- China

- /

- Auto Components

- /

- SHSE:600114

Asian Market Value Picks Featuring 3 Stocks Trading At Estimated Discounts

Reviewed by Simply Wall St

As trade tensions between the U.S. and China show signs of easing, Asian markets have experienced a positive shift in sentiment, with key indices such as Japan's Nikkei 225 and China's CSI 300 posting gains. In this environment, investors may find opportunities in stocks that are trading at estimated discounts, making them potential value picks amidst the evolving economic landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alexander Marine (TWSE:8478) | NT$145.50 | NT$281.65 | 48.3% |

| Newborn Town (SEHK:9911) | HK$8.05 | HK$16.05 | 49.8% |

| Members (TSE:2130) | ¥1137.00 | ¥2210.40 | 48.6% |

| Rakus (TSE:3923) | ¥2194.50 | ¥4291.28 | 48.9% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.32 | CN¥41.17 | 48.2% |

| Beijing Zhong Ke San Huan High-Tech (SZSE:000970) | CN¥10.54 | CN¥20.79 | 49.3% |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥39.50 | CN¥77.51 | 49% |

| Everest Medicines (SEHK:1952) | HK$48.95 | HK$97.21 | 49.6% |

| Swire Properties (SEHK:1972) | HK$16.86 | HK$32.76 | 48.5% |

| Holtek Semiconductor (TWSE:6202) | NT$41.70 | NT$81.89 | 49.1% |

Let's take a closer look at a couple of our picks from the screened companies.

NBTM New Materials Group (SHSE:600114)

Overview: NBTM New Materials Group Co., Ltd. is engaged in the production and sale of powder metallurgy mechanical parts globally, with a market cap of approximately CN¥12.28 billion.

Operations: The company's revenue is primarily derived from Powder Compaction (CN¥2.24 billion), Metal Injection Molding (CN¥1.97 billion), and Soft Magnetic Composite (CN¥901.83 million).

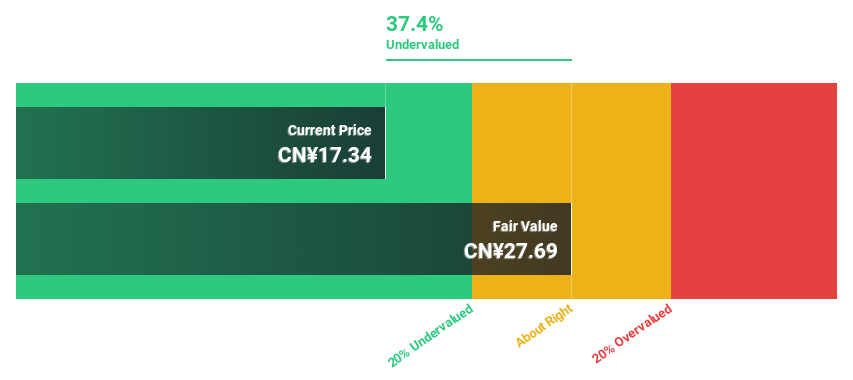

Estimated Discount To Fair Value: 37.4%

NBTM New Materials Group is trading at CN¥19.93, significantly below its estimated fair value of CN¥31.84, presenting a potentially undervalued opportunity based on cash flows. Despite high earnings growth expectations of 24.7% annually over the next three years and recent revenue increases to CN¥5.14 billion, the company's debt coverage by operating cash flow remains inadequate, and its dividend yield of 1.51% isn't well-supported by free cash flows.

- The growth report we've compiled suggests that NBTM New Materials Group's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of NBTM New Materials Group.

JAPAN MATERIAL (TSE:6055)

Overview: JAPAN MATERIAL Co., Ltd. operates in the electronics and graphics sectors in Japan with a market cap of ¥119.92 billion.

Operations: The company's revenue is primarily derived from its Electronics segment, contributing ¥45.75 billion, followed by the Graphics Solution Business at ¥1.84 billion and the Solar Power Generation Business at ¥198 million.

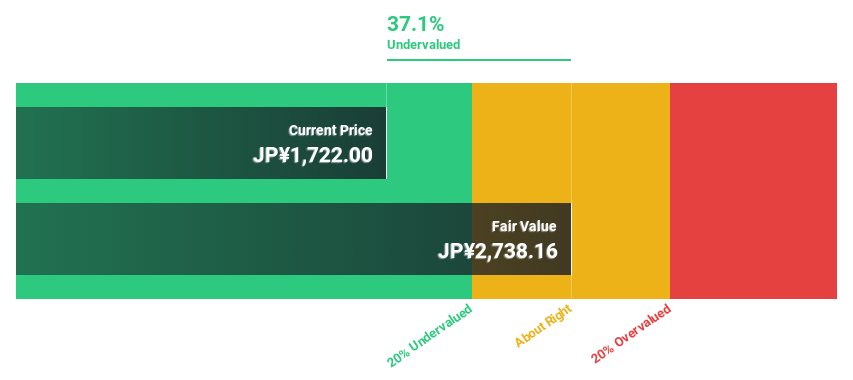

Estimated Discount To Fair Value: 40.3%

JAPAN MATERIAL, trading at ¥1,167, is significantly undervalued compared to its estimated fair value of ¥1,956.18. With forecasted annual earnings growth of 20%, outpacing the JP market's 7.6%, it presents a compelling opportunity based on cash flows despite slower revenue growth at 13.1% annually. The company maintains a reliable dividend yield of 1.89%, though its future return on equity is projected to be modest at 15.3%.

- The analysis detailed in our JAPAN MATERIAL growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of JAPAN MATERIAL stock in this financial health report.

Chung-Hsin Electric and Machinery Manufacturing (TWSE:1513)

Overview: Chung-Hsin Electric and Machinery Manufacturing Corp. operates in the electrical and machinery manufacturing industry, with a market cap of NT$63.24 billion.

Operations: The company's revenue is primarily derived from the Motor Energy Business at NT$19.29 billion, followed by the Service Business at NT$5.11 billion, and Engineering and Other at NT$3.04 billion.

Estimated Discount To Fair Value: 38.4%

Chung-Hsin Electric and Machinery Manufacturing, trading at NT$128, is significantly undervalued with an estimated fair value of NT$207.66. The company reported a substantial earnings increase to TWD 3.62 billion for 2024, reflecting robust cash flow potential despite high debt levels. Forecasted annual earnings growth of 17.3% surpasses the TW market's average, while revenue is expected to grow at 13.5% annually, supporting its strong relative value position in the industry.

- According our earnings growth report, there's an indication that Chung-Hsin Electric and Machinery Manufacturing might be ready to expand.

- Navigate through the intricacies of Chung-Hsin Electric and Machinery Manufacturing with our comprehensive financial health report here.

Where To Now?

- Gain an insight into the universe of 268 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NBTM New Materials Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600114

NBTM New Materials Group

Produces and sells powder metallurgy mechanical parts worldwide.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives