Is Taihan Precision Technology (GTSM:1336) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Taihan Precision Technology Co., Ltd. (GTSM:1336) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Taihan Precision Technology

How Much Debt Does Taihan Precision Technology Carry?

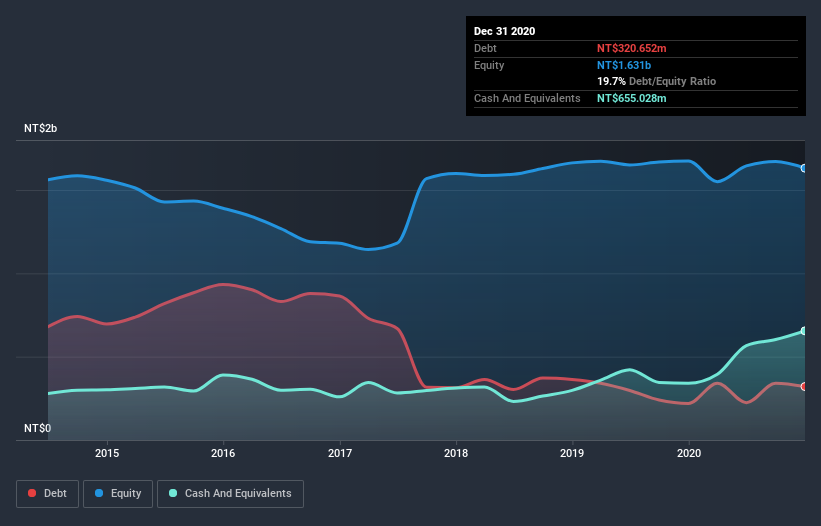

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Taihan Precision Technology had NT$320.7m of debt, an increase on NT$219.1m, over one year. However, it does have NT$655.0m in cash offsetting this, leading to net cash of NT$334.4m.

How Strong Is Taihan Precision Technology's Balance Sheet?

The latest balance sheet data shows that Taihan Precision Technology had liabilities of NT$575.4m due within a year, and liabilities of NT$247.1m falling due after that. On the other hand, it had cash of NT$655.0m and NT$355.0m worth of receivables due within a year. So it actually has NT$187.6m more liquid assets than total liabilities.

This surplus suggests that Taihan Precision Technology has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Taihan Precision Technology boasts net cash, so it's fair to say it does not have a heavy debt load!

The modesty of its debt load may become crucial for Taihan Precision Technology if management cannot prevent a repeat of the 39% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Taihan Precision Technology will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Taihan Precision Technology has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the last three years, Taihan Precision Technology actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that Taihan Precision Technology has net cash of NT$334.4m, as well as more liquid assets than liabilities. And it impressed us with free cash flow of NT$150m, being 110% of its EBIT. So we don't have any problem with Taihan Precision Technology's use of debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 2 warning signs for Taihan Precision Technology you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you’re looking to trade Taihan Precision Technology, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Taihan Precision Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:1336

Taihan Precision Technology

Engages in the design, development, manufacture, and sale of precision plastic injection molding, coating, and component assembling solutions in Taiwan, China, Vietnam, and Philippines.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)