- Netherlands

- /

- Food and Staples Retail

- /

- ENXTAM:ACOMO

3 Reliable Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

In the face of recent market fluctuations driven by tariff uncertainties and mixed economic signals, investors are increasingly seeking stability in their portfolios. Dividend stocks, known for their potential to provide consistent income streams regardless of market volatility, can offer such reliability.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.87% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.35% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.79% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.46% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.11% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.00% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.88% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

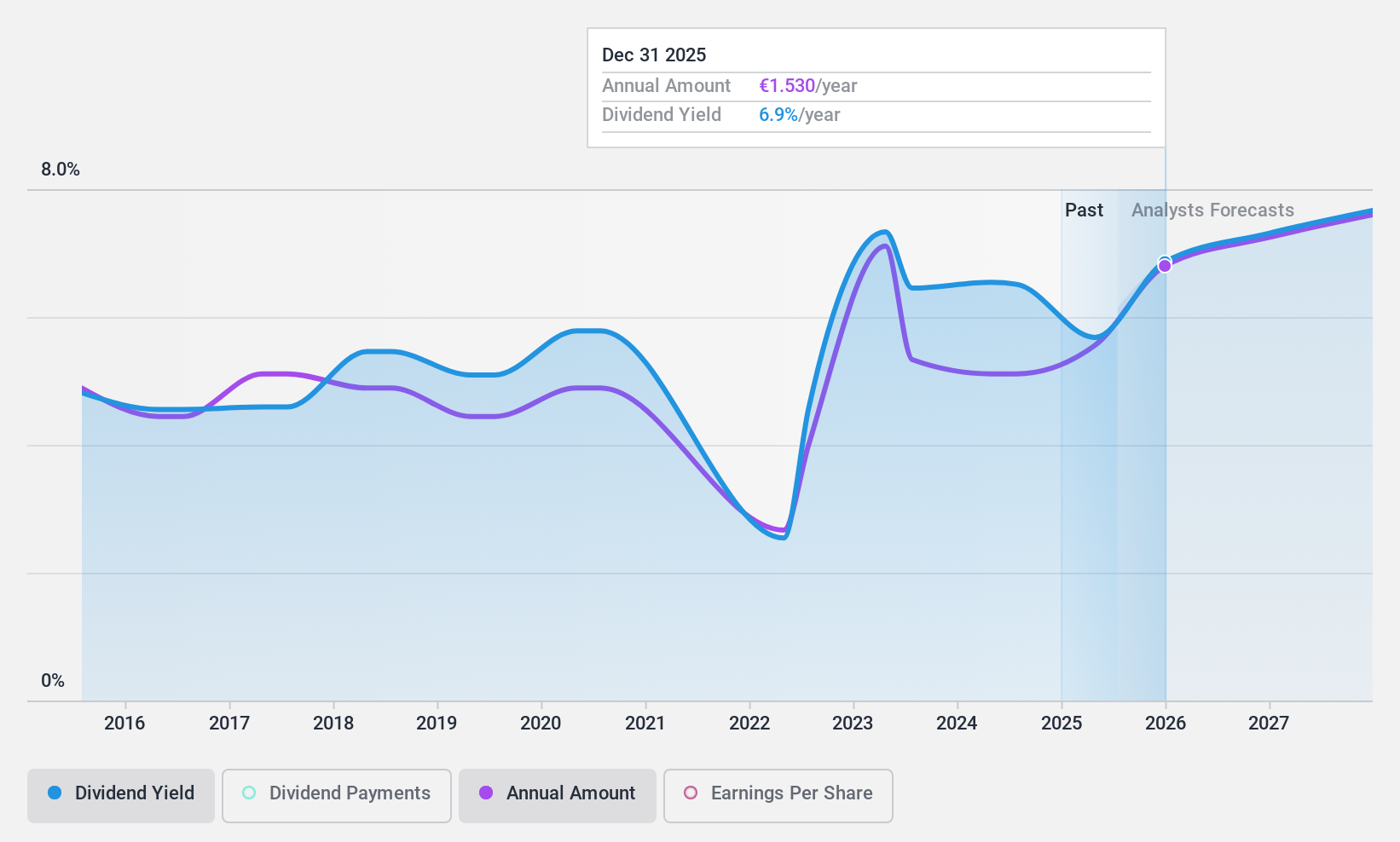

Caltagirone (BIT:CALT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Caltagirone SpA operates through its subsidiaries in cement manufacturing, media, real estate, and publishing sectors, with a market cap of €857.66 million.

Operations: Caltagirone SpA generates revenue through its segments: Publishing (€112.65 million), Constructions (€186.77 million), Management of Properties (€35.27 million), and Cement, Concrete and Aggregates (€1.64 billion).

Dividend Yield: 3.5%

Caltagirone's dividend strategy is supported by a low cash payout ratio of 9.1%, ensuring dividends are well-covered by free cash flow. The company's stable and growing dividend payments over the past decade, coupled with a modest yield of 3.52%, highlight its reliability, though it trails behind the top Italian dividend payers at 5.35%. Trading significantly below its estimated fair value suggests potential for capital appreciation alongside income generation.

- Dive into the specifics of Caltagirone here with our thorough dividend report.

- Upon reviewing our latest valuation report, Caltagirone's share price might be too pessimistic.

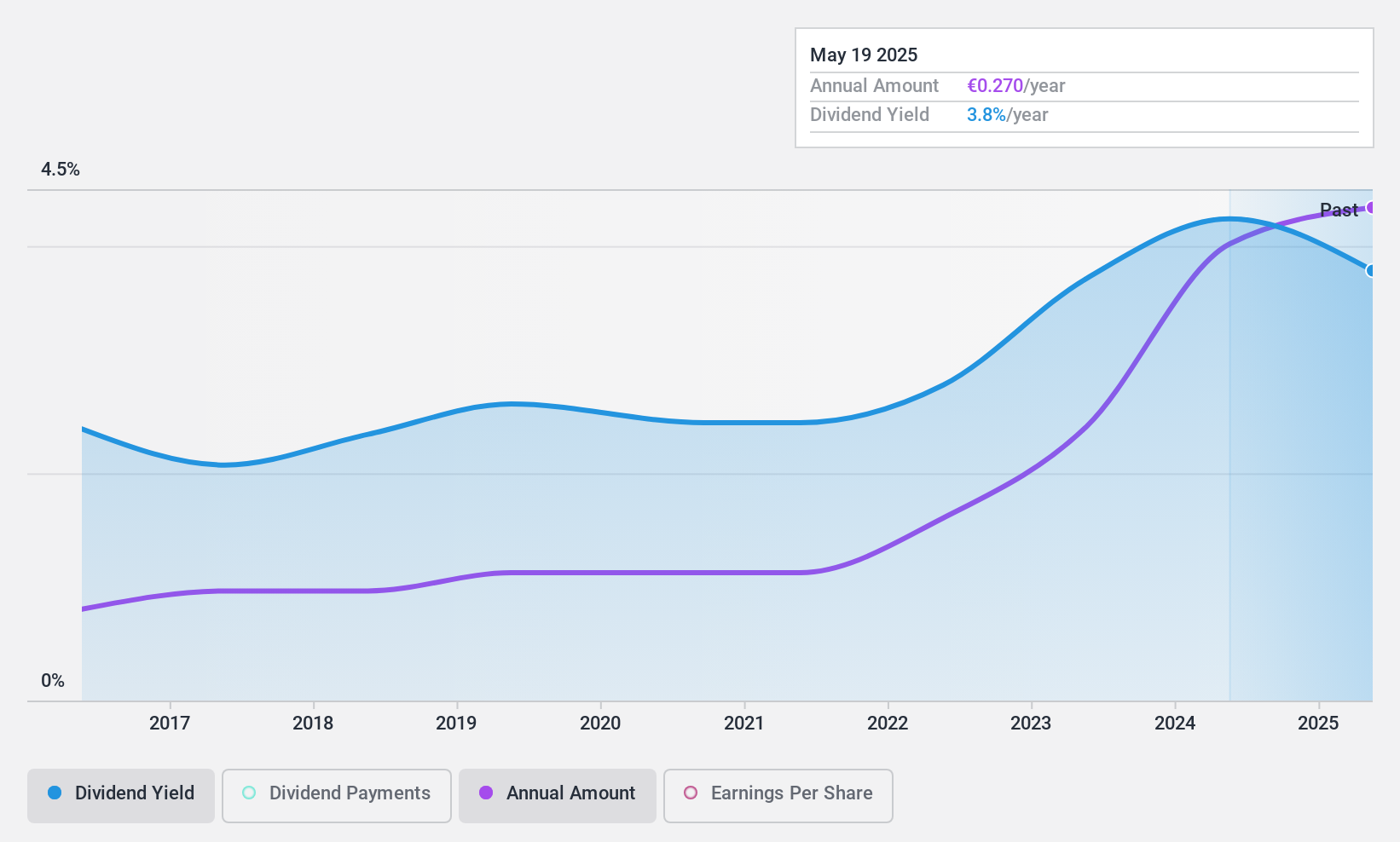

Acomo (ENXTAM:ACOMO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Acomo N.V. operates in the sourcing, trading, processing, packaging, and distribution of conventional and organic food ingredients for the food and beverage industry across Europe, North America, and internationally with a market cap of €542.60 million.

Operations: Acomo N.V.'s revenue segments include Tea (€124.04 million), Edible Seeds (€246.52 million), Food Solutions (€23.47 million), Spices and Nuts (€445.76 million), and Organic Ingredients (€429.28 million).

Dividend Yield: 6.2%

Acomo's dividend yield of 6.24% ranks in the top 25% of Dutch payers, but its sustainability is a concern due to a high payout ratio of 95.7%, not covered by earnings. Despite recent growth, dividends have been volatile over the past decade, with stability issues and outdated financial data adding uncertainty. The price-to-earnings ratio of 15.4x suggests good value compared to the broader Dutch market at 17.2x, though debt levels remain high.

- Delve into the full analysis dividend report here for a deeper understanding of Acomo.

- Insights from our recent valuation report point to the potential overvaluation of Acomo shares in the market.

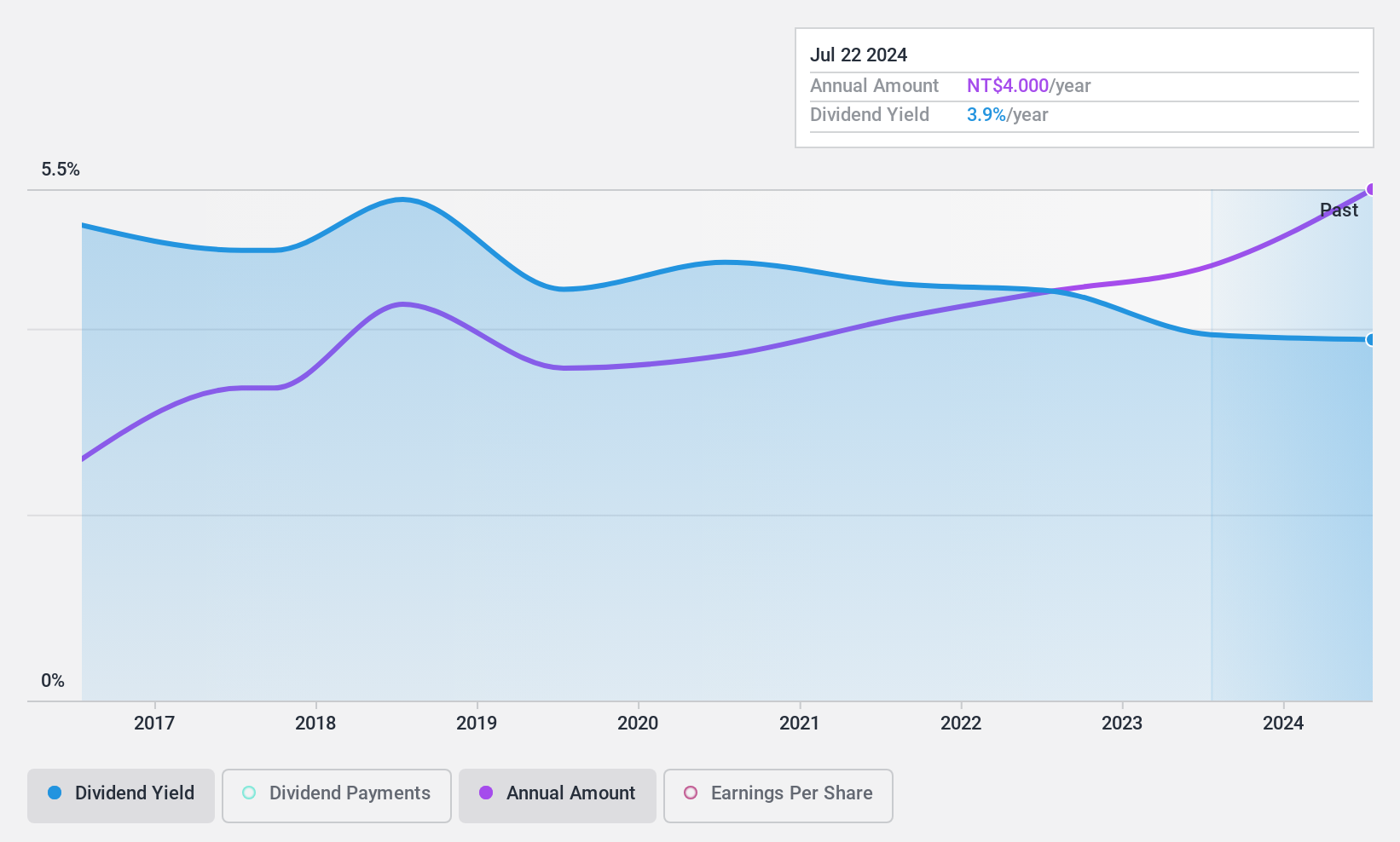

GFC (TPEX:4506)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: GFC LTD., along with its subsidiaries, manufactures and sells elevators, escalators, and generators in Taiwan, with a market cap of NT$18.67 billion.

Operations: GFC LTD.'s revenue is primarily derived from its Sales Department, including Shanghai Chong You Industrial Co., Ltd. and its subsidiaries, which contributes NT$2.97 billion, and the Maintenance Department, which adds NT$2.34 billion.

Dividend Yield: 3.8%

GFC offers a stable dividend yield of 3.79%, supported by a payout ratio of 77.4% and cash flow coverage at 69.2%. Over the past decade, dividends have been reliable and growing, though they remain below the top tier in the TW market. The company's price-to-earnings ratio of 20.4x is slightly below the market average, indicating reasonable value. Recent earnings show modest growth in net income and sales, underscoring its capacity to maintain dividend payments.

- Click to explore a detailed breakdown of our findings in GFC's dividend report.

- The valuation report we've compiled suggests that GFC's current price could be inflated.

Make It Happen

- Unlock our comprehensive list of 1969 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ACOMO

Acomo

Engages in sourcing, trading, processing, packaging, and distributing conventional and organic food ingredients and solutions for the food and beverage industry in the Netherlands, other European countries, North America, and internationally.

Solid track record average dividend payer.

Market Insights

Community Narratives