The Market Doesn't Like What It Sees From Cathay Financial Holding Co., Ltd.'s (TWSE:2882) Earnings Yet

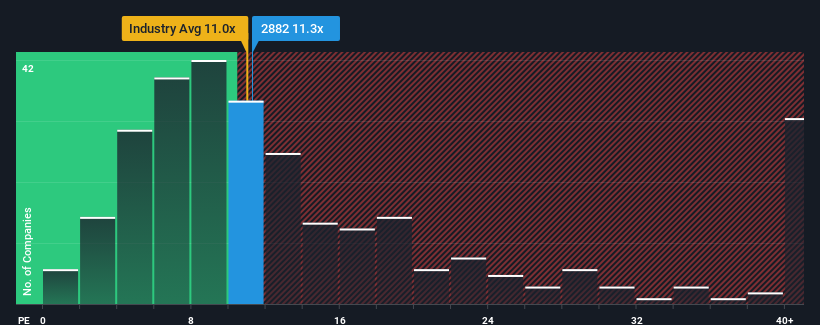

Cathay Financial Holding Co., Ltd.'s (TWSE:2882) price-to-earnings (or "P/E") ratio of 11.3x might make it look like a buy right now compared to the market in Taiwan, where around half of the companies have P/E ratios above 22x and even P/E's above 39x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's superior to most other companies of late, Cathay Financial Holding has been doing relatively well. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Cathay Financial Holding

Is There Any Growth For Cathay Financial Holding?

There's an inherent assumption that a company should underperform the market for P/E ratios like Cathay Financial Holding's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 118% last year. Still, incredibly EPS has fallen 38% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 15% as estimated by the nine analysts watching the company. That's shaping up to be materially lower than the 25% growth forecast for the broader market.

With this information, we can see why Cathay Financial Holding is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Cathay Financial Holding maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Cathay Financial Holding, and understanding should be part of your investment process.

If you're unsure about the strength of Cathay Financial Holding's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2882

Cathay Financial Holding

Through its subsidiaries, provides various financial products and services in Taiwan, rest of Asia, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives