Universal Textile (TPE:1445) Has Debt But No Earnings; Should You Worry?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Universal Textile Co., Ltd. (TPE:1445) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Universal Textile

What Is Universal Textile's Net Debt?

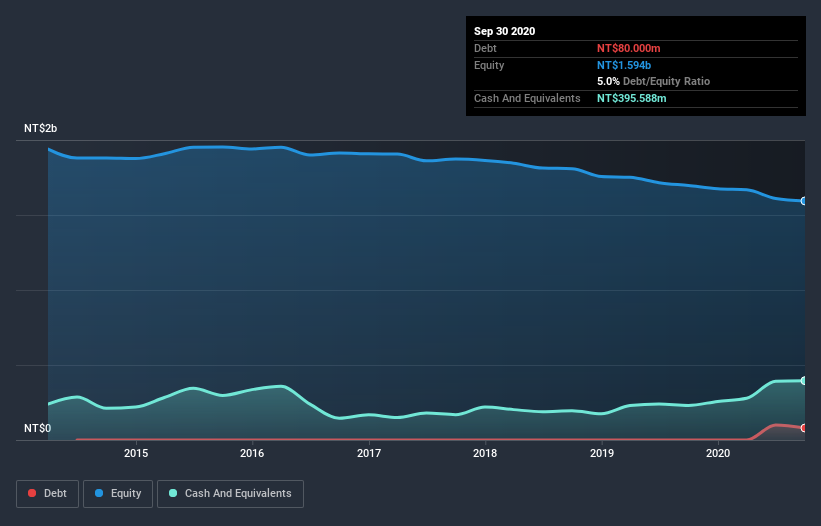

You can click the graphic below for the historical numbers, but it shows that as of September 2020 Universal Textile had NT$79.9m of debt, an increase on none, over one year. However, its balance sheet shows it holds NT$395.6m in cash, so it actually has NT$315.7m net cash.

How Strong Is Universal Textile's Balance Sheet?

The latest balance sheet data shows that Universal Textile had liabilities of NT$215.9m due within a year, and liabilities of NT$162.4m falling due after that. On the other hand, it had cash of NT$395.6m and NT$99.1m worth of receivables due within a year. So it actually has NT$116.5m more liquid assets than total liabilities.

This surplus suggests that Universal Textile has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Universal Textile boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Universal Textile will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Universal Textile made a loss at the EBIT level, and saw its revenue drop to NT$1.0b, which is a fall of 26%. That makes us nervous, to say the least.

So How Risky Is Universal Textile?

Although Universal Textile had an earnings before interest and tax (EBIT) loss over the last twelve months, it generated positive free cash flow of NT$118m. So although it is loss-making, it doesn't seem to have too much near-term balance sheet risk, keeping in mind the net cash. We'll feel more comfortable with the stock once EBIT is positive, given the lacklustre revenue growth. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Universal Textile you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Universal Textile, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:1445

Universal Textile

Manufactures and sells various processed yarns and synthetic fiber fabrics in Taiwan.

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026