- Taiwan

- /

- Construction

- /

- TWSE:5515

Top Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets grapple with economic uncertainties, including trade policy concerns and inflationary pressures, investors are increasingly looking towards Asia for opportunities. In this context, dividend stocks in the region offer a potential avenue for generating steady income amidst market volatility.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.79% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.05% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.92% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.75% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.34% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 3.95% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.23% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.19% | ★★★★★★ |

Click here to see the full list of 1120 stocks from our Top Asian Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

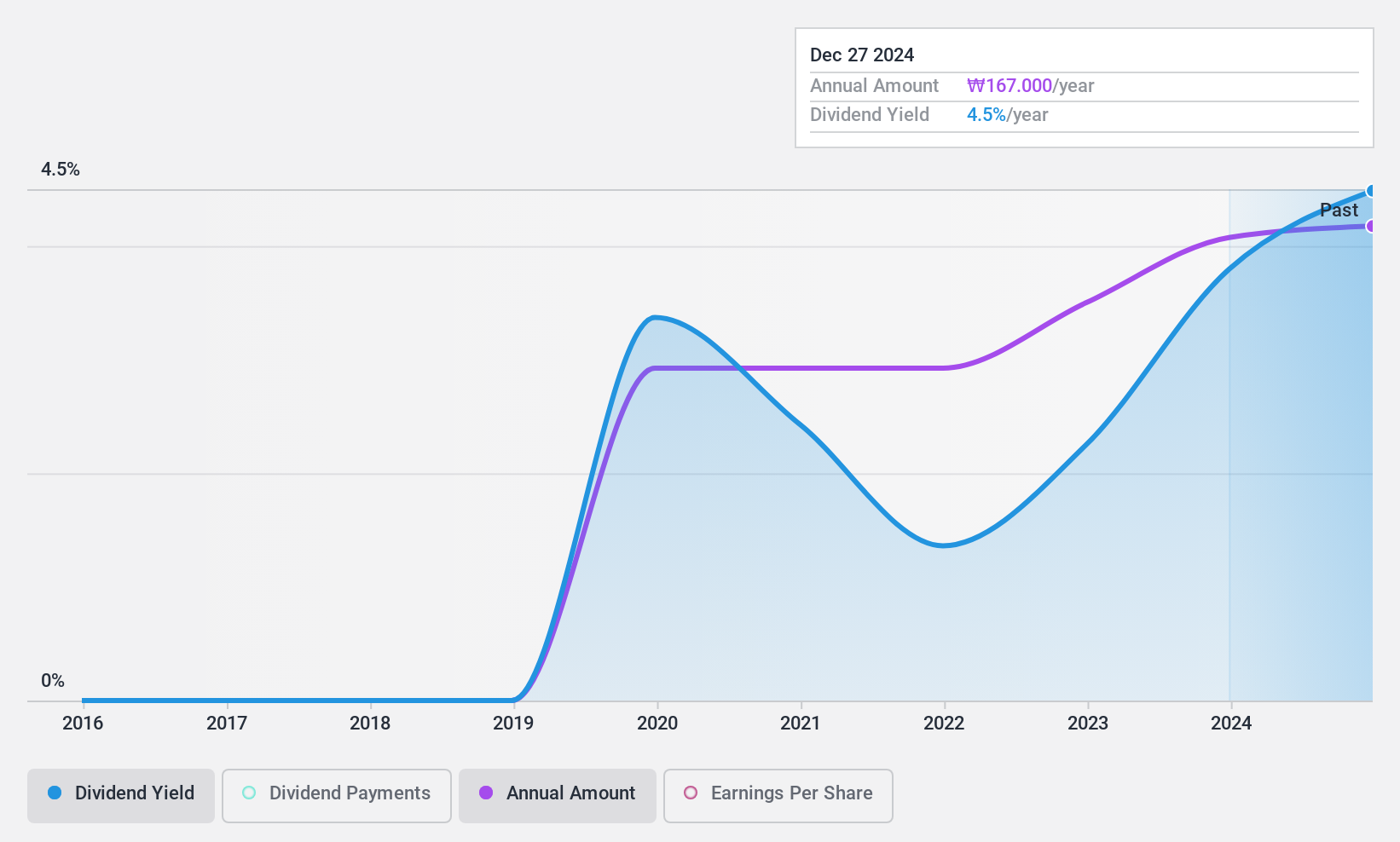

GOLFZON NEWDIN HOLDINGS (KOSDAQ:A121440)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GOLFZON NEWDIN HOLDINGS Co., Ltd. operates in the golf, sports, health, and lifestyle sectors through its subsidiaries both in South Korea and internationally, with a market cap of approximately ₩163.29 billion.

Operations: GOLFZON NEWDIN HOLDINGS Co., Ltd. generates its revenue through its subsidiaries in the golf, sports, health, and lifestyle industries across South Korea and international markets.

Dividend Yield: 4.1%

GOLFZON NEWDIN HOLDINGS has demonstrated stable and reliable dividend payments, with a low payout ratio of 15.5%, ensuring dividends are well-covered by earnings. Although it has only been paying dividends for five years, the company’s yield is competitive at 4.14%. A recent share repurchase program worth KRW 10 billion aims to enhance shareholder value further. Despite a decline in sales, net income increased to KRW 43.61 billion, supporting its dividend sustainability strategy.

- Get an in-depth perspective on GOLFZON NEWDIN HOLDINGS' performance by reading our dividend report here.

- Our expertly prepared valuation report GOLFZON NEWDIN HOLDINGS implies its share price may be lower than expected.

Yen Sun Technology (TPEX:6275)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yen Sun Technology Corporation manufactures and sells home appliances and electronic cooling products across various international markets, with a market cap of NT$3.97 billion.

Operations: Yen Sun Technology's revenue is primarily derived from its Electronic Heat Transfer Department, contributing NT$3.16 billion, and its Home Electric Appliance Division, which accounts for NT$581.17 million.

Dividend Yield: 5.9%

Yen Sun Technology's dividend yield of 5.88% ranks in the top 25% of Taiwan's market, yet its sustainability is questionable due to a high cash payout ratio of 408.5%, indicating dividends aren't well-covered by cash flows. Despite an earnings growth of 85.8% last year, dividends have been volatile over the past decade. Recent corporate actions include a proposed amendment to the Articles of Incorporation and plans for a private placement issuance approved by shareholders on March 6, 2025.

- Unlock comprehensive insights into our analysis of Yen Sun Technology stock in this dividend report.

- The valuation report we've compiled suggests that Yen Sun Technology's current price could be inflated.

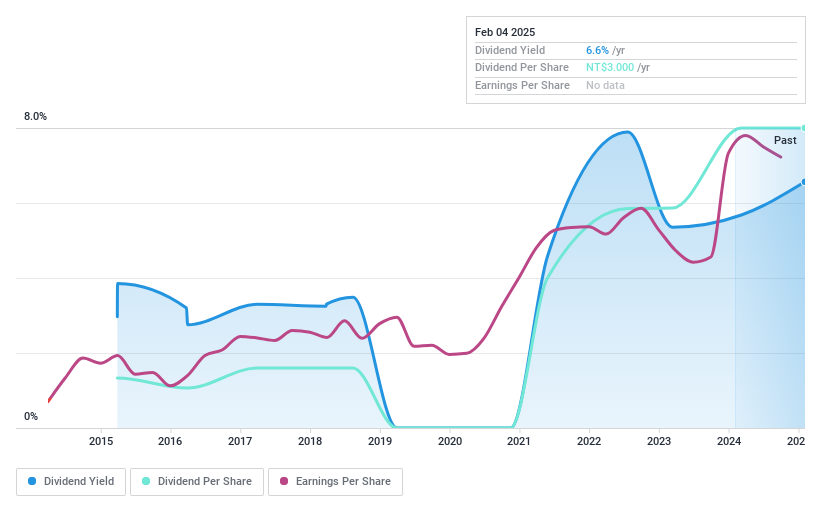

Chien Kuo Construction (TWSE:5515)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chien Kuo Construction Co., Ltd. operates in the construction industry across Taiwan and China, with a market capitalization of NT$6.25 billion.

Operations: Chien Kuo Construction Co., Ltd. generates its revenue from construction activities in Taiwan and China.

Dividend Yield: 4%

Chien Kuo Construction's dividend yield of 4.03% is below Taiwan's top quartile, but its dividends are well-supported by a payout ratio of 51.4% and a cash payout ratio of 49.6%. The company has shown consistent dividend growth over the past decade with minimal volatility. Recent earnings results revealed significant growth, with net income rising to TWD 681.76 million in 2024 from TWD 338.51 million in the previous year, enhancing its financial stability for future payouts.

- Take a closer look at Chien Kuo Construction's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Chien Kuo Construction is trading beyond its estimated value.

Key Takeaways

- Unlock more gems! Our Top Asian Dividend Stocks screener has unearthed 1117 more companies for you to explore.Click here to unveil our expertly curated list of 1120 Top Asian Dividend Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:5515

Chien Kuo Construction

Engages in the construction business in Taiwan and China.

Flawless balance sheet established dividend payer.