Investor Optimism Abounds Lien Hwa Industrial Holdings Corporation (TWSE:1229) But Growth Is Lacking

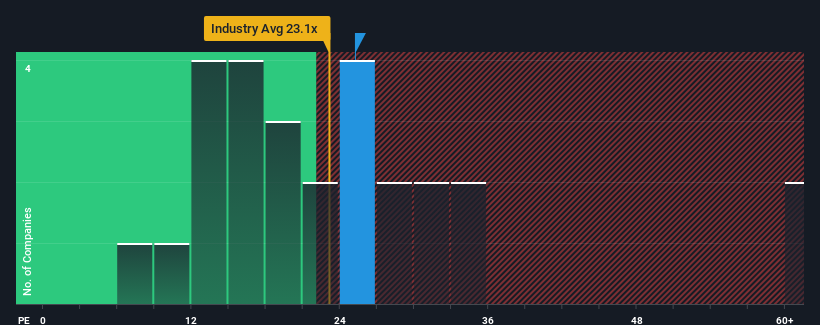

There wouldn't be many who think Lien Hwa Industrial Holdings Corporation's (TWSE:1229) price-to-earnings (or "P/E") ratio of 25.2x is worth a mention when the median P/E in Taiwan is similar at about 23x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Lien Hwa Industrial Holdings has been doing a decent job lately as it's been growing earnings at a reasonable pace. It might be that many expect the respectable earnings performance to only match most other companies over the coming period, which has kept the P/E from rising. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Check out our latest analysis for Lien Hwa Industrial Holdings

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Lien Hwa Industrial Holdings' to be considered reasonable.

Retrospectively, the last year delivered a decent 7.4% gain to the company's bottom line. The latest three year period has also seen an excellent 34% overall rise in EPS, aided somewhat by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Comparing that to the market, which is predicted to deliver 26% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

With this information, we find it interesting that Lien Hwa Industrial Holdings is trading at a fairly similar P/E to the market. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

What We Can Learn From Lien Hwa Industrial Holdings' P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Lien Hwa Industrial Holdings currently trades on a higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Lien Hwa Industrial Holdings with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:1229

Lien Hwa Industrial Holdings

Engages in the production and sale of flour products.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives