- Taiwan

- /

- Personal Products

- /

- TWSE:6666

Know This Before Buying Luo Lih-Fen Holding Co., Ltd. (TPE:6666) For Its Dividend

Is Luo Lih-Fen Holding Co., Ltd. (TPE:6666) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

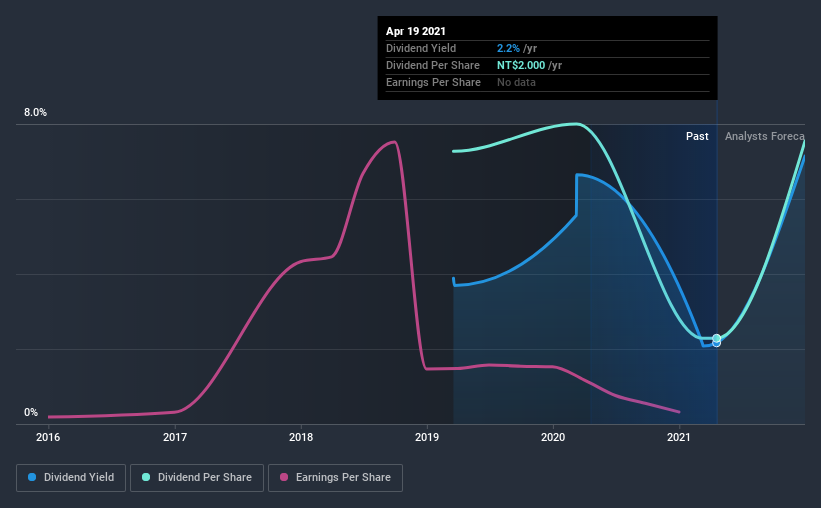

With only a two-year payment history, and a 2.2% yield, investors probably think Luo Lih-Fen Holding is not much of a dividend stock. While it may not look like much, if earnings are growing it could become quite interesting. Some simple research can reduce the risk of buying Luo Lih-Fen Holding for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Luo Lih-Fen Holding paid out 91% of its profit as dividends, over the trailing twelve month period. Its payout ratio is quite high, and the dividend is not well covered by earnings. If earnings are growing or the company has a large cash balance, this might be sustainable - still, we think it is a concern.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. Last year, Luo Lih-Fen Holding paid a dividend while reporting negative free cash flow. While there may be an explanation, we think this behaviour is generally not sustainable.

With a strong net cash balance, Luo Lih-Fen Holding investors may not have much to worry about in the near term from a dividend perspective.

Remember, you can always get a snapshot of Luo Lih-Fen Holding's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. This company's dividend has been unstable, and with a relatively short history, we think it's a little soon to draw strong conclusions about its long term dividend potential. During the past two-year period, the first annual payment was NT$6.4 in 2019, compared to NT$2.0 last year. This works out to a decline of approximately 69% over that time.

A shrinking dividend over a two-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS are growing. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see Luo Lih-Fen Holding has grown its earnings per share at 11% per annum over the past five years. While EPS are growing rapidly, Luo Lih-Fen Holding paid out a very high 91% of its income as dividends. If earnings continue to grow, this dividend may be sustainable, but we think a payout this high definitely bears watching.

Conclusion

When we look at a dividend stock, we need to form a judgement on whether the dividend will grow, if the company is able to maintain it in a wide range of economic circumstances, and if the dividend payout is sustainable. It's a concern to see that the company paid out such a high percentage of its earnings and cashflow as dividends. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. With this information in mind, we think Luo Lih-Fen Holding may not be an ideal dividend stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for Luo Lih-Fen Holding (of which 1 is potentially serious!) you should know about.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

When trading Luo Lih-Fen Holding or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:6666

Luo Lih-Fen Holding

Researches and develops, manufactures, and sells cosmetics and medical devices in Taiwan and Mainland China.

Excellent balance sheet and good value.

Market Insights

Community Narratives