As global markets navigate the potential for rate cuts and fluctuating economic indicators, small-cap indices like the S&P Mid-Cap 400 and Russell 2000 have shown robust performance, buoyed by investor optimism. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can offer intriguing opportunities for those looking to explore undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Lion Rock Group | 9.41% | 15.39% | 13.20% | ★★★★★★ |

| Q P Group Holdings | 5.68% | -1.99% | -0.40% | ★★★★★★ |

| Wison Engineering Services | 28.12% | -0.65% | 12.25% | ★★★★★★ |

| YH Entertainment Group | 4.44% | -11.47% | -43.36% | ★★★★★★ |

| China Leon Inspection Holding | 10.37% | 18.71% | 17.95% | ★★★★★★ |

| Wholetech System Hitech | 6.48% | 14.41% | 19.21% | ★★★★★☆ |

| ShareHope Medicine | 33.76% | 2.13% | -11.17% | ★★★★★☆ |

| Tait Marketing & Distribution | 0.69% | 8.02% | 10.61% | ★★★★★☆ |

| Palasino Holdings | 9.75% | 10.88% | -14.54% | ★★★★★☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Haiyang Technology (SHSE:603382)

Simply Wall St Value Rating: ★★★★★☆

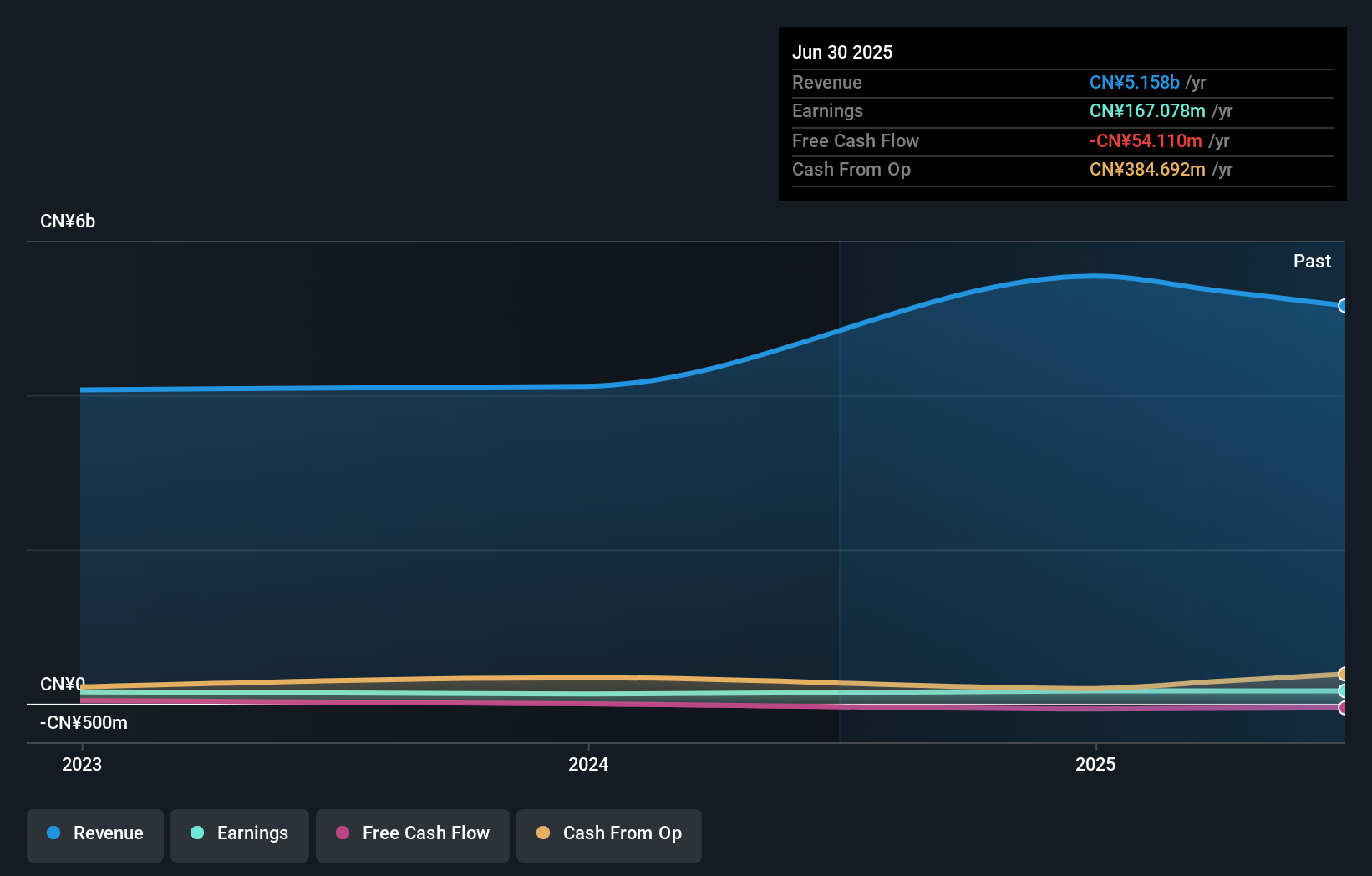

Overview: Haiyang Technology Co., Ltd. is involved in the research, development, production, and sale of nylon 6 series products both domestically and internationally with a market cap of approximately CN¥6.51 billion.

Operations: Haiyang Technology generates revenue primarily from its textile manufacturing segment, which accounts for CN¥5.54 billion. The company's financial performance is highlighted by a notable net profit margin trend over recent periods, reflecting its operational efficiency in the nylon 6 series products market.

Haiyang Technology, a promising player in its field, recently completed an IPO raising CNY 521.1 million. The company's earnings surged by 33% over the past year, outpacing the Chemicals industry growth of just 0.6%. Despite a volatile share price recently, Haiyang's net debt to equity ratio is at a satisfactory 6.9%, and interest payments are well-covered with EBIT at 17 times interest repayments. However, free cash flow isn't positive currently which may impact future investments or expansions without additional funding sources. With high-quality earnings and a competitive P/E ratio of 43x against the market's average of 45x, it remains an intriguing prospect for investors seeking growth potential in niche markets.

C Sun Mfg (TWSE:2467)

Simply Wall St Value Rating: ★★★★☆☆

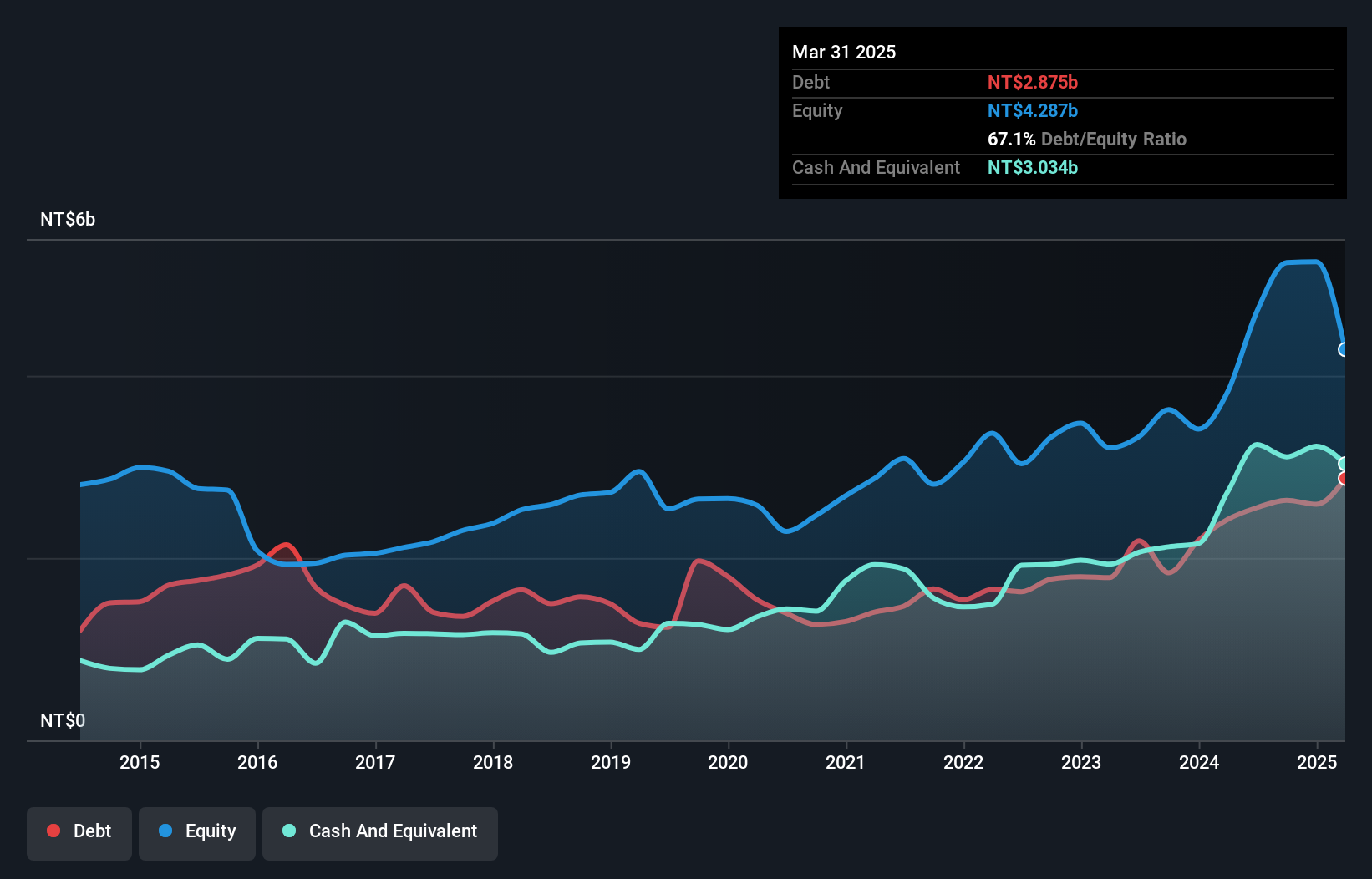

Overview: C Sun Mfg Ltd., along with its subsidiaries, offers a range of processing equipment across Taiwan, China, and international markets, with a market capitalization of NT$27.74 billion.

Operations: C Sun Mfg Ltd. generates revenue primarily through its subsidiaries, with Suzhou Top Creation Machines Co Ltd. contributing NT$1.71 billion and C Sun Manufacturing LTD adding NT$1.15 billion to the total revenue stream.

C Sun Mfg, a nimble player in the machinery sector, has shown robust earnings growth of 12.4% over the past year, outpacing its industry peers who faced a -9.7% earnings contraction. The company's net debt to equity ratio stands at a satisfactory 39.6%, though it has increased from 60.8% to 81.9% over five years, indicating rising leverage concerns. Recent financial results reveal sales for Q2 reached TWD 1,510 million and net income hit TWD 207 million, both improving from last year’s figures of TWD 1,349 million and TWD 187 million respectively, showcasing resilience amid market volatility.

- Get an in-depth perspective on C Sun Mfg's performance by reading our health report here.

Gain insights into C Sun Mfg's past trends and performance with our Past report.

Machvision (TWSE:3563)

Simply Wall St Value Rating: ★★★★★★

Overview: Machvision Inc. develops and sells machine vision systems for the semiconductor and printed circuit board (PCB) industry in Taiwan, with a market cap of NT$31.11 billion.

Operations: Machvision generates revenue primarily from its Optical Inspection Machinery Equipment and related products, amounting to NT$2.71 billion. The company focuses on the semiconductor and PCB industries in Taiwan.

Machvision has demonstrated impressive growth, with earnings skyrocketing by 242.7% over the past year, far outpacing the semiconductor industry's -9.5%. The company reported TWD 968.73 million in sales for Q2 2025, a significant jump from TWD 311.61 million a year ago, and net income rose to TWD 243.9 million from TWD 88.15 million in the same period last year. With no debt on its books now compared to a debt-to-equity ratio of 8.5% five years ago, Machvision's financial health appears robust, making it an intriguing player in its sector's landscape.

- Unlock comprehensive insights into our analysis of Machvision stock in this health report.

Review our historical performance report to gain insights into Machvision's's past performance.

Turning Ideas Into Actions

- Unlock more gems! Our Global Undiscovered Gems With Strong Fundamentals screener has unearthed 2950 more companies for you to explore.Click here to unveil our expertly curated list of 2953 Global Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haiyang Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603382

Haiyang Technology

Engages in the research and development, production, and sale of nylon 6 series products in China and internationally.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026