Exploring CIG Shanghai And 2 Other Undiscovered Gems In Asia

Reviewed by Simply Wall St

In recent weeks, Asian markets have been navigating a complex landscape marked by trade policy uncertainties and fluctuating economic indicators. While major indices have seen mixed performances, with smaller-cap indexes posting positive returns despite lagging behind larger counterparts, this environment presents unique opportunities for discerning investors to uncover potential growth stocks. In such a dynamic market setting, identifying promising stocks often involves looking beyond the immediate headlines to focus on companies with strong fundamentals and innovative strategies. This article explores CIG Shanghai and two other lesser-known yet promising stocks in Asia that may offer intriguing prospects amidst current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sinopower Semiconductor | NA | 1.45% | -4.33% | ★★★★★★ |

| MSC | 30.39% | 6.56% | 14.62% | ★★★★★★ |

| Xinjiang Torch Gas | 0.78% | 16.31% | 14.06% | ★★★★★★ |

| Sinotherapeutics | NA | 25.52% | -7.66% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Anji Foodstuff | NA | 9.26% | -13.65% | ★★★★★★ |

| CMC | 1.18% | 2.73% | 9.22% | ★★★★★☆ |

| BIOBIJOULtd | 6.87% | 72.99% | 117.16% | ★★★★★☆ |

| Nippon Sharyo | 53.44% | -0.74% | -11.37% | ★★★★☆☆ |

| Shenzhen Leaguer | 63.12% | 1.96% | -16.52% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

CIG Shanghai (SHSE:603083)

Simply Wall St Value Rating: ★★★★★★

Overview: CIG Shanghai Co., Ltd. focuses on the research and development, production, and sale of edge computing, industrial interconnection, and high-speed optical module products both in China and internationally, with a market cap of CN¥11.21 billion.

Operations: CIG Shanghai generates revenue primarily from its Computer, Communications, and Other Electronic Equipment Manufacturing segment, amounting to CN¥3.70 billion. The company's financial performance is influenced by the dynamics of this sector.

CIG Shanghai, a dynamic player in the communications sector, has showcased impressive growth with earnings surging by 247.8% over the past year, outpacing the industry average of 8.8%. The company's net income for Q1 2025 reached CNY 31.43 million, up from CNY 25.95 million in the previous year. Despite a high Price-To-Earnings ratio of 65.1x, it remains competitive within its industry at an average of 66.5x. Debt management appears solid with a reduced debt-to-equity ratio from 57.3% to 52.8% over five years and interest payments well-covered by EBIT at a multiple of 45x.

- Take a closer look at CIG Shanghai's potential here in our health report.

Assess CIG Shanghai's past performance with our detailed historical performance reports.

Fujian Snowman Group (SZSE:002639)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fujian Snowman Group Co., Ltd. specializes in the design, research and development, production, and sale of ice-making, storage, and delivery equipment and systems both in China and internationally, with a market cap of CN¥10.09 billion.

Operations: Snowman Group generates revenue primarily from the sale of ice-making, storage, and delivery equipment and systems. The company focuses on both domestic and international markets for its products.

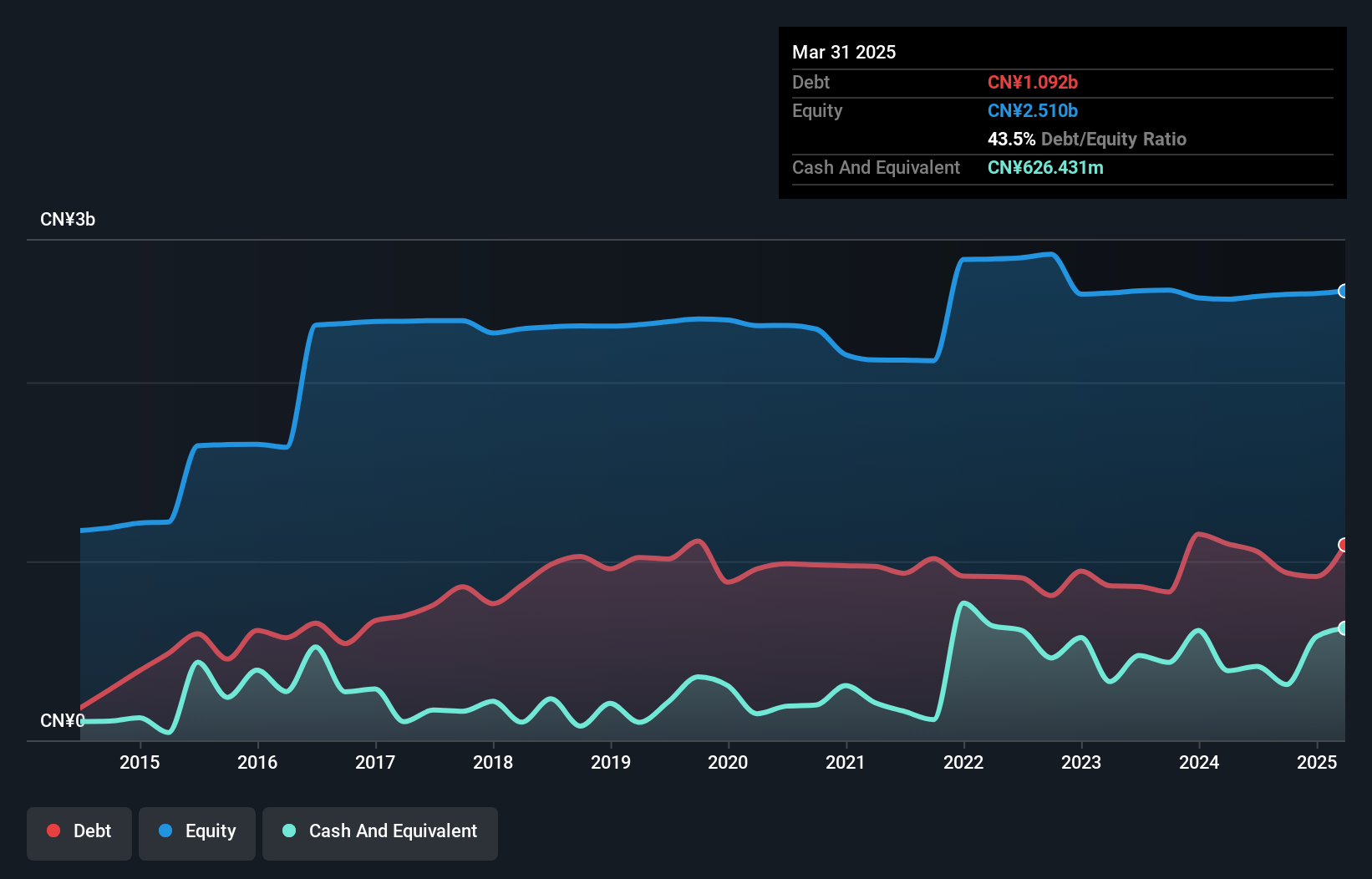

Fujian Snowman Group, a noteworthy player in the machinery sector, has recently turned profitable, boasting high-quality earnings that surpass industry growth rates. Despite its debt to equity ratio rising slightly from 41.3% to 43.5% over five years, the company's net debt to equity remains satisfactory at 18.6%. Trading at nearly 77% below estimated fair value suggests potential undervaluation for investors seeking opportunities in Asia's small-cap market. Recent reports highlight a revenue increase to CNY 402 million for Q1 2025 from CNY 343 million last year and net income of CNY 10 million compared to CNY 9 million previously, reflecting positive momentum.

- Click here and access our complete health analysis report to understand the dynamics of Fujian Snowman Group.

Understand Fujian Snowman Group's track record by examining our Past report.

Techman Robot (TPEX:4585)

Simply Wall St Value Rating: ★★★★★★

Overview: Techman Robot Inc. specializes in providing collaborative robots equipped with visual systems, software, and application-based solutions across various regions including Taiwan, China, Europe, Japan, South Korea, and Southeast Asia with a market cap of NT$34.61 billion.

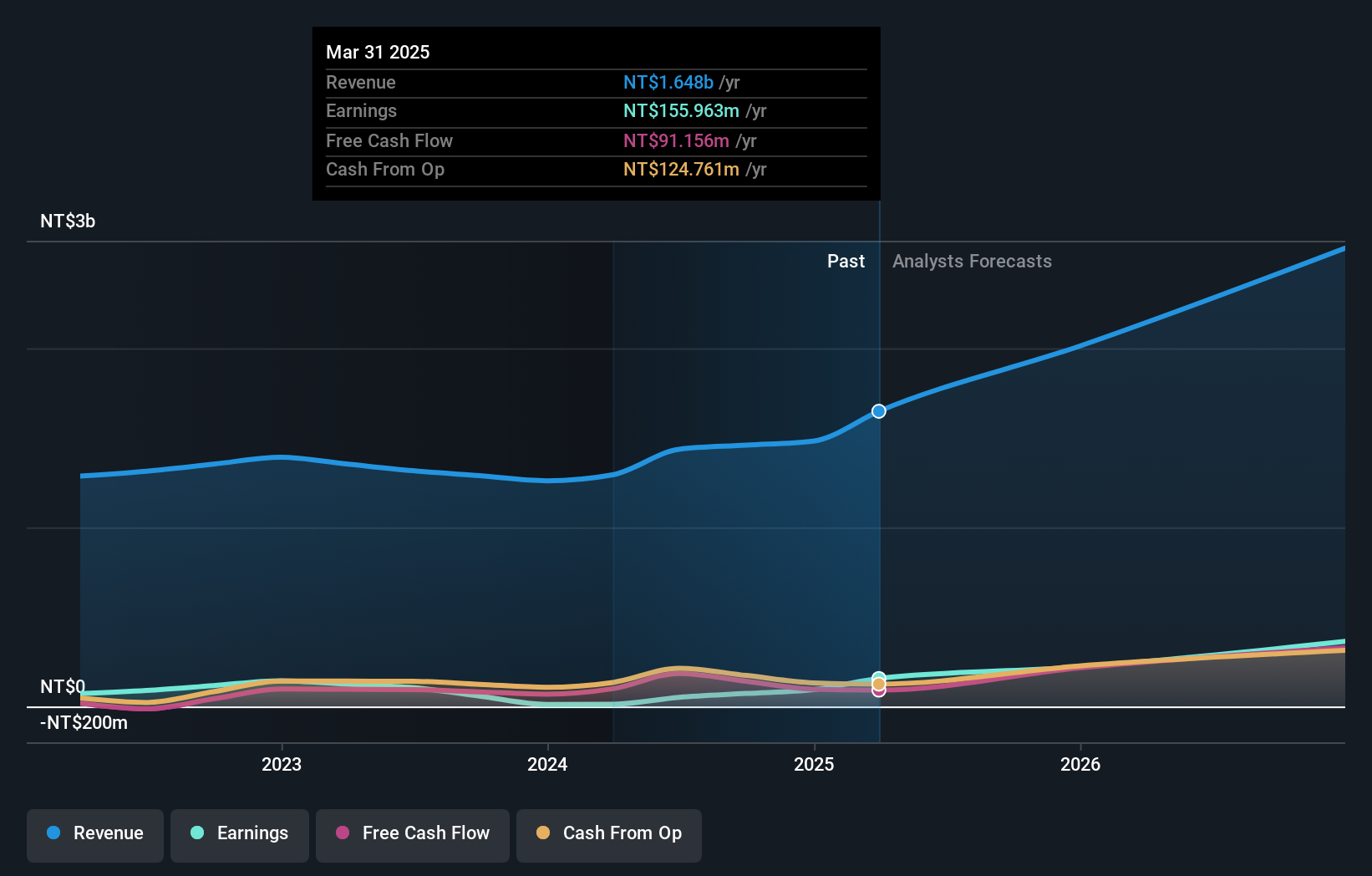

Operations: Techman Robot generates revenue primarily from the manufacturing of robot arms, sales, and warranty repair services, totaling NT$1.65 billion.

Techman Robot, a nimble player in the automation industry, has made significant strides with its earnings growth of 1145% over the past year, far outpacing the machinery sector's average. Reporting TWD 495 million in sales for Q1 2025 compared to TWD 329 million a year ago, it also achieved net income of TWD 66 million from just TWD 4 million previously. The company is debt-free and boasts high-quality earnings, underscoring its robust financial health. Recent innovations like the TM6S cobot and strategic partnerships are likely enhancing its market position and expanding applications across various industries.

- Get an in-depth perspective on Techman Robot's performance by reading our health report here.

Examine Techman Robot's past performance report to understand how it has performed in the past.

Where To Now?

- Navigate through the entire inventory of 2604 Asian Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Techman Robot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:4585

Techman Robot

Provides collaborative robots with visual systems, software, and application-based solutions in Taiwan, China, Europe, Japan, South Korea, and Southeast Asia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives