As global markets experience mixed results with major U.S. indexes reaching record highs and geopolitical events in Europe causing some turbulence, investors are closely monitoring economic indicators such as job growth and interest rate decisions. Amidst this backdrop, dividend stocks offering attractive yields can provide a reliable income stream and potential stability for portfolios, especially when sectors like energy and utilities face downturns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.97% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.12% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.09% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.32% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

Click here to see the full list of 1927 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

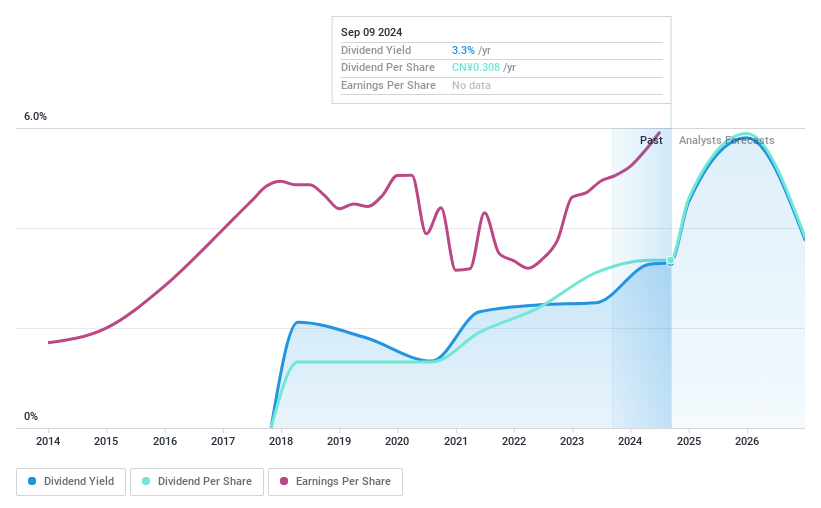

Shanghai Daimay Automotive Interior (SHSE:603730)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shanghai Daimay Automotive Interior Co., Ltd specializes in the research, development, production, and sale of passenger car components for OEMs and automakers both in China and internationally, with a market cap of CN¥15.55 billion.

Operations: Shanghai Daimay Automotive Interior Co., Ltd generates revenue through the production and sale of passenger car components for original equipment manufacturers and automakers on a global scale.

Dividend Yield: 3.1%

Shanghai Daimay Automotive Interior offers a compelling dividend profile, with its dividend yield of 3.13% ranking in the top 25% of CN market payers. The company's dividends are well-covered by earnings and cash flows, with payout ratios at 69.7% and 65.3%, respectively. Despite having paid dividends for only seven years, they have been stable and reliable, supported by recent earnings growth to CNY 623 million over nine months ending September 2024.

- Click here and access our complete dividend analysis report to understand the dynamics of Shanghai Daimay Automotive Interior.

- According our valuation report, there's an indication that Shanghai Daimay Automotive Interior's share price might be on the cheaper side.

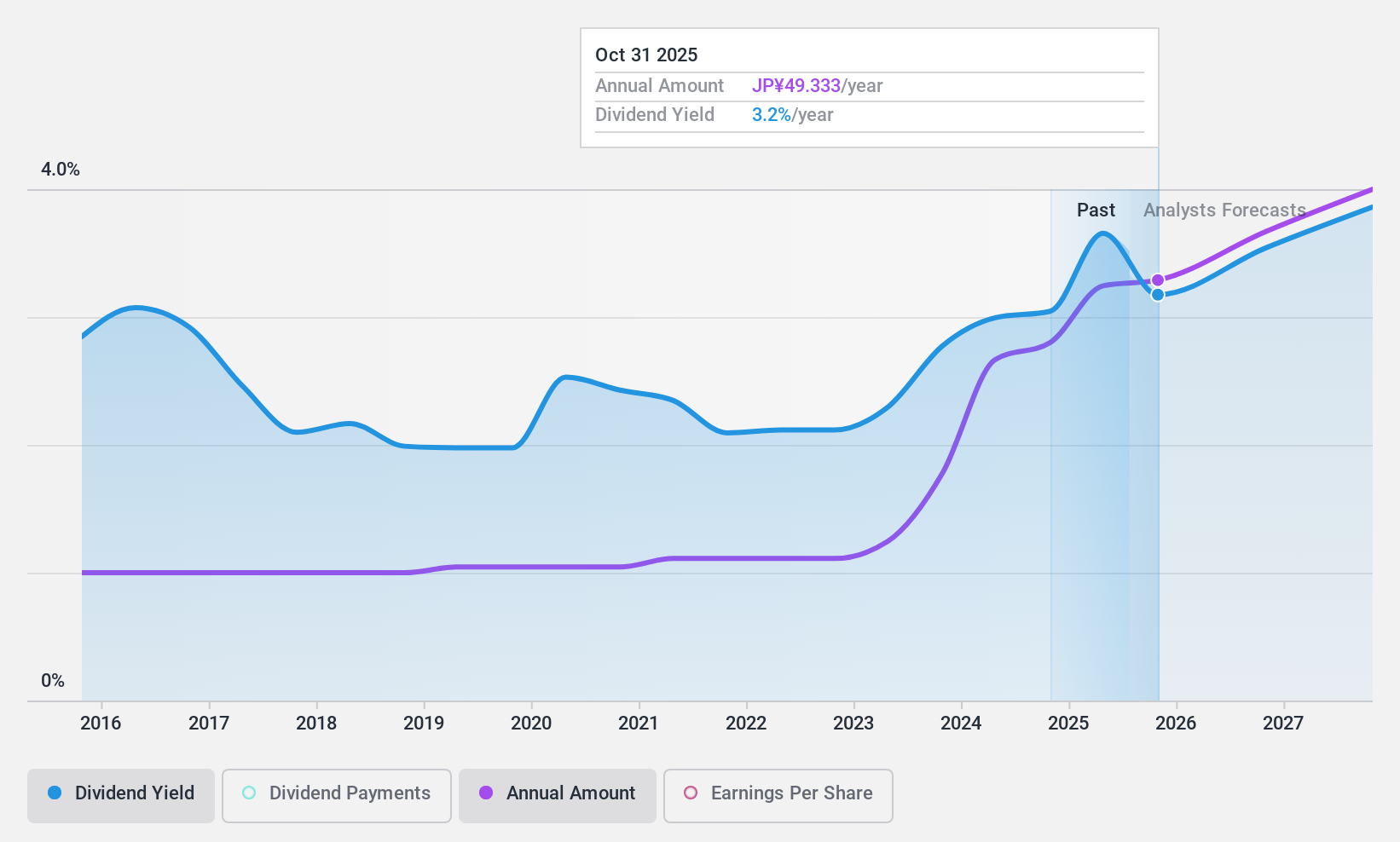

Tomoe Engineering (TSE:6309)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tomoe Engineering Co., Ltd. operates in the chemical and machinery and equipment sectors across Japan, Asia, and internationally with a market cap of ¥39.56 billion.

Operations: Tomoe Engineering Co., Ltd. generates revenue through its chemical and machinery and equipment sectors across various regions including Japan, Asia, and internationally.

Dividend Yield: 3%

Tomoe Engineering provides a stable dividend profile, paying a reliable 3.04% yield over the past decade with minimal volatility. Although this yield is below Japan's top-tier payers, the dividends are well-covered by earnings and cash flows, with low payout ratios of 19.7% and 25.8%, respectively. The stock trades significantly below its estimated fair value while earnings have shown strong growth of 29.8% last year and are projected to grow further at 9.15% annually.

- Take a closer look at Tomoe Engineering's potential here in our dividend report.

- Our valuation report unveils the possibility Tomoe Engineering's shares may be trading at a premium.

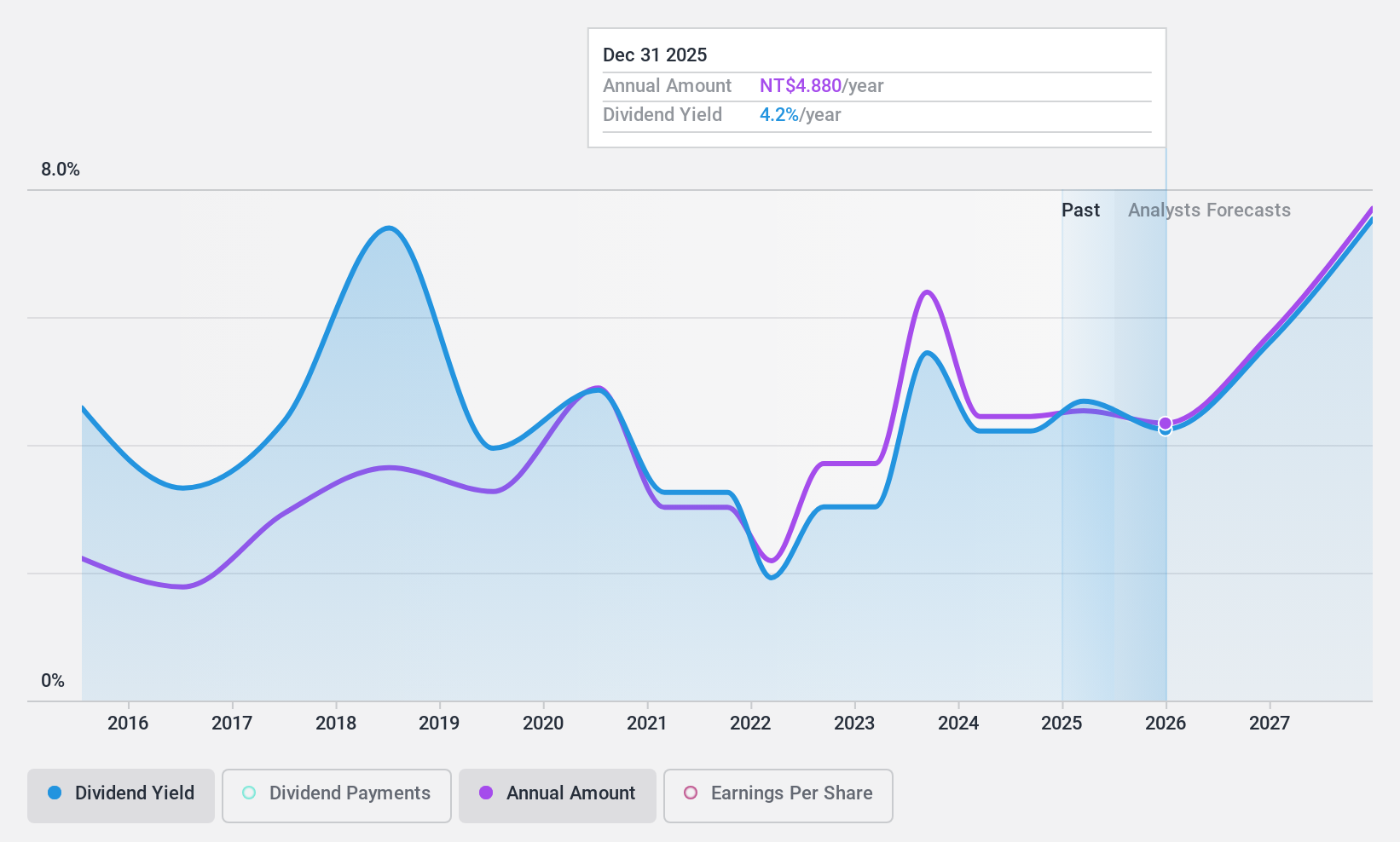

Fulgent Sun International (Holding) (TWSE:9802)

Simply Wall St Dividend Rating: ★★★☆☆☆

Overview: Fulgent Sun International (Holding) Co., Ltd. and its subsidiaries produce and sell sports and leisure outdoor footwear in Taiwan, with a market cap of NT$20.37 billion.

Operations: The company's revenue from the production and sales of sports and leisure outdoor footwear is NT$13.90 billion.

Dividend Yield: 4.3%

Fulgent Sun International's dividend yield of 4.26% is lower than Taiwan's top-tier payers, and its dividends have been volatile over the past decade. While the payout ratio of 66.8% suggests coverage by earnings, the high cash payout ratio of 178.8% indicates dividends are not well supported by free cash flows. Recent earnings show a decline in net income and profit margins compared to last year, raising concerns about dividend sustainability despite projected revenue growth.

- Click here to discover the nuances of Fulgent Sun International (Holding) with our detailed analytical dividend report.

- Our expertly prepared valuation report Fulgent Sun International (Holding) implies its share price may be too high.

Taking Advantage

- Take a closer look at our Top Dividend Stocks list of 1927 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fulgent Sun International (Holding), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:9802

Fulgent Sun International (Holding)

Produces and sells sports and leisure outdoor footwear in Taiwan.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives