- Japan

- /

- Transportation

- /

- TSE:9028

China Design Group And 2 Other Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate mixed signals, with U.S. stocks closing a strong year despite recent slumps and European indices showing varied performance, investors are keenly observing economic indicators like the Chicago PMI and GDP forecasts for insights into future trends. Amid these fluctuating conditions, dividend stocks continue to attract attention for their potential to provide steady income streams, making them an appealing option for those seeking stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.30% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.53% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

Click here to see the full list of 1997 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

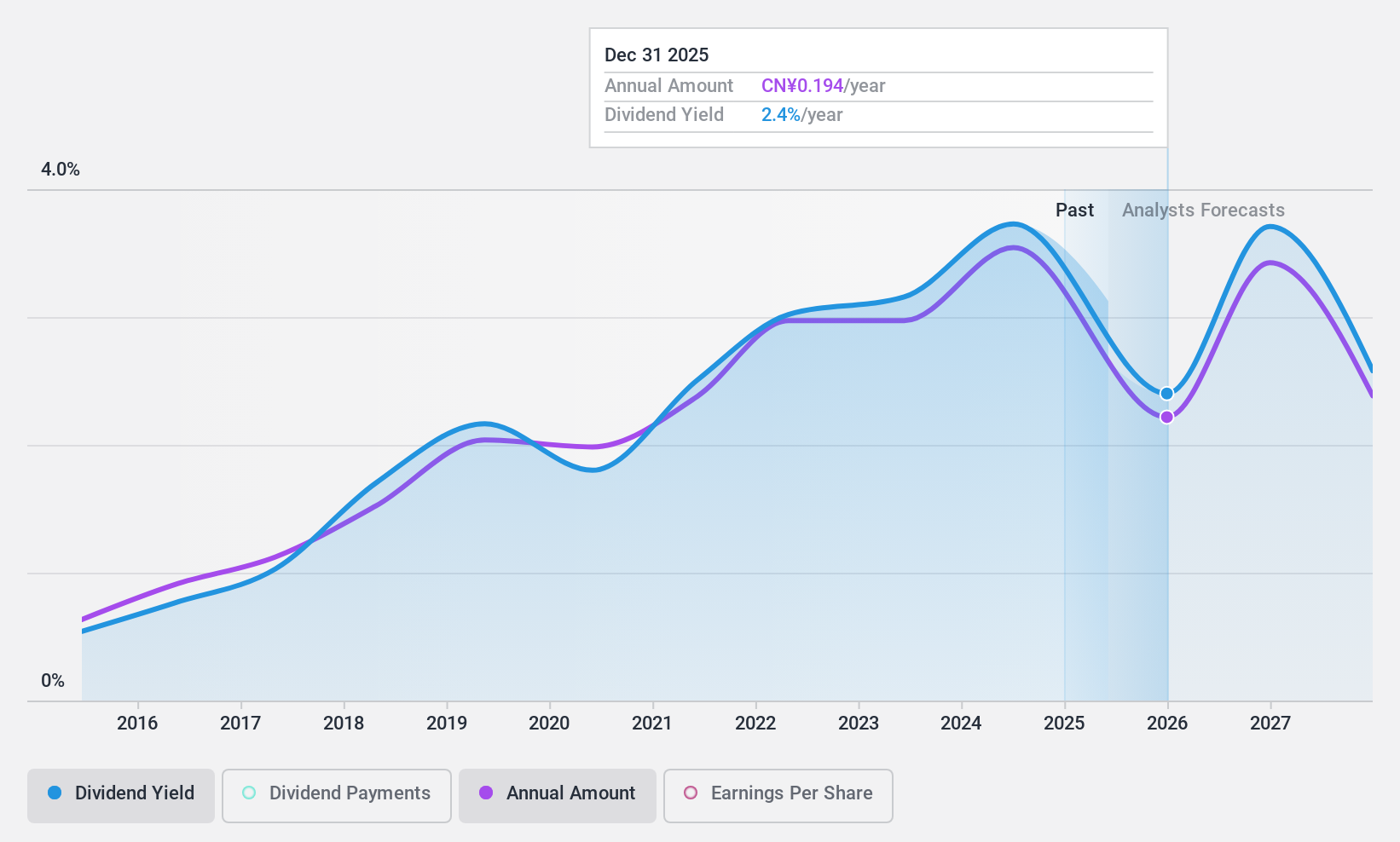

China Design Group (SHSE:603018)

Simply Wall St Dividend Rating: ★★★★★★

Overview: China Design Group Co., Ltd. offers engineering survey and design services in China, with a market cap of CN¥5.23 billion.

Operations: China Design Group Co., Ltd. generates its revenue primarily from engineering survey and design services within China.

Dividend Yield: 3.7%

China Design Group offers a high dividend yield of 3.75%, placing it in the top 25% of dividend payers in China. The dividend is well-covered by earnings with a payout ratio of 37% and has been stable over the past decade, showing consistent growth. Despite recent declines in sales and net income, the stock trades at a favorable price-to-earnings ratio of 9.7x, below the market average, suggesting good value for investors focused on dividends.

- Delve into the full analysis dividend report here for a deeper understanding of China Design Group.

- Our valuation report here indicates China Design Group may be undervalued.

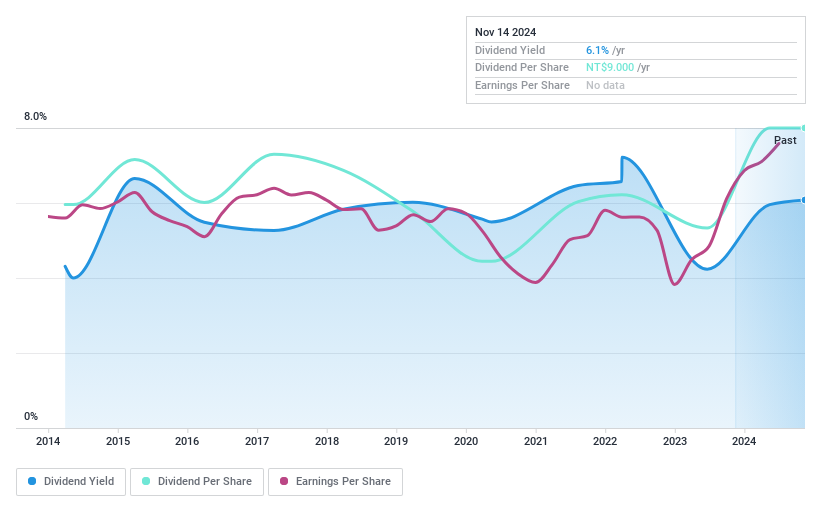

Sinmag Equipment (TPEX:1580)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sinmag Equipment Corporation manufactures, retails, and wholesales baking and food service equipment, with a market cap of NT$7.38 billion.

Operations: Sinmag Equipment Corporation generates its revenue through the production and distribution of baking and food service equipment.

Dividend Yield: 6%

Sinmag Equipment's dividend yield of 5.96% ranks in the top 25% of Taiwan's market, supported by a payout ratio of 71.5%. Despite recent earnings growth and coverage by cash flows, dividends have been historically volatile and unreliable over the past decade. The stock trades at a discount to its estimated fair value, potentially offering good value for dividend-focused investors. Recent earnings showed mixed results with increased nine-month revenue but decreased quarterly net income year-on-year.

- Navigate through the intricacies of Sinmag Equipment with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Sinmag Equipment shares in the market.

ZERO (TSE:9028)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ZERO Co., Ltd., along with its subsidiaries, offers vehicle transportation and maintenance services in Japan and has a market cap of ¥43.40 billion.

Operations: ZERO Co., Ltd.'s revenue segments include Domestic Car Related Business at ¥66.47 billion, Overseas Related Business at ¥48.69 billion, Human Resource Business at ¥23.92 billion, and General Cargo Transportation at ¥6.46 billion.

Dividend Yield: 4%

ZERO's dividend yield of 3.97% places it among the top 25% in Japan, with a low payout ratio of 19.5%, indicating dividends are well-covered by earnings and cash flows. Despite recent earnings growth, its dividend history has been volatile and unreliable over the past decade. The stock is trading significantly below its estimated fair value, suggesting potential value for investors seeking dividends despite an unstable track record and highly volatile share price recently.

- Dive into the specifics of ZERO here with our thorough dividend report.

- Upon reviewing our latest valuation report, ZERO's share price might be too pessimistic.

Where To Now?

- Gain an insight into the universe of 1997 Top Dividend Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZERO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9028

Solid track record with excellent balance sheet and pays a dividend.