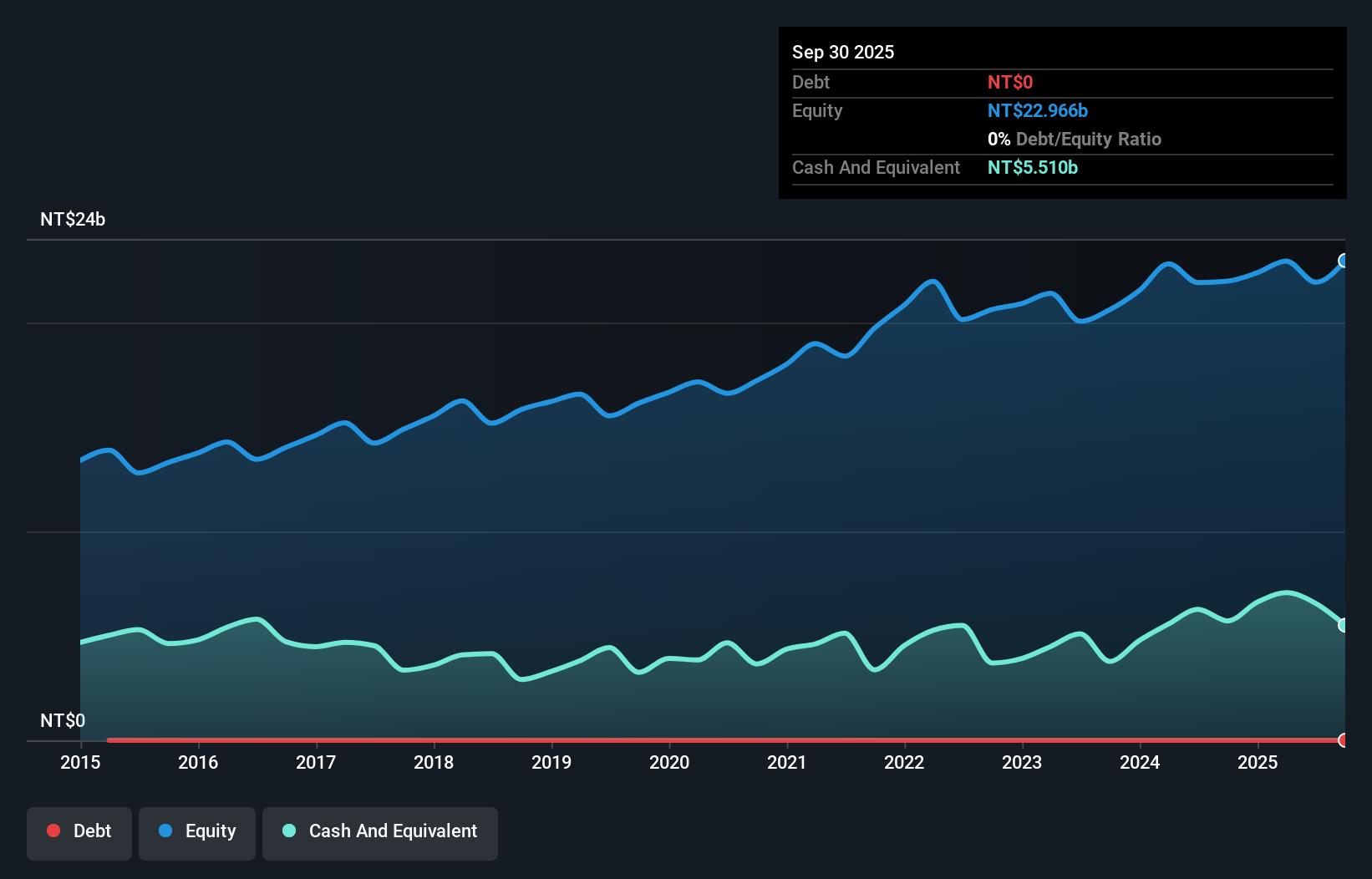

Overview: Greatek Electronics Inc. and its subsidiaries specialize in the packaging and testing of integrated circuits across Taiwan, Asia, America, Europe, and Africa with a market cap of NT$35.27 billion.

Operations: Greatek Electronics generates revenue primarily from its semiconductor segment, totaling NT$14.85 billion.

Greatek Electronics, a promising player in the semiconductor space, has shown robust earnings growth of 29% over the past year, outpacing the industry's 6%. With no debt on its books for five years and a price-to-earnings ratio of 15x below the TW market average of 21x, it presents an attractive valuation. Recent financials reveal sales for Q3 at TWD 3.86 billion compared to TWD 3.51 billion last year, and net income increased to TWD 673 million from TWD 594 million. Despite a slight annual earnings dip over five years by roughly less than one percent annually, its free cash flow remains positive.

Seize The Opportunity

- Embark on your investment journey to our 4658 Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4441

Great Giant Fibre Garment

Engages in manufacturing and selling garments and textiles in Taiwan.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion