- Taiwan

- /

- Consumer Durables

- /

- TWSE:1604

Is There More To The Story Than Sampo's (TPE:1604) Earnings Growth?

Many investors consider it preferable to invest in profitable companies over unprofitable ones, because profitability suggests a business is sustainable. Having said that, sometimes statutory profit levels are not a good guide to ongoing profitability, because some short term one-off factor has impacted profit levels. This article will consider whether Sampo's (TPE:1604) statutory profits are a good guide to its underlying earnings.

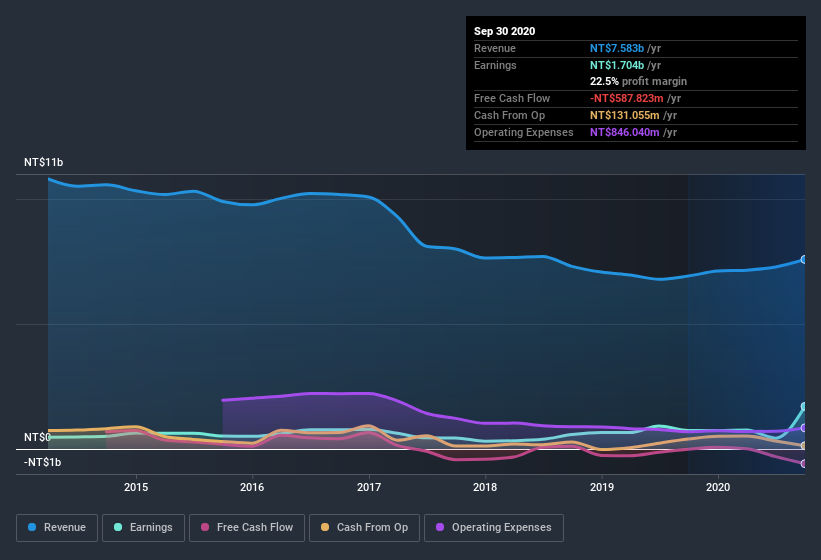

While Sampo was able to generate revenue of NT$7.58b in the last twelve months, we think its profit result of NT$1.70b was more important. As depicted below, while its revenue may have fallen over the last few years, its profit actually improved.

View our latest analysis for Sampo

Of course, it is only sensible to look beyond the statutory profits and question how well those numbers represent the sustainable earnings power of the business. As a result, today we're going to take a closer look at Sampo's cashflow, and unusual items, with a view to understanding what these might tell us about its statutory profit. Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Sampo.

A Closer Look At Sampo's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. The ratio shows us how much a company's profit exceeds its FCF.

Therefore, it's actually considered a good thing when a company has a negative accrual ratio, but a bad thing if its accrual ratio is positive. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

Sampo has an accrual ratio of 0.32 for the year to September 2020. We can therefore deduce that its free cash flow fell well short of covering its statutory profit, suggesting we might want to think twice before putting a lot of weight on the latter. Even though it reported a profit of NT$1.70b, a look at free cash flow indicates it actually burnt through NT$588m in the last year. We also note that Sampo's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of NT$588m. However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio.

The Impact Of Unusual Items On Profit

The fact that the company had unusual items boosting profit by NT$1.4b, in the last year, probably goes some way to explain why its accrual ratio was so weak. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And, after all, that's exactly what the accounting terminology implies. We can see that Sampo's positive unusual items were quite significant relative to its profit in the year to September 2020. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Sampo's Profit Performance

Sampo had a weak accrual ratio, but its profit did receive a boost from unusual items. For the reasons mentioned above, we think that a perfunctory glance at Sampo's statutory profits might make it look better than it really is on an underlying level. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. To that end, you should learn about the 2 warning signs we've spotted with Sampo (including 1 which doesn't sit too well with us).

Our examination of Sampo has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

When trading Sampo or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1604

Sampo

Engages in the manufacture, processing, contracting, wholesaling, retailing, repair, and consignment of electronics, electrochemicals, telecommunications, electrical materials, information, and audio products in Taiwan and internationally.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)