The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Tri Ocean Textile Co., Ltd. (TPE:1472) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Tri Ocean Textile

What Is Tri Ocean Textile's Debt?

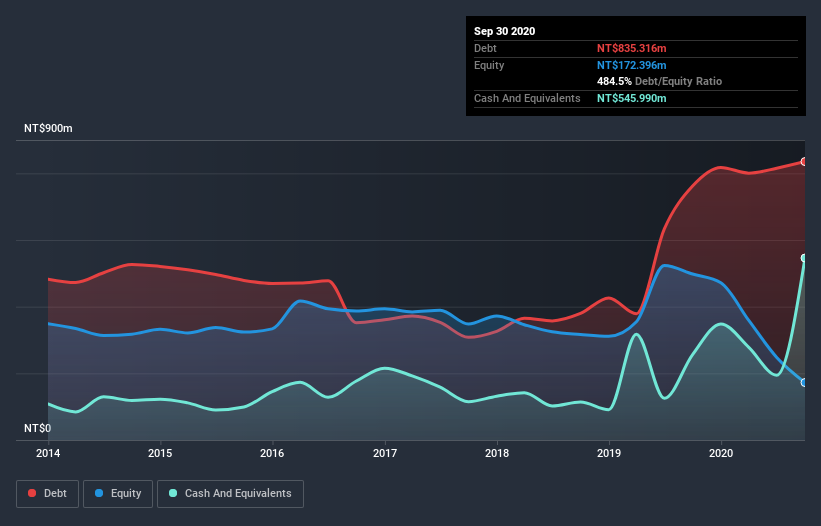

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Tri Ocean Textile had NT$835.3m of debt, an increase on NT$761.9m, over one year. On the flip side, it has NT$546.0m in cash leading to net debt of about NT$289.3m.

A Look At Tri Ocean Textile's Liabilities

According to the last reported balance sheet, Tri Ocean Textile had liabilities of NT$652.8m due within 12 months, and liabilities of NT$306.2m due beyond 12 months. Offsetting this, it had NT$546.0m in cash and NT$41.0m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$372.0m.

This deficit is considerable relative to its market capitalization of NT$441.2m, so it does suggest shareholders should keep an eye on Tri Ocean Textile's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Tri Ocean Textile will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Tri Ocean Textile had a loss before interest and tax, and actually shrunk its revenue by 7.5%, to NT$385m. We would much prefer see growth.

Caveat Emptor

Over the last twelve months Tri Ocean Textile produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping NT$407m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through NT$105m of cash over the last year. So in short it's a really risky stock. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Tri Ocean Textile (at least 1 which is concerning) , and understanding them should be part of your investment process.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you’re looking to trade Tri Ocean Textile, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Triocean Industrial Corporation, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Triocean Industrial Corporation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TWSE:1472

Triocean Industrial Corporation

Engages in the construction business in Taiwan.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives