The Honmyue Enterprise (TPE:1474) Share Price Has Gained 16% And Shareholders Are Hoping For More

We believe investing is smart because history shows that stock markets go higher in the long term. But not every stock you buy will perform as well as the overall market. Over the last year the Honmyue Enterprise Co., Ltd. (TPE:1474) share price is up 16%, but that's less than the broader market return. Having said that, the longer term returns aren't so impressive, with stock gaining just 3.6% in three years.

View our latest analysis for Honmyue Enterprise

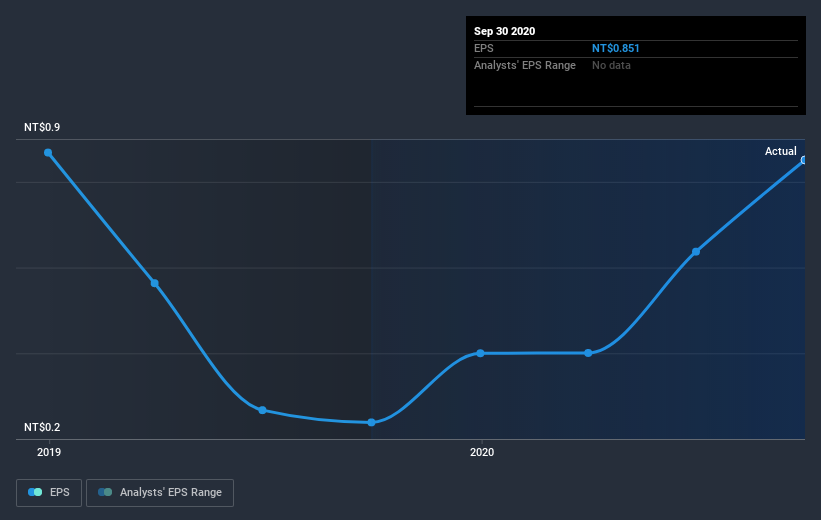

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Honmyue Enterprise grew its earnings per share (EPS) by 254%. It's fair to say that the share price gain of 16% did not keep pace with the EPS growth. So it seems like the market has cooled on Honmyue Enterprise, despite the growth. Interesting.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

A Different Perspective

Honmyue Enterprise shareholders gained a total return of 16% during the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 6% over half a decade This could indicate that the company is winning over new investors, as it pursues its strategy. It's always interesting to track share price performance over the longer term. But to understand Honmyue Enterprise better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Honmyue Enterprise (of which 2 shouldn't be ignored!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade Honmyue Enterprise, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Honmyue Enterprise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1474

Honmyue Enterprise

Engages in the manufacturing and trading of cotton, wool, silk, and synthetic fiber textiles in Taiwan, China, and internationally.

Adequate balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026