There's No Escaping Cathay Financial Holding Co., Ltd.'s (TWSE:2882) Muted Earnings

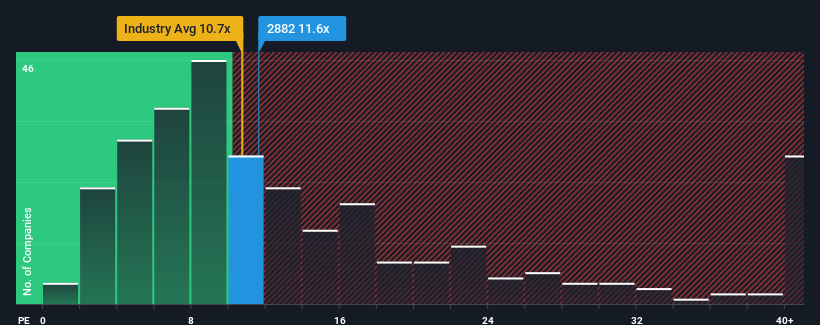

When close to half the companies in Taiwan have price-to-earnings ratios (or "P/E's") above 22x, you may consider Cathay Financial Holding Co., Ltd. (TWSE:2882) as an attractive investment with its 11.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for Cathay Financial Holding as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Cathay Financial Holding

Does Growth Match The Low P/E?

Cathay Financial Holding's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 347% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 41% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 5.0% per annum as estimated by the ten analysts watching the company. That's shaping up to be materially lower than the 14% per annum growth forecast for the broader market.

With this information, we can see why Cathay Financial Holding is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Cathay Financial Holding's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Cathay Financial Holding's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Cathay Financial Holding that you should be aware of.

If these risks are making you reconsider your opinion on Cathay Financial Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2882

Cathay Financial Holding

Through its subsidiaries, provides various financial products and services in Taiwan, rest of Asia, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives