- Taiwan

- /

- Semiconductors

- /

- TWSE:3413

Top Asian Dividend Stocks To Consider In April 2025

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets have experienced a positive shift, with notable gains in major indices such as Japan's Nikkei 225 and China's CSI 300. In this context of improving sentiment, investors may find dividend stocks particularly appealing for their potential to provide steady income amid global economic uncertainties.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.92% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.61% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.97% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.94% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.85% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.54% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.17% | ★★★★★★ |

Click here to see the full list of 1212 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

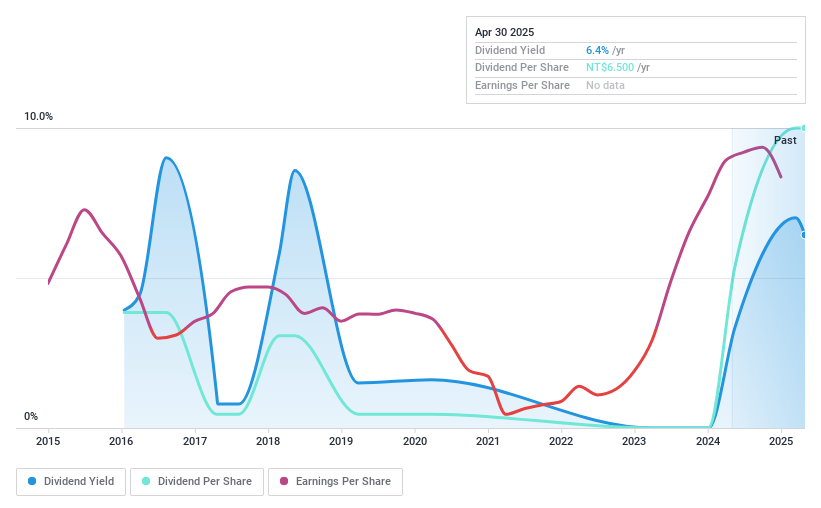

Life Travel & Tourist Service (TPEX:2745)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Life Travel & Tourist Service Co., Ltd., along with its subsidiaries, offers a range of package tour services in Taiwan and has a market capitalization of NT$3.41 billion.

Operations: Life Travel & Tourist Service Co., Ltd. generates its revenue primarily from travel services, amounting to NT$7.56 billion.

Dividend Yield: 6.4%

Life Travel & Tourist Service Co., Ltd. offers a dividend yield of 6.44%, placing it in the top 25% of dividend payers in Taiwan, though its track record has been volatile over nine years with some annual drops exceeding 20%. Despite this instability, recent earnings growth and a payout ratio of 71.7% suggest dividends are currently covered by earnings and cash flows, supported by a low cash payout ratio of 39.1%.

- Click here to discover the nuances of Life Travel & Tourist Service with our detailed analytical dividend report.

- Our valuation report unveils the possibility Life Travel & Tourist Service's shares may be trading at a discount.

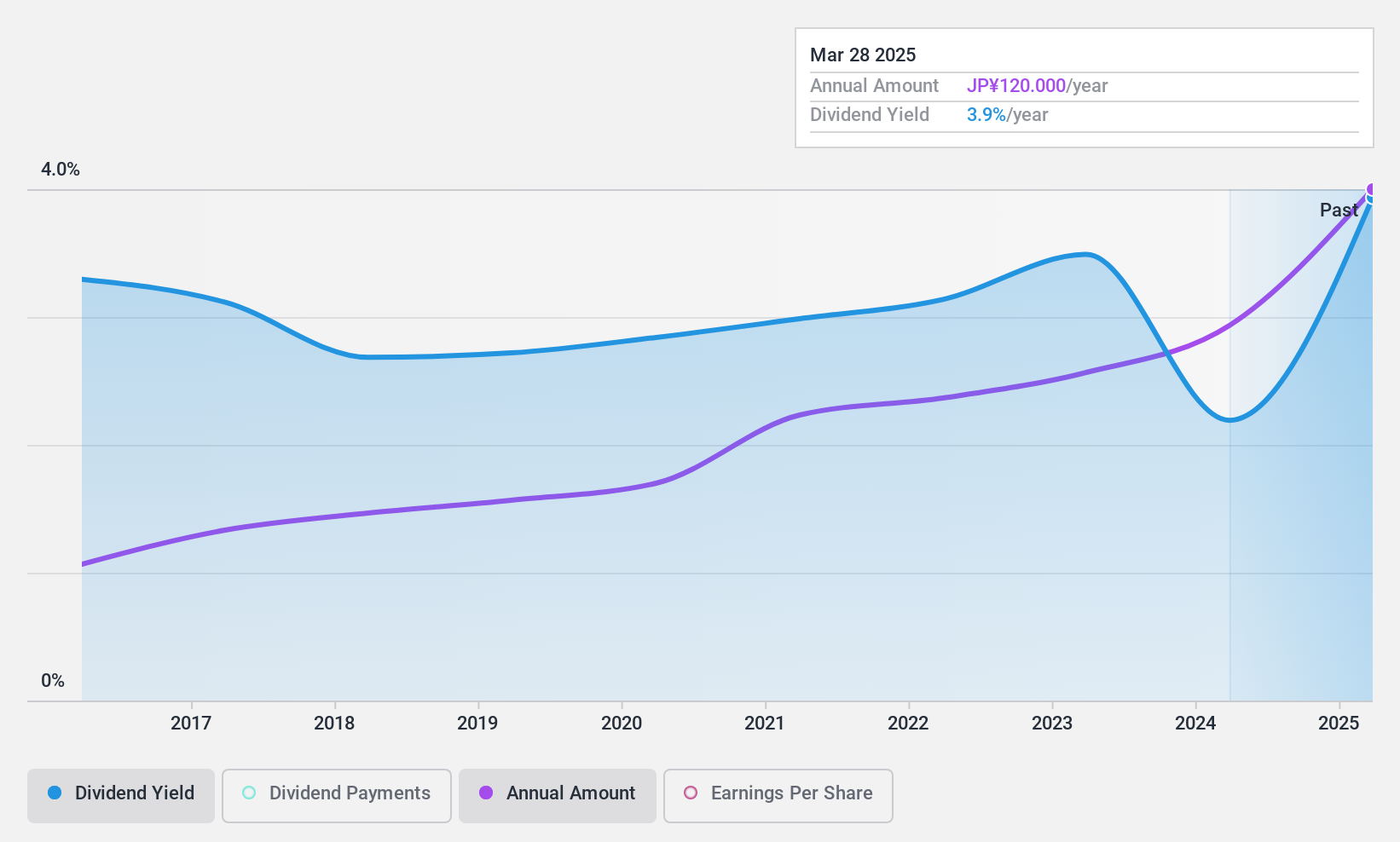

KSKLtd (TSE:9687)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: KSK Co., Ltd. operates in the LSI, software, hardware, customer service, and data entry sectors with a market capitalization of approximately ¥20.35 billion.

Operations: KSK Co., Ltd.'s revenue is primarily derived from its IT Solution Business at ¥5.34 billion, System Core Business at ¥4.10 billion, and Network Service Business at ¥13.59 billion.

Dividend Yield: 3.6%

KSK Ltd. maintains a reliable dividend yield of 3.56%, though it falls short of Japan's top quartile payers. Its dividends are well-supported by earnings with a payout ratio of 30.8% and cash flows at 55.1%. Over the past decade, KSK has consistently grown its dividends without volatility, underscoring financial stability. Currently trading at 29.3% below estimated fair value, KSK offers potential for capital appreciation alongside stable income returns for investors in Asia's dividend market.

- Unlock comprehensive insights into our analysis of KSKLtd stock in this dividend report.

- The valuation report we've compiled suggests that KSKLtd's current price could be quite moderate.

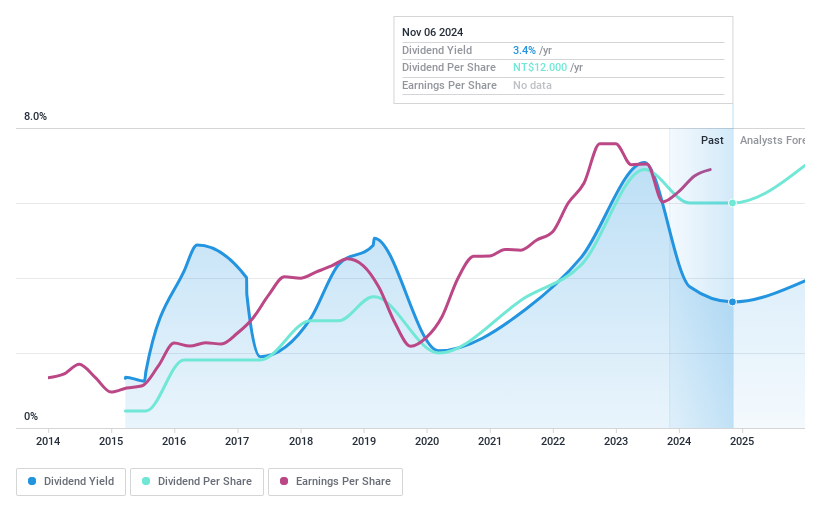

Foxsemicon Integrated Technology (TWSE:3413)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Foxsemicon Integrated Technology Inc. specializes in the research, development, design, manufacturing, and sale of semiconductor equipment subsystems and system integration across Taiwan, the United States, China, and internationally with a market cap of NT$29.04 billion.

Operations: Foxsemicon Integrated Technology Inc. generates its revenue primarily from semiconductor equipment and services, amounting to NT$16.45 billion.

Dividend Yield: 5.3%

Foxsemicon Integrated Technology's dividend yield of 5.29% is among Taiwan's top quartile, but its sustainability is questionable due to a high cash payout ratio of 609.8%, indicating dividends are not well-covered by free cash flows despite being covered by earnings with a 57.5% payout ratio. Recent earnings growth and a planned acquisition of FairTech Corporation may impact future payouts, though past dividend volatility suggests caution for income-focused investors seeking stability in Asia's market.

- Navigate through the intricacies of Foxsemicon Integrated Technology with our comprehensive dividend report here.

- Our valuation report here indicates Foxsemicon Integrated Technology may be undervalued.

Seize The Opportunity

- Navigate through the entire inventory of 1212 Top Asian Dividend Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3413

Foxsemicon Integrated Technology

Engages in the research, development, design, manufacturing, and sale of semiconductor equipment subsystems and system integration in Taiwan, the United States, China, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives