- Taiwan

- /

- Trade Distributors

- /

- TWSE:6192

3 Dividend Stocks To Consider With Yields Up To 6.3%

Reviewed by Simply Wall St

As global markets edge toward record highs, buoyed by robust performances in U.S. and European indices, investors are keeping a keen eye on inflation data and interest rate expectations. Amidst this dynamic economic landscape, dividend stocks offer an appealing option for those seeking steady income streams; they can provide a buffer against market volatility while potentially benefiting from capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.93% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.37% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 3.93% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.07% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.42% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.86% | ★★★★★★ |

Click here to see the full list of 1985 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ENN Natural GasLtd (SHSE:600803)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ENN Natural Gas Co., Ltd. operates in China, focusing on natural gas distribution, trading, storage, transportation, production, and engineering with a market cap of CN¥59.82 billion.

Operations: ENN Natural Gas Co., Ltd. generates revenue through its activities in natural gas distribution, trading, storage, transportation, production, and engineering within China.

Dividend Yield: 3.4%

ENN Natural Gas Ltd. offers a dividend yield of 3.39%, placing it in the top 25% of CN market dividend payers, despite a history of volatility over the past decade. The dividends are well-covered by earnings and cash flows, with payout ratios at 27.3% and 38.5%, respectively, suggesting sustainability from current profits and cash generation. Recent inclusion in major indices may enhance its visibility among investors seeking value in dividend stocks.

- Click here and access our complete dividend analysis report to understand the dynamics of ENN Natural GasLtd.

- Upon reviewing our latest valuation report, ENN Natural GasLtd's share price might be too pessimistic.

Youngtek Electronics (TPEX:6261)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Youngtek Electronics Corporation, with a market cap of NT$8.08 billion, operates in Taiwan's semiconductor industry focusing on sawing and pick and place OEM services.

Operations: Youngtek Electronics Corporation generates revenue from two main segments: the OEM Business Department, contributing NT$2.41 billion, and the Own Product Business Department, accounting for NT$1.81 billion.

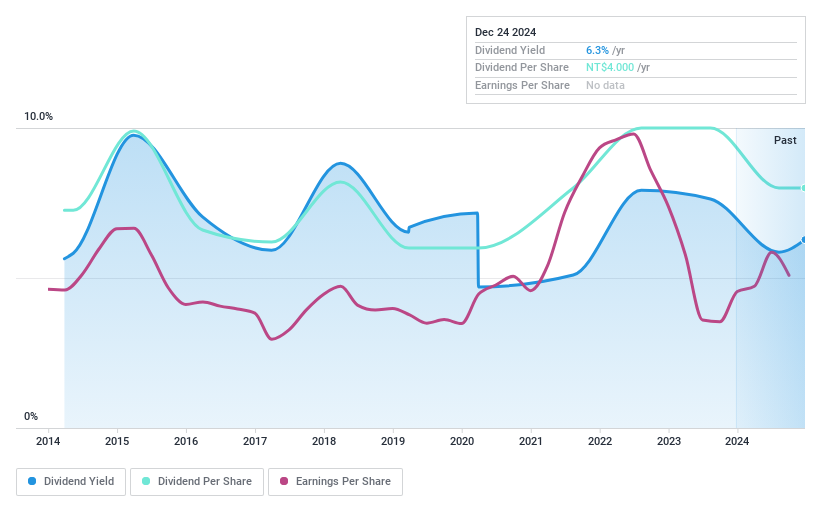

Dividend Yield: 6.4%

Youngtek Electronics offers a dividend yield of 6.36%, ranking in the top 25% of TW market payers, though its track record is marked by volatility and past unreliability. The dividends are covered by earnings (payout ratio: 87.3%) and cash flows (cash payout ratio: 63.1%), indicating reasonable sustainability despite fluctuations. With a price-to-earnings ratio of 13.7x, below the market average, it may appeal to value-focused investors despite its unstable dividend history.

- Dive into the specifics of Youngtek Electronics here with our thorough dividend report.

- Upon reviewing our latest valuation report, Youngtek Electronics' share price might be too optimistic.

Lumax International (TWSE:6192)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lumax International Corp., Ltd. operates in Taiwan and China, offering electronic components and program-controlled instruments, with a market cap of NT$10.38 billion.

Operations: Lumax International Corp., Ltd. generates revenue from various segments including Electronics Component (NT$555.50 million), Program-Controlled System (NT$1.92 billion), Program-Controlled Instrument (NT$2.81 billion), Other Program Control Business (NT$1.76 billion), and Communication and Linear Transmission System (NT$563.41 million).

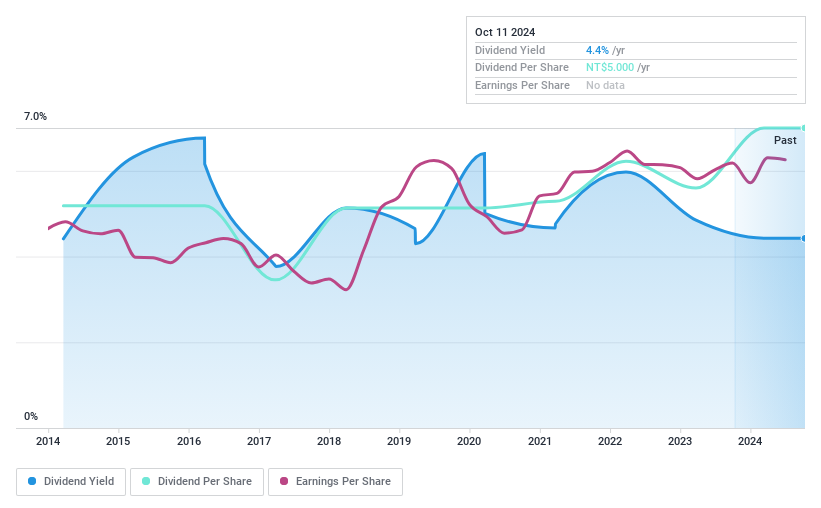

Dividend Yield: 4.6%

Lumax International's dividend yield of 4.63% places it in the top 25% of TW market payers, yet its history shows volatility and unreliability over the past decade. Despite this, dividends are covered by earnings (payout ratio: 57.2%) and cash flows (cash payout ratio: 60%), suggesting sustainability. Trading at a significant discount to its estimated fair value, Lumax may interest value investors despite an unstable dividend track record highlighted in recent discussions on financial performance.

- Unlock comprehensive insights into our analysis of Lumax International stock in this dividend report.

- According our valuation report, there's an indication that Lumax International's share price might be on the cheaper side.

Summing It All Up

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1982 more companies for you to explore.Click here to unveil our expertly curated list of 1985 Top Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6192

Lumax International

Provides electronic components and program-controlled instruments in Taiwan and China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives