- South Korea

- /

- Personal Products

- /

- KOSE:A278470

APR And 2 Other Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

In a week marked by volatility, global markets have been influenced by a mix of geopolitical tensions, central bank decisions, and competitive pressures in the AI sector. While the Dow Jones Industrial Average managed modest gains, other indices like the Nasdaq Composite faced declines due to emerging competition from Chinese AI developers and mixed corporate earnings reports. In such an environment, identifying stocks that may be trading below their estimated value can offer opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zhongji Innolight (SZSE:300308) | CN¥98.25 | CN¥195.56 | 49.8% |

| Reach Subsea (OB:REACH) | NOK8.06 | NOK16.12 | 50% |

| TF Bank (OM:TFBANK) | SEK376.00 | SEK750.28 | 49.9% |

| Telefonaktiebolaget LM Ericsson (OM:ERIC B) | SEK82.94 | SEK165.72 | 50% |

| Decisive Dividend (TSXV:DE) | CA$5.97 | CA$11.89 | 49.8% |

| Northwest Bancshares (NasdaqGS:NWBI) | US$13.23 | US$26.31 | 49.7% |

| Groupe Dynamite (TSX:GRGD) | CA$16.11 | CA$32.07 | 49.8% |

| WuXi XDC Cayman (SEHK:2268) | HK$28.25 | HK$56.12 | 49.7% |

| Sociedad Química y Minera de Chile (NYSE:SQM) | US$37.70 | US$75.20 | 49.9% |

| Kyndryl Holdings (NYSE:KD) | US$43.45 | US$86.66 | 49.9% |

Let's explore several standout options from the results in the screener.

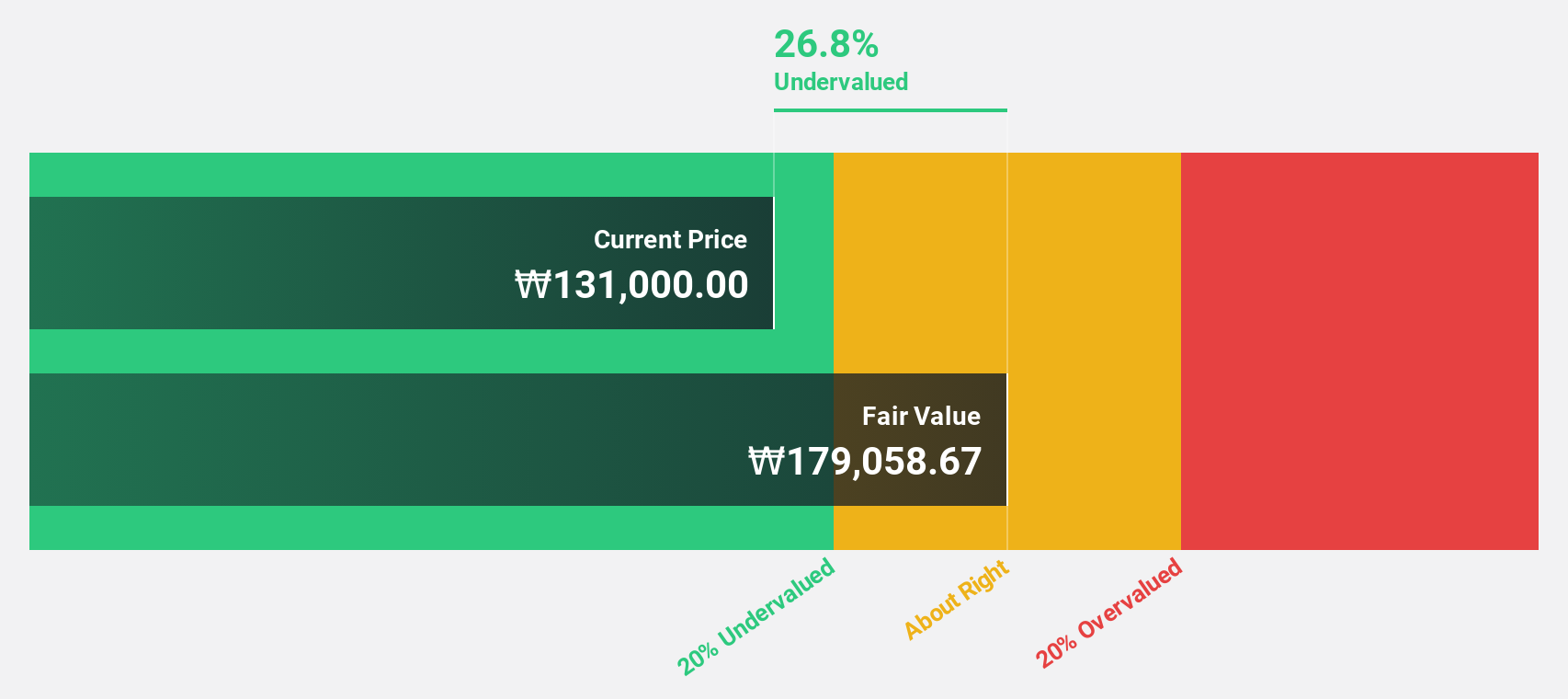

APR (KOSE:A278470)

Overview: APR Co., Ltd is a company that manufactures and sells cosmetic products for men and women, with a market cap of ₩1.77 billion.

Operations: The company's revenue is primarily derived from the Cosmetics Sector, contributing ₩693.18 million, followed by the Clothing Fashion Sector with ₩57.97 million.

Estimated Discount To Fair Value: 41.8%

APR Co., Ltd. is trading 41.8% below its estimated fair value of ₩81,581.64, indicating potential undervaluation based on cash flows. The company has initiated a share buyback program worth KRW 30 billion to stabilize stock prices and enhance shareholder value. Despite high non-cash earnings, APR's revenue is forecast to grow at 18.9% annually, surpassing the market average but with earnings growth trailing the market at 23.8%.

- The growth report we've compiled suggests that APR's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of APR.

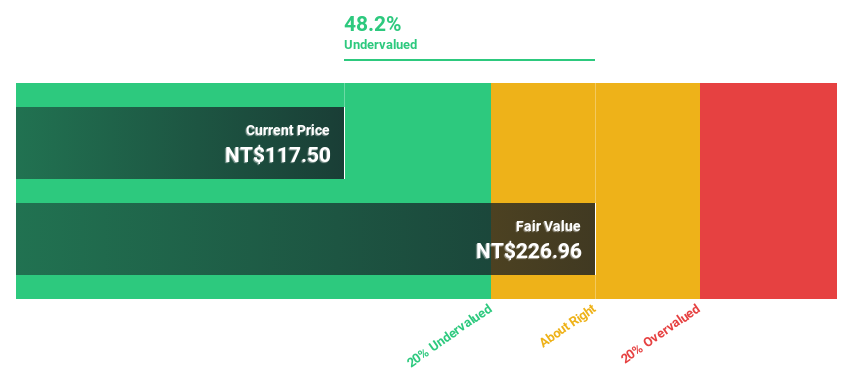

TCI (TPEX:8436)

Overview: TCI Co., Ltd. is an original design manufacturer that produces, wholesales, and retails health foods and cosmetics products in Taiwan, Mainland China, the United States, and internationally, with a market cap of NT$14.30 billion.

Operations: The company's revenue is primarily generated from Taiwan (NT$5.46 billion), followed by Asia (NT$2.43 billion) and the United States (NT$2.01 billion).

Estimated Discount To Fair Value: 48.9%

TCI Co., Ltd. is trading at NT$121.5, significantly below its estimated fair value of NT$237.74, highlighting potential undervaluation based on cash flows. Despite recent executive changes and a decline in earnings, the company's profits are forecast to grow at 30.2% per year, outpacing the market average of 17.5%. However, its dividend yield of 5.76% is not well supported by earnings or free cash flow, posing sustainability concerns.

- Our comprehensive growth report raises the possibility that TCI is poised for substantial financial growth.

- Take a closer look at TCI's balance sheet health here in our report.

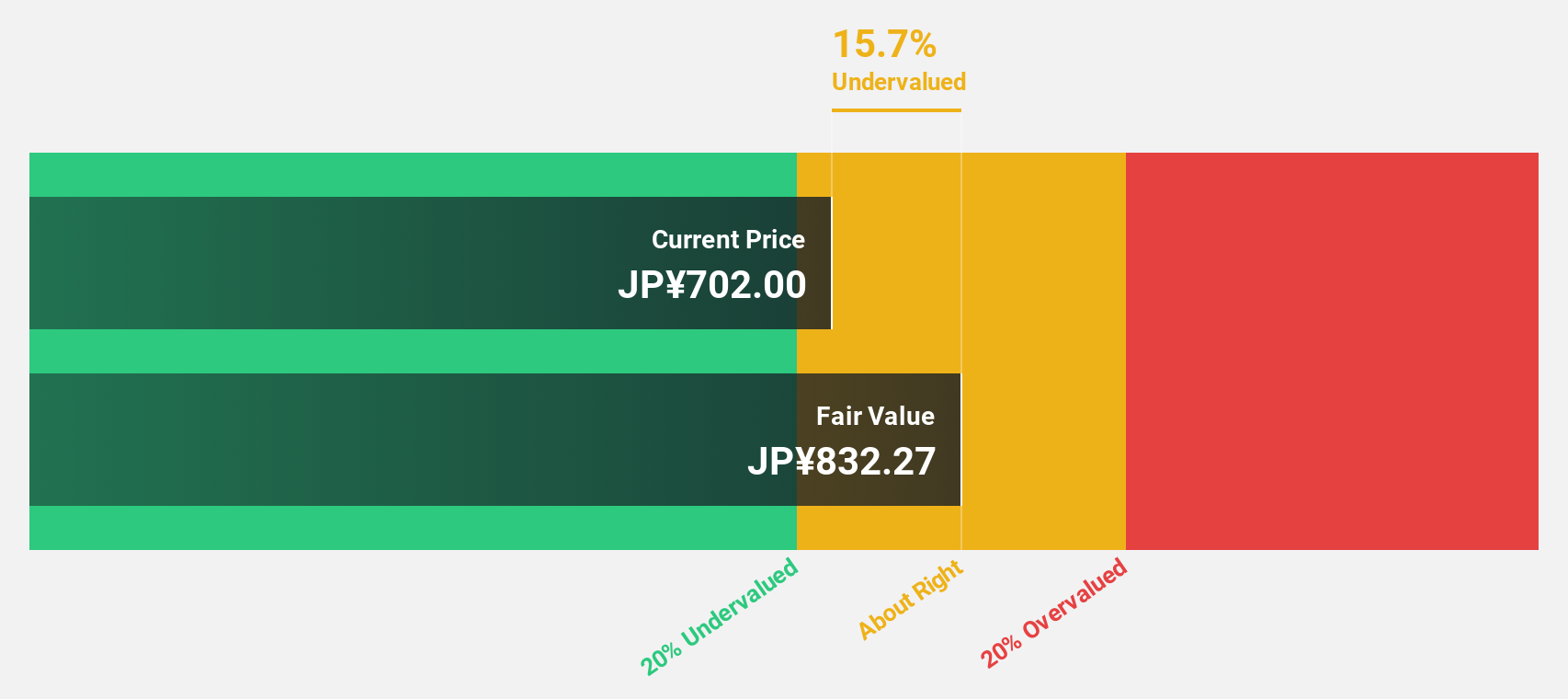

TOC (TSE:8841)

Overview: TOC Co., Ltd. operates in the real estate sector in Japan and has a market capitalization of approximately ¥64.46 billion.

Operations: TOC Co., Ltd.'s revenue segments include its operations in the real estate sector within Japan.

Estimated Discount To Fair Value: 37.5%

TOC Co., Ltd. is trading at ¥692, significantly below its estimated fair value of ¥1107.35, suggesting undervaluation based on cash flows. Despite a substantial drop in profit margins from 49.2% to 3.4%, earnings are forecast to grow at 63.3% annually, outpacing market averages. Recent share buybacks totaling ¥3,311.55 million aim to enhance capital efficiency and may positively impact shareholder value amidst anticipated growth challenges in revenue and return on equity forecasts.

- According our earnings growth report, there's an indication that TOC might be ready to expand.

- Click here to discover the nuances of TOC with our detailed financial health report.

Summing It All Up

- Click here to access our complete index of 925 Undervalued Stocks Based On Cash Flows.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A278470

APR

APR Co.,Ltd manufactures and sells cosmetic products for men and women.

Flawless balance sheet and good value.

Market Insights

Community Narratives