King Chou Marine Technology (GTSM:4417) Has A Pretty Healthy Balance Sheet

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that King Chou Marine Technology Co., Ltd. (GTSM:4417) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for King Chou Marine Technology

What Is King Chou Marine Technology's Debt?

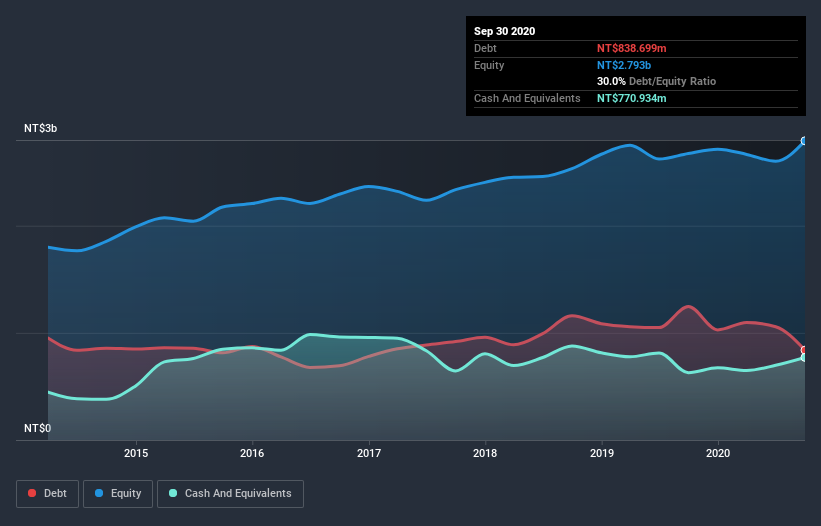

You can click the graphic below for the historical numbers, but it shows that King Chou Marine Technology had NT$838.7m of debt in September 2020, down from NT$1.25b, one year before. However, it does have NT$770.9m in cash offsetting this, leading to net debt of about NT$67.8m.

How Healthy Is King Chou Marine Technology's Balance Sheet?

The latest balance sheet data shows that King Chou Marine Technology had liabilities of NT$871.7m due within a year, and liabilities of NT$494.7m falling due after that. On the other hand, it had cash of NT$770.9m and NT$682.6m worth of receivables due within a year. So it can boast NT$87.2m more liquid assets than total liabilities.

This surplus suggests that King Chou Marine Technology has a conservative balance sheet, and could probably eliminate its debt without much difficulty.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

King Chou Marine Technology has a low net debt to EBITDA ratio of only 0.13. And its EBIT covers its interest expense a whopping 43.7 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. While King Chou Marine Technology doesn't seem to have gained much on the EBIT line, at least earnings remain stable for now. When analysing debt levels, the balance sheet is the obvious place to start. But it is King Chou Marine Technology's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, King Chou Marine Technology's free cash flow amounted to 45% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

King Chou Marine Technology's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its net debt to EBITDA also supports that impression! Taking all this data into account, it seems to us that King Chou Marine Technology takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that King Chou Marine Technology is showing 3 warning signs in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade King Chou Marine Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if King Chou Marine Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:4417

King Chou Marine Technology

Manufactures, processes, exports, and imports fishing nets for the marine industries under the King Net brand name worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026