- Taiwan

- /

- Electrical

- /

- TWSE:6412

We Think Chicony Power Technology's (TWSE:6412) Solid Earnings Are Understated

Investors signalled that they were pleased with Chicony Power Technology Co., Ltd.'s (TWSE:6412) most recent earnings report. This reaction by the market reaction is understandable when looking at headline profits and we have found some further encouraging factors.

Check out our latest analysis for Chicony Power Technology

Examining Cashflow Against Chicony Power Technology's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

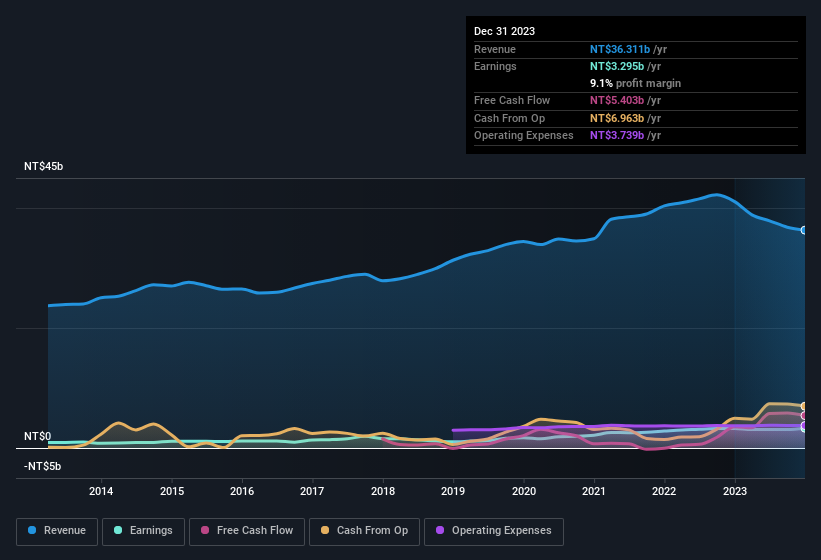

For the year to December 2023, Chicony Power Technology had an accrual ratio of -0.19. Therefore, its statutory earnings were very significantly less than its free cashflow. In fact, it had free cash flow of NT$5.4b in the last year, which was a lot more than its statutory profit of NT$3.29b. Chicony Power Technology shareholders are no doubt pleased that free cash flow improved over the last twelve months.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Chicony Power Technology's Profit Performance

As we discussed above, Chicony Power Technology's accrual ratio indicates strong conversion of profit to free cash flow, which is a positive for the company. Because of this, we think Chicony Power Technology's underlying earnings potential is as good as, or possibly even better, than the statutory profit makes it seem! And the EPS is up 50% annually, over the last three years. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. At Simply Wall St, we found 1 warning sign for Chicony Power Technology and we think they deserve your attention.

This note has only looked at a single factor that sheds light on the nature of Chicony Power Technology's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

If you're looking to trade Chicony Power Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:6412

Chicony Power Technology

Develops, manufactures, and sells switching power supplies, electronic components and LED lighting modules, and smart building solutions in Taiwan.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives