- Taiwan

- /

- Consumer Durables

- /

- TWSE:5225

3 Reliable Dividend Stocks Offering Yields Up To 5.2%

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and mixed economic signals, global markets have shown both resilience and volatility. With major indices like the Nasdaq Composite reaching record highs only to retreat sharply, investors are increasingly seeking stability in uncertain times. Dividend stocks often provide this stability, offering consistent income even when market conditions fluctuate. As we explore three reliable dividend stocks with yields up to 5.2%, it's important to consider how these investments can serve as anchors in a dynamic financial landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Mitsubishi Shokuhin (TSE:7451) | 3.86% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.69% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.19% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.03% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.97% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.01% | ★★★★★★ |

Click here to see the full list of 2033 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Wuchan Zhongda GroupLtd (SHSE:600704)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wuchan Zhongda Group Co., Ltd. operates in China and internationally by offering bulk commodity supply chain integration services, with a market capitalization of approximately CN¥27.47 billion.

Operations: Wuchan Zhongda Group Co., Ltd. generates revenue through its provision of bulk commodity supply chain integration services both domestically and internationally.

Dividend Yield: 4%

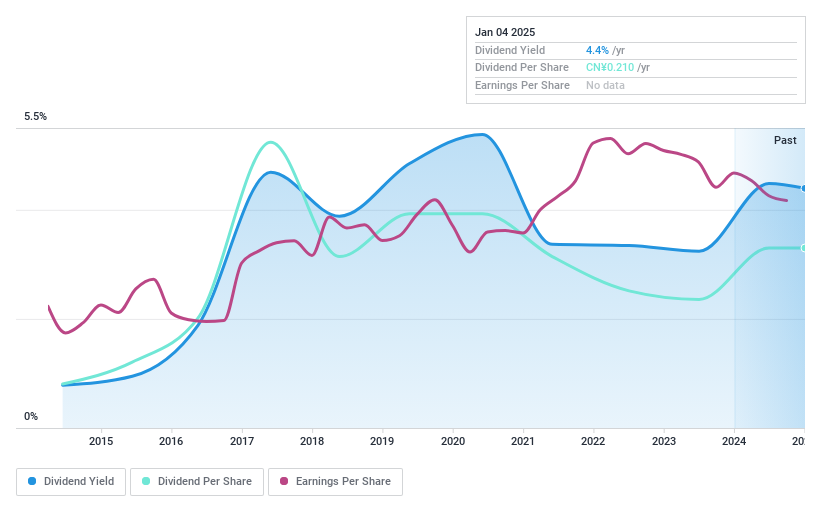

Wuchan Zhongda Group Ltd. offers a dividend yield of 3.97%, placing it in the top 25% of dividend payers in the Chinese market, yet its dividends have been volatile over the past decade. Despite a low payout ratio of 34.6%, indicating coverage by earnings, the dividends are not supported by free cash flows, raising sustainability concerns. Recent earnings showed stable sales but declining net income, which could impact future dividend reliability and growth prospects.

- Get an in-depth perspective on Wuchan Zhongda GroupLtd's performance by reading our dividend report here.

- The valuation report we've compiled suggests that Wuchan Zhongda GroupLtd's current price could be inflated.

Zhejiang Jianye Chemical (SHSE:603948)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhejiang Jianye Chemical Co., Ltd. focuses on the research, development, production, and sales of fine chemical products in China with a market cap of CN¥3.11 billion.

Operations: Zhejiang Jianye Chemical Co., Ltd. generates revenue through its involvement in the fine chemical industry in China.

Dividend Yield: 5.2%

Zhejiang Jianye Chemical's dividend yield of 5.55% ranks it among the top 25% in China, yet its four-year dividend history is marked by volatility and unreliability. Despite this, dividends are covered by earnings with a payout ratio of 66% and cash flows at 48.5%. Recent earnings revealed a decline in sales to CNY 1.78 billion and net income to CNY 166.31 million, which may affect future dividend stability.

- Dive into the specifics of Zhejiang Jianye Chemical here with our thorough dividend report.

- Our expertly prepared valuation report Zhejiang Jianye Chemical implies its share price may be lower than expected.

Eastech Holding (TWSE:5225)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eastech Holding Limited, with a market cap of NT$9.98 billion, engages in the research, development, design, assembly, manufacture, and sale of speakers and electronic entertainment systems across South Korea, Japan, Sweden, China, Denmark and other international markets.

Operations: Eastech Holding Limited generates revenue of NT$11.93 billion from its Audio/Video Products segment, which includes speakers, speaker systems, home electronic entertainment systems, and earphones.

Dividend Yield: 5%

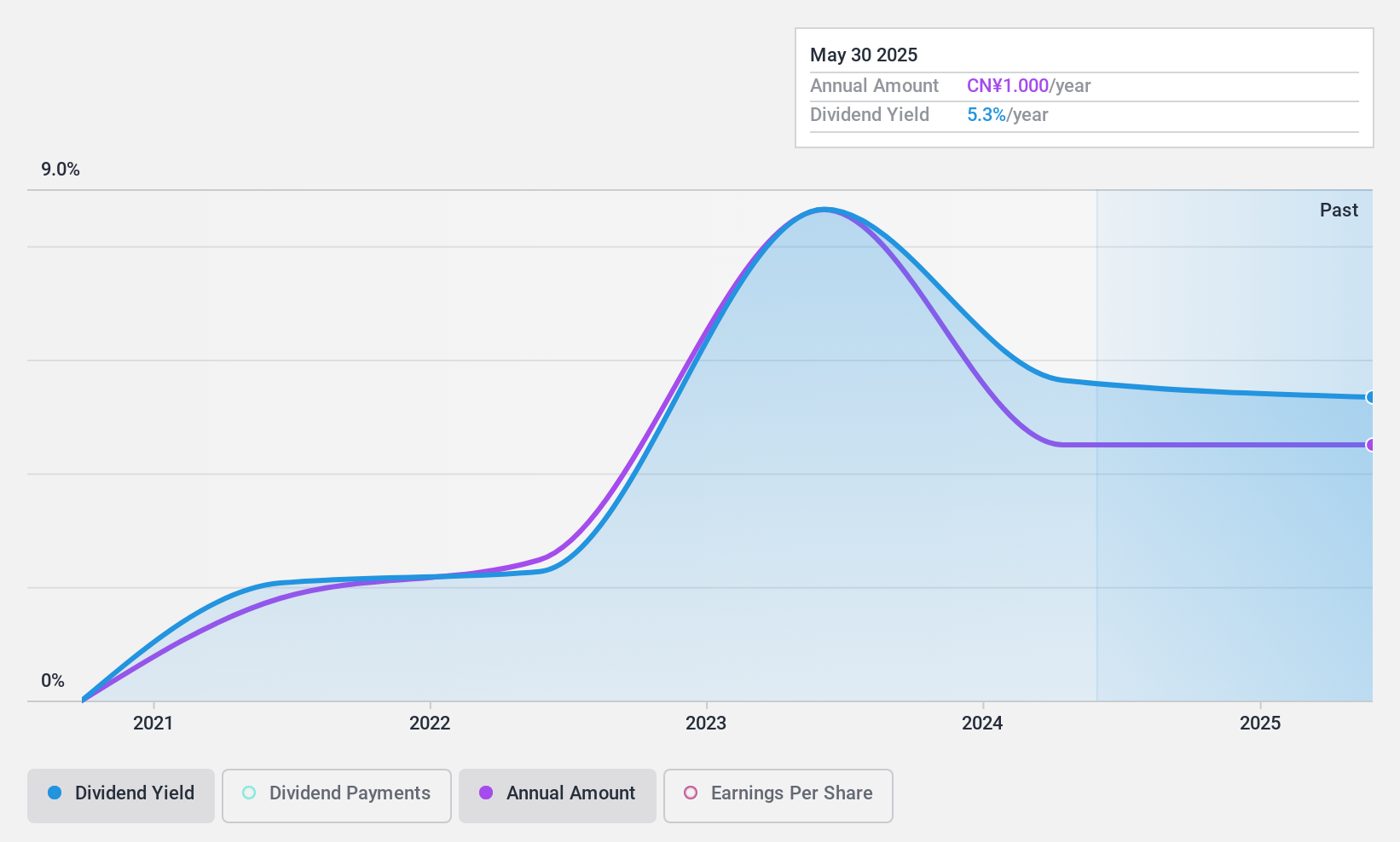

Eastech Holding's dividend yield of 5.04% is among the top 25% in Taiwan, with dividends covered by earnings (payout ratio: 60.1%) and cash flows (cash payout ratio: 53.6%). However, its dividend history over the past decade has been volatile, marked by significant annual drops exceeding 20%. Despite recent earnings growth and inclusion in the S&P Global BMI Index, shareholder dilution and share price volatility pose challenges to dividend reliability.

- Click to explore a detailed breakdown of our findings in Eastech Holding's dividend report.

- The analysis detailed in our Eastech Holding valuation report hints at an deflated share price compared to its estimated value.

Next Steps

- Gain an insight into the universe of 2033 Top Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastech Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5225

Eastech Holding

Researches, develops, designs, assembles, manufactures, and sells speakers, speaker systems, home electronic entertainment system, and earphones in South Korea, Japan, Sweden, China, Denmark, and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.