David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that The Landis Taipei Hotel Co., Ltd (GTSM:5703) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Landis Taipei Hotel

What Is Landis Taipei Hotel's Net Debt?

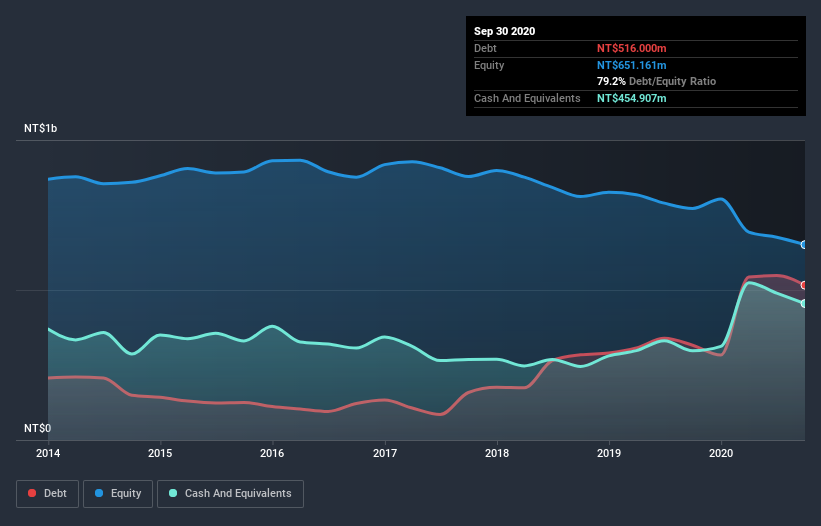

The image below, which you can click on for greater detail, shows that at September 2020 Landis Taipei Hotel had debt of NT$516.0m, up from NT$316.0m in one year. However, it does have NT$454.9m in cash offsetting this, leading to net debt of about NT$61.1m.

How Strong Is Landis Taipei Hotel's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Landis Taipei Hotel had liabilities of NT$589.8m due within 12 months and liabilities of NT$220.4m due beyond that. Offsetting this, it had NT$454.9m in cash and NT$67.8m in receivables that were due within 12 months. So it has liabilities totalling NT$287.5m more than its cash and near-term receivables, combined.

Of course, Landis Taipei Hotel has a market capitalization of NT$1.48b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Landis Taipei Hotel will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Landis Taipei Hotel reported revenue of NT$703m, which is a gain of 22%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

Despite the top line growth, Landis Taipei Hotel still had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost NT$99m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled NT$2.8m in negative free cash flow over the last twelve months. So to be blunt we think it is risky. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Landis Taipei Hotel is showing 3 warning signs in our investment analysis , and 2 of those are potentially serious...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Landis Taipei Hotel, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:5703

Solid track record with adequate balance sheet.

Market Insights

Community Narratives