- Taiwan

- /

- Personal Products

- /

- TPEX:6703

Can You Imagine How Shiny Brands Group's (GTSM:6703) Shareholders Feel About The 50% Share Price Increase?

The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. For example, the Shiny Brands Group Co., Ltd. (GTSM:6703) share price is up 50% in the last year, clearly besting the market return of around 35% (not including dividends). So that should have shareholders smiling. We'll need to follow Shiny Brands Group for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Shiny Brands Group

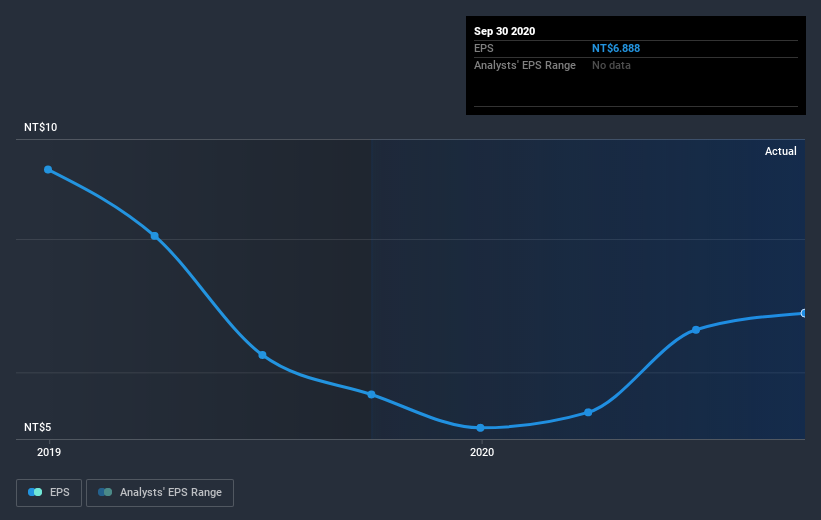

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year Shiny Brands Group grew its earnings per share (EPS) by 22%. The share price gain of 50% certainly outpaced the EPS growth. This indicates that the market is now more optimistic about the stock.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Shiny Brands Group's TSR for the last year was 59%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Shiny Brands Group boasts a total shareholder return of 59% for the last year (that includes the dividends) . We regret to report that the share price is down 3.6% over ninety days. Shorter term share price moves often don't signify much about the business itself. It's always interesting to track share price performance over the longer term. But to understand Shiny Brands Group better, we need to consider many other factors. Take risks, for example - Shiny Brands Group has 3 warning signs we think you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Shiny Brands Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:6703

Shiny Brands Group

Engages in the research, development, and production of skin care products in Taiwan and internationally.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Community Narratives