- Taiwan

- /

- Consumer Durables

- /

- TPEX:8342

Shareholders Of I Jang IndustrialLtd (GTSM:8342) Must Be Happy With Their 43% Return

Low-cost index funds make it easy to achieve average market returns. But across the board there are plenty of stocks that underperform the market. Unfortunately for shareholders, while the I Jang Industrial Co.,Ltd. (GTSM:8342) share price is up 15% in the last three years, that falls short of the market return. Looking at more recent returns, the stock is up 10% in a year.

See our latest analysis for I Jang IndustrialLtd

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

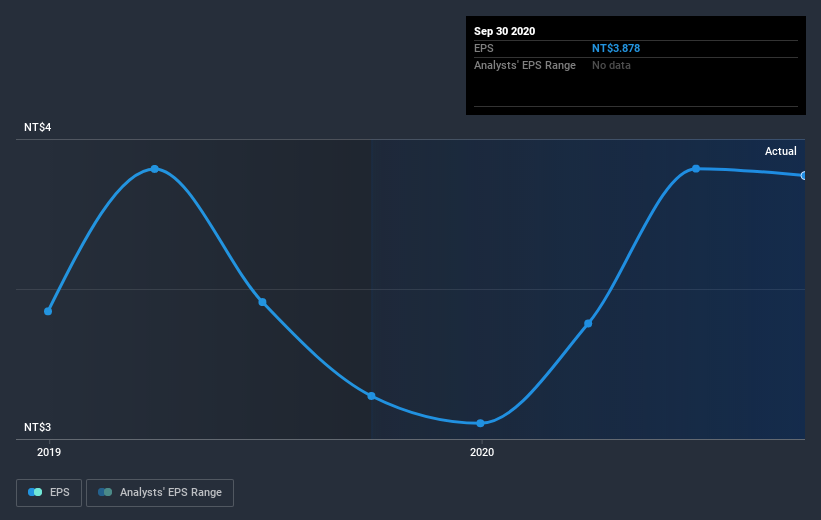

Over the last three years, I Jang IndustrialLtd failed to grow earnings per share, which fell 2.8% (annualized).

The comparison of the modestly falling earnings per share, and the relatively resilient share price, suggests the market is less cautious about the stock, these days. Still, if EPS declines indefinitely, the share price will likely follow (especially if the company makes a loss).

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on I Jang IndustrialLtd's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered I Jang IndustrialLtd's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. I Jang IndustrialLtd's TSR of 43% for the 3 years exceeded its share price return, because it has paid dividends.

A Different Perspective

I Jang IndustrialLtd produced a TSR of 18% over the last year. It's always nice to make money but this return falls short of the market return which was about 21% for the year. On the other hand, the TSR over three years was worse, at just 13% per year. This suggests the company's position is improving. If the business can justify the share price gain with improving fundamental data, then there could be more gains to come. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 3 warning signs for I Jang IndustrialLtd (1 makes us a bit uncomfortable) that you should be aware of.

But note: I Jang IndustrialLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on TW exchanges.

If you decide to trade I Jang IndustrialLtd, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:8342

I Jang IndustrialLtd

Manufactures and sells commercial storage equipment, and custom-made and household products worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026