- Taiwan

- /

- Electrical

- /

- TWSE:3296

Powertech Industrial Co., Ltd.'s (TPE:3296) On An Uptrend But Financial Prospects Look Pretty Weak: Is The Stock Overpriced?

Powertech Industrial (TPE:3296) has had a great run on the share market with its stock up by a significant 51% over the last three months. However, we decided to pay close attention to its weak financials as we are doubtful that the current momentum will keep up, given the scenario. In this article, we decided to focus on Powertech Industrial's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Powertech Industrial

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Powertech Industrial is:

0.6% = NT$7.9m ÷ NT$1.4b (Based on the trailing twelve months to September 2020).

The 'return' is the profit over the last twelve months. One way to conceptualize this is that for each NT$1 of shareholders' capital it has, the company made NT$0.01 in profit.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

A Side By Side comparison of Powertech Industrial's Earnings Growth And 0.6% ROE

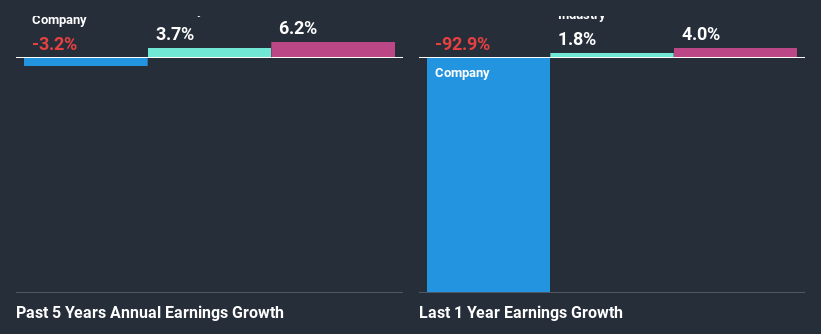

It is quite clear that Powertech Industrial's ROE is rather low. Not just that, even compared to the industry average of 7.9%, the company's ROE is entirely unremarkable. Given the circumstances, the significant decline in net income by 3.2% seen by Powertech Industrial over the last five years is not surprising. We believe that there also might be other aspects that are negatively influencing the company's earnings prospects. For example, the business has allocated capital poorly, or that the company has a very high payout ratio.

So, as a next step, we compared Powertech Industrial's performance against the industry and were disappointed to discover that while the company has been shrinking its earnings, the industry has been growing its earnings at a rate of 3.7% in the same period.

Earnings growth is a huge factor in stock valuation. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. Is Powertech Industrial fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Powertech Industrial Using Its Retained Earnings Effectively?

Powertech Industrial's declining earnings is not surprising given how the company is spending most of its profits in paying dividends, judging by its three-year median payout ratio of 87% (or a retention ratio of 13%). With only very little left to reinvest into the business, growth in earnings is far from likely. To know the 5 risks we have identified for Powertech Industrial visit our risks dashboard for free.

Additionally, Powertech Industrial has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth.

Summary

In total, we would have a hard think before deciding on any investment action concerning Powertech Industrial. As a result of its low ROE and lack of mich reinvestment into the business, the company has seen a disappointing earnings growth rate. Up till now, we've only made a short study of the company's growth data. So it may be worth checking this free detailed graph of Powertech Industrial's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

When trading Powertech Industrial or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Powertech Industrial, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TWSE:3296

Powertech Industrial

Powertech Industrial Co., Ltd., together with its subsidiaries, manufacture and sell electronic circuit power protection and smart home wireless remote control devices, wired and wireless communication equipment, and electronic modules and parts.

Excellent balance sheet low.

Market Insights

Community Narratives