As global markets navigate a landscape marked by U.S.-China trade tensions and monetary policy shifts, investors are increasingly looking toward Asia for opportunities in dividend stocks. In such a dynamic environment, a good dividend stock is typically characterized by its ability to maintain stable payouts and demonstrate resilience amid economic fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.24% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.78% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.05% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.98% | ★★★★★★ |

| NCD (TSE:4783) | 4.35% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.05% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.47% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.80% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.53% | ★★★★★★ |

Click here to see the full list of 1081 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Prada (SEHK:1913)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Prada S.p.A. is a global producer and distributor of leather goods, footwear, and ready-to-wear products, with a market cap of HK$119.96 billion.

Operations: Prada S.p.A.'s revenue segments include apparel, which generated €5.62 billion.

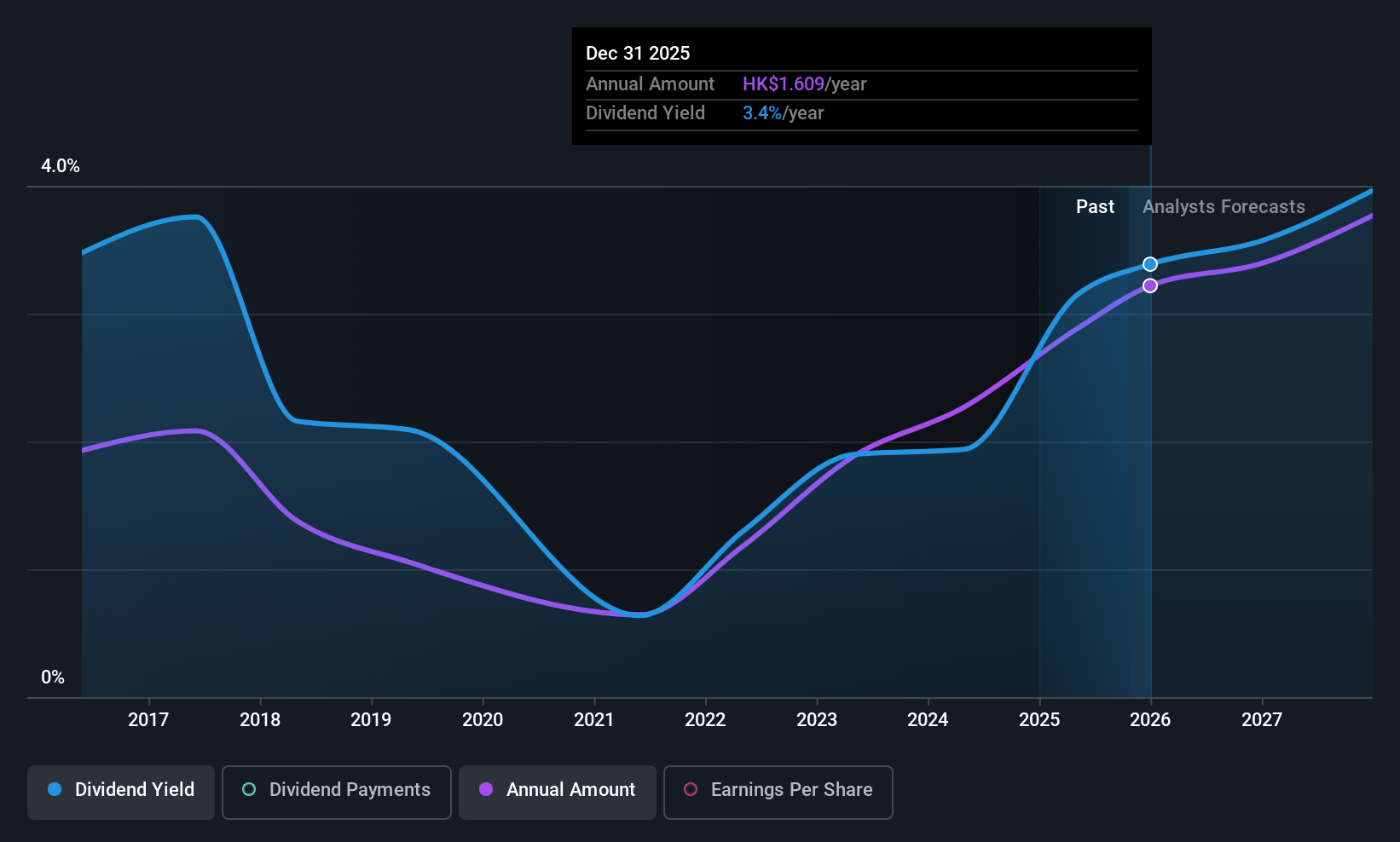

Dividend Yield: 3.2%

Prada's dividend payments are well-covered by earnings and cash flows, with payout ratios of 49.9% and 42.2%, respectively. However, its dividend history has been volatile over the past decade, making it less reliable for consistent income seekers. Despite this volatility, dividends have grown over the last ten years. Recent earnings show slight growth in net income to €385.88 million for H1 2025 from €383.5 million a year prior, indicating stable financial performance amidst executive changes.

- Click here and access our complete dividend analysis report to understand the dynamics of Prada.

- The valuation report we've compiled suggests that Prada's current price could be inflated.

Zhejiang Expressway (SEHK:576)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zhejiang Expressway Co., Ltd. is an investment holding company that focuses on investing in, developing, maintaining, and operating roads in the People’s Republic of China with a market cap of HK$46.01 billion.

Operations: Zhejiang Expressway Co., Ltd. generates revenue primarily from its Toll Operation segment, which accounts for CN¥10.68 billion, and its Securities Operation segment, contributing CN¥6.56 billion.

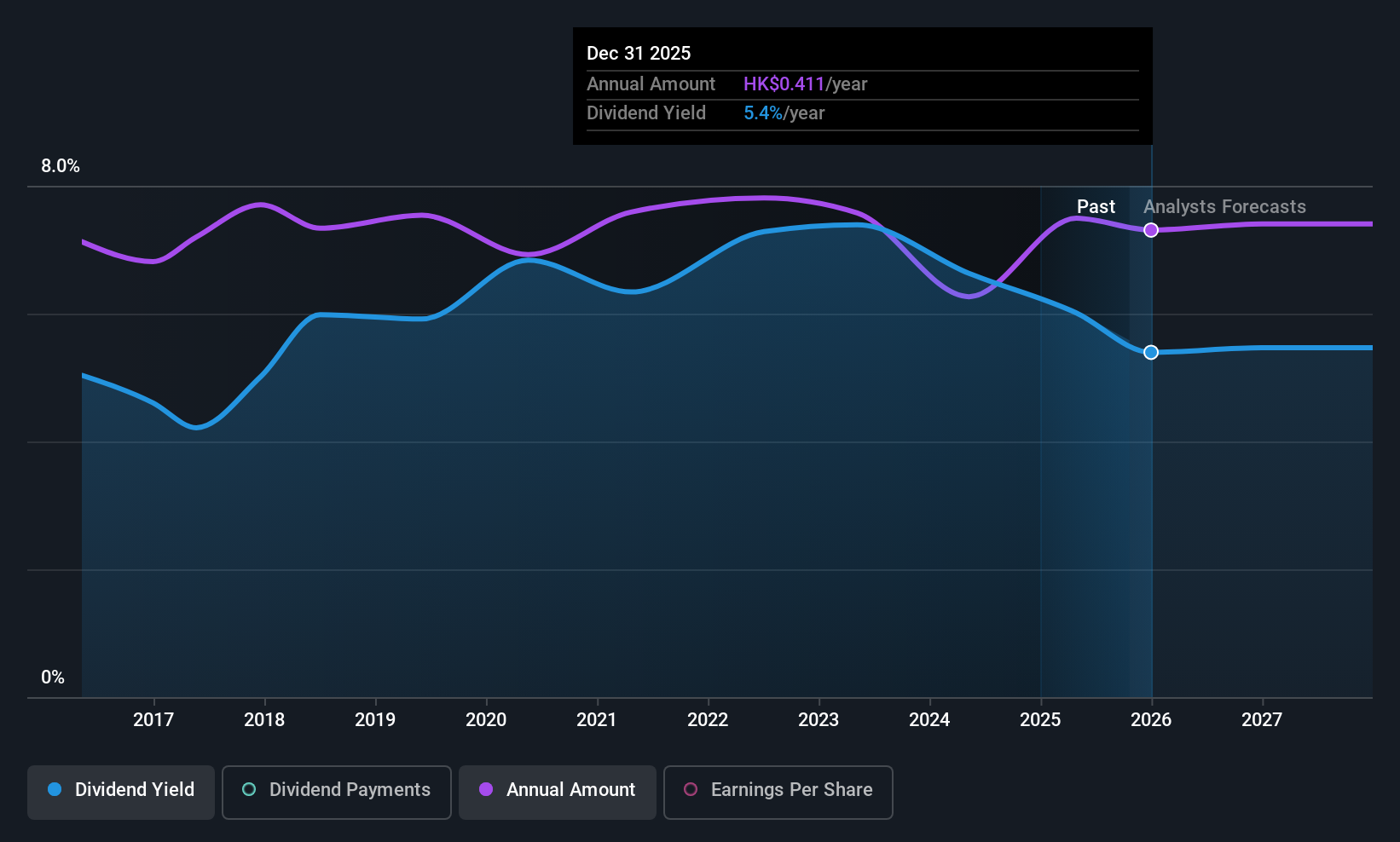

Dividend Yield: 5.5%

Zhejiang Expressway's dividends are covered by earnings and cash flows, with payout ratios of 41.1% and 47.5%, respectively, indicating sustainability. The dividend yield of 5.51% is below the top quartile in Hong Kong but has been stable and growing over the past decade, offering reliability for income investors. Recent changes in company bylaws affecting registered capital reflect strategic adjustments amidst consistent earnings growth, with net income rising to CNY 2.79 billion for H1 2025 from CNY 2.68 billion a year earlier.

- Click to explore a detailed breakdown of our findings in Zhejiang Expressway's dividend report.

- Our comprehensive valuation report raises the possibility that Zhejiang Expressway is priced lower than what may be justified by its financials.

King Chou Marine Technology (TPEX:4417)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: King Chou Marine Technology Co., Ltd. operates globally under the King Net brand, specializing in the manufacture, processing, export, and import of fishing nets for marine industries, with a market cap of NT$4.38 billion.

Operations: King Chou Marine Technology Co., Ltd.'s revenue segments include Chin Chou with NT$2.66 billion and Kunshan Cing Chou with NT$406.20 million.

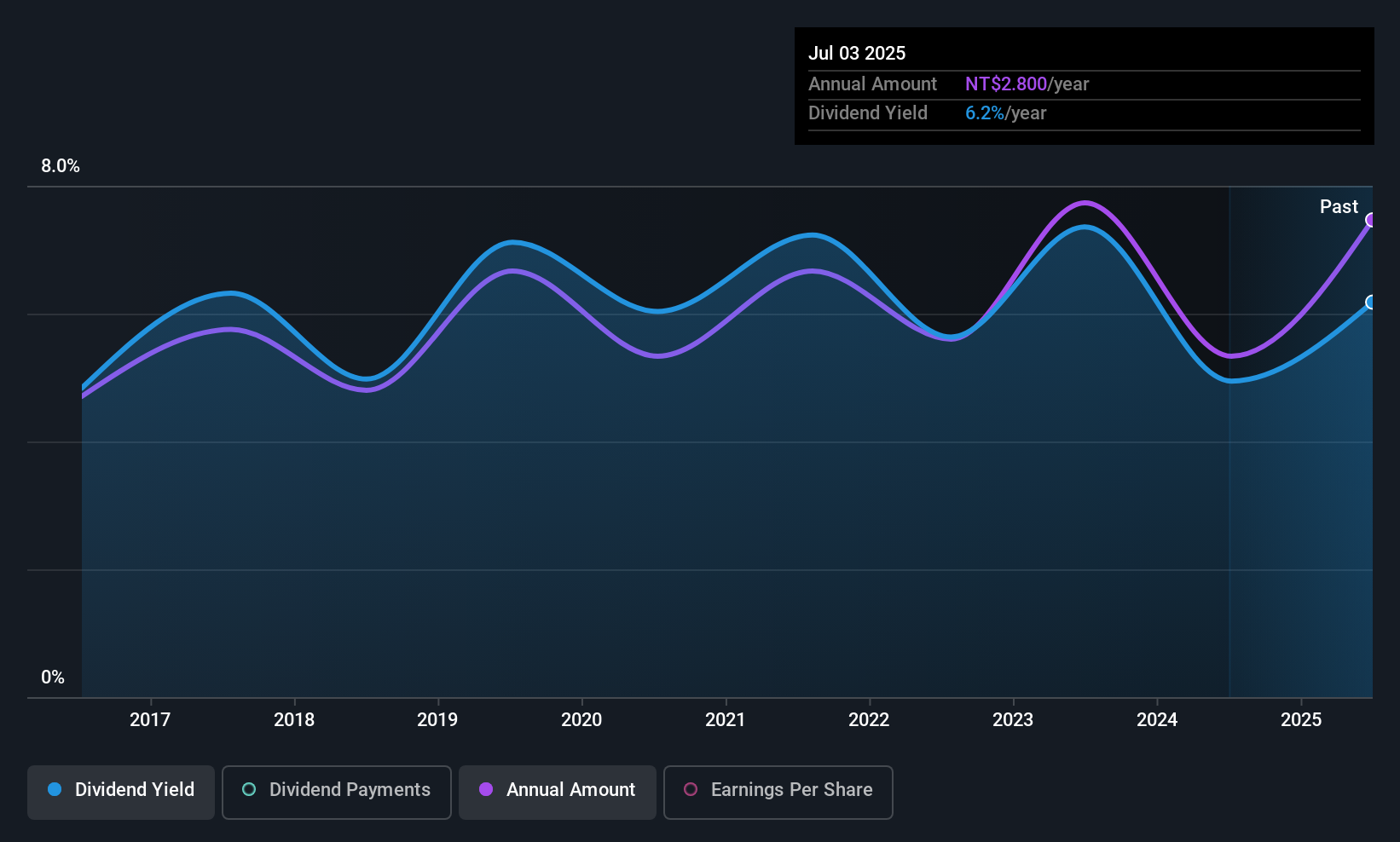

Dividend Yield: 5.4%

King Chou Marine Technology's dividend yield of 5.36% is in the top quartile of Taiwan's market, supported by low payout ratios—47.1% for earnings and 33.5% for cash flows—suggesting sustainability despite a volatile dividend history over the past decade. Recent earnings results show strong growth, with net income rising to TWD 177.26 million in Q2 2025 from TWD 107.87 million a year earlier, bolstering its capacity to maintain dividends amidst fluctuating payouts historically.

- Get an in-depth perspective on King Chou Marine Technology's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that King Chou Marine Technology is trading behind its estimated value.

Turning Ideas Into Actions

- Gain an insight into the universe of 1081 Top Asian Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1913

Prada

Produces and distributes leather goods, footwear, and ready to wear products worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives