- Taiwan

- /

- Renewable Energy

- /

- TWSE:6873

Uncovering Apex Mining And 2 Other Promising Small Caps with Solid Potential

Reviewed by Simply Wall St

In a week marked by volatility, global markets have been influenced by fluctuating corporate earnings and geopolitical concerns, with the S&P MidCap 400 and Russell 2000 indices experiencing declines. As investors navigate these uncertain times, small-cap stocks often present unique opportunities due to their potential for growth and ability to adapt quickly to changing market conditions. Identifying promising small caps like Apex Mining requires careful consideration of factors such as financial health, competitive positioning, and market trends that align with current economic indicators.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.73% | 7.10% | 12.89% | ★★★★★★ |

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Voltamp Energy SAOG | 35.98% | -1.56% | 50.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| All E Technologies | NA | 18.60% | 31.35% | ★★★★★★ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| Bank MNC Internasional | 18.72% | 4.80% | 43.63% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Apex Mining (PSE:APX)

Simply Wall St Value Rating: ★★★★★☆

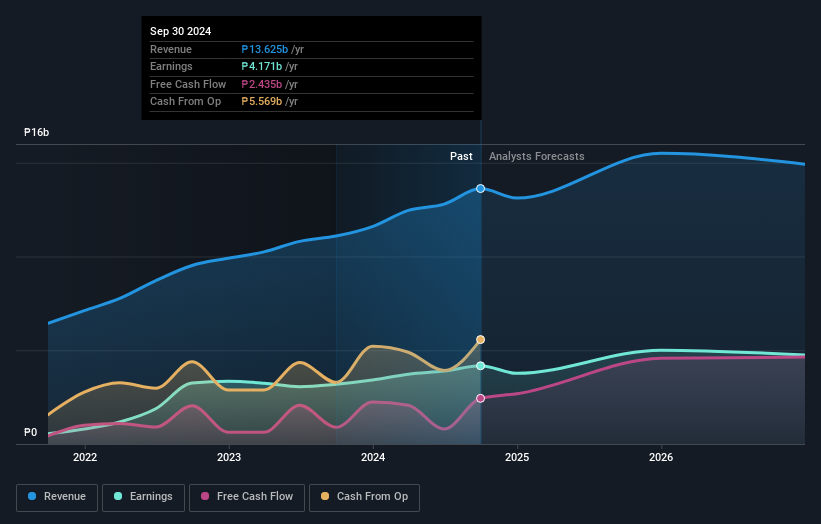

Overview: Apex Mining Co., Inc. operates in the Philippines, focusing on mining and processing gold deposits, with a market capitalization of approximately ₱23.37 billion.

Operations: Apex Mining generates revenue primarily from mining and processing gold deposits in the Philippines. The company's financial performance is influenced by its ability to manage production costs, which directly impact its profitability.

Apex Mining, a promising player in the mining sector, has shown impressive financial strength with earnings growing by 30.9% over the past year, outpacing its industry peers. Its debt to equity ratio improved significantly from 100.1% to 36.4% over five years, indicating better financial health and management of liabilities. The company trades at an attractive valuation, reportedly 56.2% below estimated fair value, suggesting potential for upside appreciation. Recent reports highlight revenue growth from PHP 3 billion to PHP 3.9 billion in Q3 and net income rising from PHP 1 billion to PHP 1.3 billion year-over-year, reflecting robust operational performance.

- Click here and access our complete health analysis report to understand the dynamics of Apex Mining.

Assess Apex Mining's past performance with our detailed historical performance reports.

Altek (TWSE:3059)

Simply Wall St Value Rating: ★★★★★☆

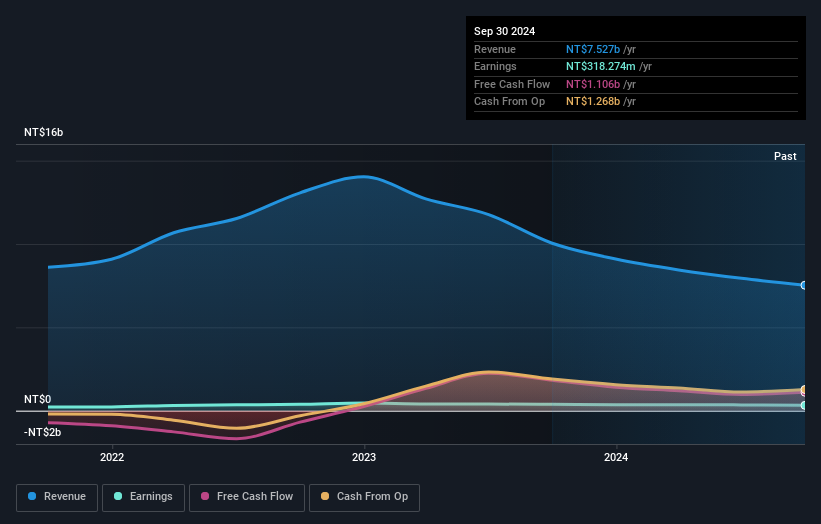

Overview: Altek Corporation, along with its subsidiaries, focuses on developing, manufacturing, and selling automobile cameras and medical and digital image technology application products, with a market cap of NT$11.80 billion.

Operations: Altek generates revenue primarily from its Photographic Equipment & Supplies segment, amounting to NT$7.53 billion.

Altek, a nimble player in its field, has seen its share price fluctuate significantly over the past three months. Despite this volatility, the company remains free cash flow positive and holds more cash than total debt. However, Altek faced a challenging year with earnings growth dipping 16% compared to an industry average of 8.9%. Recently completing a follow-on equity offering worth TWD 723.6 million could bolster financial flexibility. For Q3 2024, sales were TWD 1.88 billion against last year's TWD 2.30 billion, while net income stood at TWD 78.69 million from TWD 106.86 million previously—a reflection of current market pressures.

- Get an in-depth perspective on Altek's performance by reading our health report here.

Gain insights into Altek's historical performance by reviewing our past performance report.

HD Renewable Energy (TWSE:6873)

Simply Wall St Value Rating: ★★★★★☆

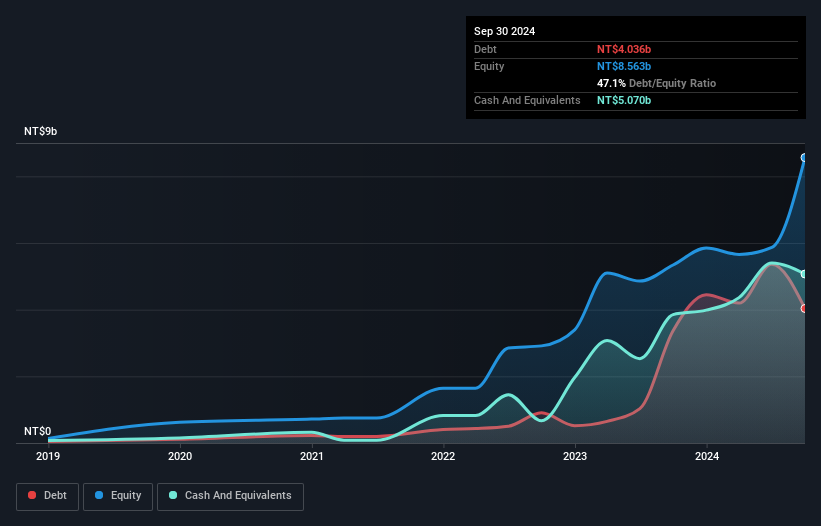

Overview: HD Renewable Energy Co., LTD. focuses on the generation and sale of electricity in Taiwan, with a market capitalization of approximately NT$23.08 billion.

Operations: HD Renewable Energy generates revenue primarily from its heavy construction segment, amounting to NT$8.82 billion.

HD Renewable Energy, a dynamic player in the renewable sector, has shown remarkable growth. Recent earnings for Q3 2024 revealed sales of TWD 3.85 billion compared to TWD 975.53 million last year, with net income jumping to TWD 436.49 million from TWD 92.59 million. The company is trading at a significant discount—92.8% below estimated fair value—and boasts strong EBIT coverage on interest payments at 15 times over the past year, highlighting its robust financial health despite increased debt levels from a debt-to-equity ratio rising to 47.1% over five years and volatile share price movements recently observed.

- Dive into the specifics of HD Renewable Energy here with our thorough health report.

Gain insights into HD Renewable Energy's past trends and performance with our Past report.

Key Takeaways

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4664 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if HD Renewable Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6873

HD Renewable Energy

Engages in the development of solar power generation systems, engineering construction, and maintenances in Taiwan.

Undervalued with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>