- Taiwan

- /

- Hospitality

- /

- TWSE:2739

Investors Holding Back On My Humble House Hospitality Management Consulting Co., Ltd. (TWSE:2739)

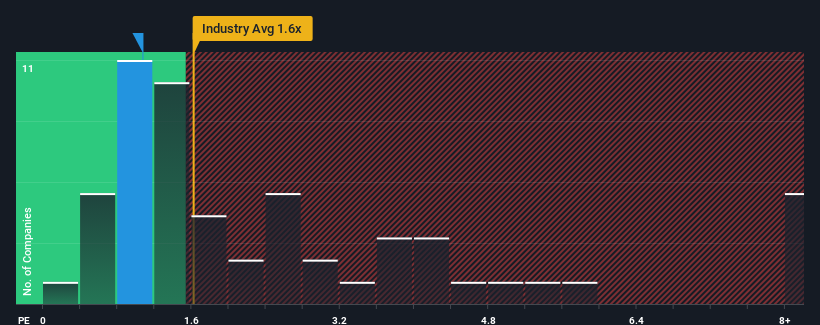

With a price-to-sales (or "P/S") ratio of 1.1x My Humble House Hospitality Management Consulting Co., Ltd. (TWSE:2739) may be sending bullish signals at the moment, given that almost half of all the Hospitality companies in Taiwan have P/S ratios greater than 1.6x and even P/S higher than 4x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for My Humble House Hospitality Management Consulting

What Does My Humble House Hospitality Management Consulting's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, My Humble House Hospitality Management Consulting has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on My Humble House Hospitality Management Consulting will help you uncover what's on the horizon.How Is My Humble House Hospitality Management Consulting's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like My Humble House Hospitality Management Consulting's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 41%. Pleasingly, revenue has also lifted 72% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 6.5% during the coming year according to the lone analyst following the company. That's shaping up to be similar to the 7.8% growth forecast for the broader industry.

With this in consideration, we find it intriguing that My Humble House Hospitality Management Consulting's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does My Humble House Hospitality Management Consulting's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of My Humble House Hospitality Management Consulting's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about these 2 warning signs we've spotted with My Humble House Hospitality Management Consulting (including 1 which makes us a bit uncomfortable).

If these risks are making you reconsider your opinion on My Humble House Hospitality Management Consulting, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2739

My Humble House Hospitality Management Consulting

My Humble House Hospitality Management Consulting Co., Ltd.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives