- Taiwan

- /

- Consumer Finance

- /

- TWSE:6592

Hotai Finance (TWSE:6592) Has Announced That Its Dividend Will Be Reduced To NT$3.00

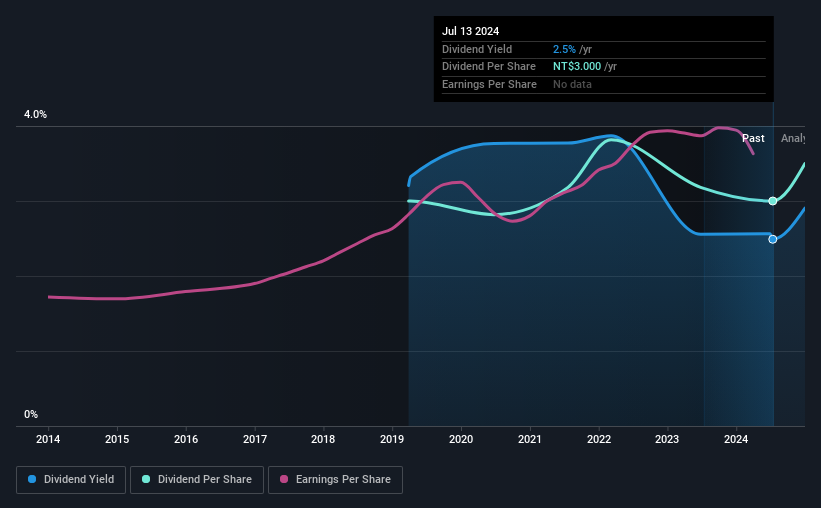

Hotai Finance Co., Ltd. (TWSE:6592) has announced that on 16th of August, it will be paying a dividend ofNT$3.00, which a reduction from last year's comparable dividend. Despite the cut, the dividend yield of 2.5% will still be comparable to other companies in the industry.

View our latest analysis for Hotai Finance

Hotai Finance's Payment Has Solid Earnings Coverage

We like a dividend to be consistent over the long term, so checking whether it is sustainable is important. Before making this announcement, Hotai Finance was earning enough to cover the dividend, but it wasn't generating any free cash flows. No cash flows could definitely make returning cash to shareholders difficult, or at least mean the balance sheet will come under pressure.

Over the next year, EPS is forecast to expand by 7.4%. If the dividend continues along recent trends, we estimate the payout ratio will be 62%, which is in the range that makes us comfortable with the sustainability of the dividend.

Hotai Finance Doesn't Have A Long Payment History

It is great to see that Hotai Finance has been paying a stable dividend for a number of years now, however we want to be a bit cautious about whether this will remain true through a full economic cycle. The last annual payment of NT$3.00 was flat on the annual payment from5 years ago. Hotai Finance hasn't been paying a dividend for very long, so we wouldn't get to excited about its record of growth just yet.

Dividend Growth May Be Hard To Achieve

Investors could be attracted to the stock based on the quality of its payment history. However, Hotai Finance's EPS was effectively flat over the past five years, which could stop the company from paying more every year. Growth of 1.8% may indicate that the company has limited investment opportunity so it is returning its earnings to shareholders instead. This isn't bad in itself, but unless earnings growth pick up we wouldn't expect dividends to grow either.

An additional note is that the company has been raising capital by issuing stock equal to 18% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Our Thoughts On Hotai Finance's Dividend

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. While Hotai Finance is earning enough to cover the payments, the cash flows are lacking. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 3 warning signs for Hotai Finance (1 is potentially serious!) that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

If you're looking to trade Hotai Finance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hotai Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6592

Hotai Finance

Provides vehicle installment sales, and leasing of vehicles and equipment services in Taiwan and China.

Slightly overvalued with questionable track record.

Similar Companies

Market Insights

Community Narratives