- Taiwan

- /

- Hospitality

- /

- TWSE:8462

Investors Appear Satisfied With Power Wind Health Industry Incorporated's (TWSE:8462) Prospects As Shares Rocket 31%

Power Wind Health Industry Incorporated (TWSE:8462) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 2.2% isn't as impressive.

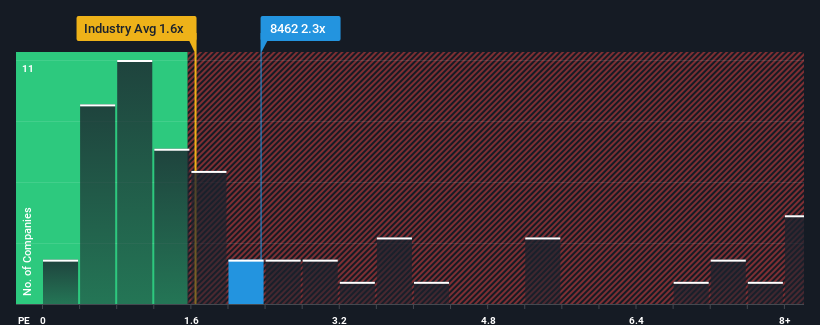

Since its price has surged higher, when almost half of the companies in Taiwan's Hospitality industry have price-to-sales ratios (or "P/S") below 1.6x, you may consider Power Wind Health Industry as a stock probably not worth researching with its 2.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Power Wind Health Industry

What Does Power Wind Health Industry's Recent Performance Look Like?

Recent revenue growth for Power Wind Health Industry has been in line with the industry. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Power Wind Health Industry.What Are Revenue Growth Metrics Telling Us About The High P/S?

Power Wind Health Industry's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 21% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 40% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% during the coming year according to the only analyst following the company. That's shaping up to be materially higher than the 7.6% growth forecast for the broader industry.

With this in mind, it's not hard to understand why Power Wind Health Industry's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The large bounce in Power Wind Health Industry's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Power Wind Health Industry's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Power Wind Health Industry with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Power Wind Health Industry, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:8462

Power Wind Health Industry

Engages in the business of membership-based fitness center chains, leisure sports venues, and other sports services in Taiwan.

Solid track record and fair value.

Market Insights

Community Narratives