As global markets navigate mixed signals, with the S&P 500 Index capping off a strong two-year performance despite recent economic concerns like the Chicago PMI contraction, investors are keenly observing opportunities that offer stability and income. In such an environment, dividend stocks can be appealing due to their potential for regular income streams and resilience amid fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.60% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.53% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.92% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.51% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.43% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

Click here to see the full list of 1997 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Spar Nord Bank (CPSE:SPNO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Spar Nord Bank A/S offers a range of banking products and services to retail and business customers in Denmark, with a market cap of DKK23.62 billion.

Operations: Spar Nord Bank's revenue segments include DKK533 million from the Trading Division and DKK4.96 billion from Spar Nord's Local Banks, including the Group's Leasing Activities.

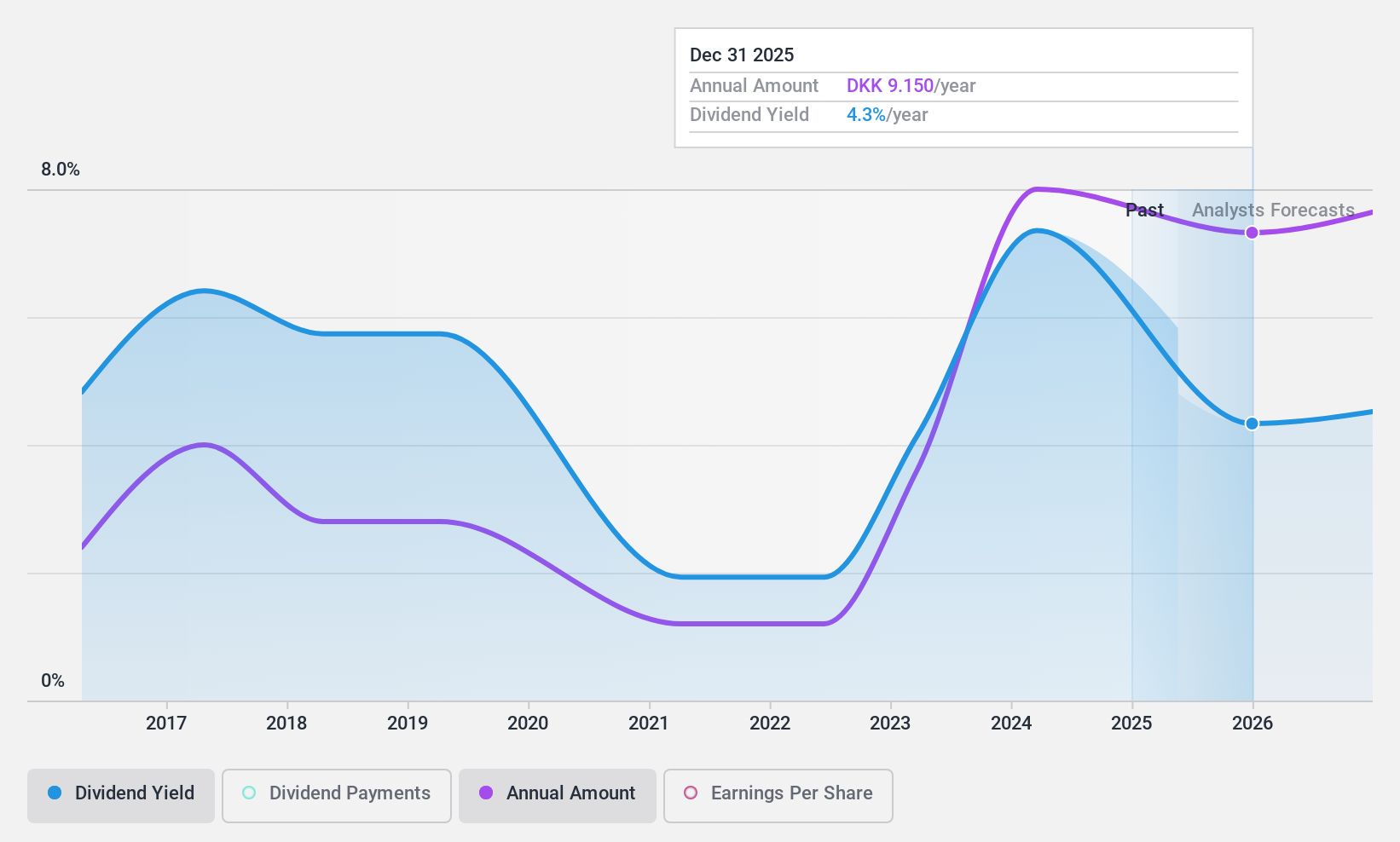

Dividend Yield: 4.8%

Spar Nord Bank's dividend payments have been unreliable and volatile over the past decade, despite a reasonable payout ratio of 51.3% indicating coverage by earnings. The bank is trading below its estimated fair value, but faces high non-performing loans at 2.4%. Recent developments include a tender offer from Nykredit Realkredit A/S to acquire Spar Nord Bank for DKK 19.3 billion, potentially leading to delisting if completed in early 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Spar Nord Bank.

- The analysis detailed in our Spar Nord Bank valuation report hints at an inflated share price compared to its estimated value.

SRA Holdings (TSE:3817)

Simply Wall St Dividend Rating: ★★★★★★

Overview: SRA Holdings, Inc. operates in systems development, operation/administration, and product solutions marketing both in Japan and internationally, with a market cap of ¥53.50 billion.

Operations: SRA Holdings, Inc. generates revenue from its Sales Business (¥16.91 billion), Operation/Construction Business (¥6.72 billion), and Construction in Progress - Development (¥25.32 billion).

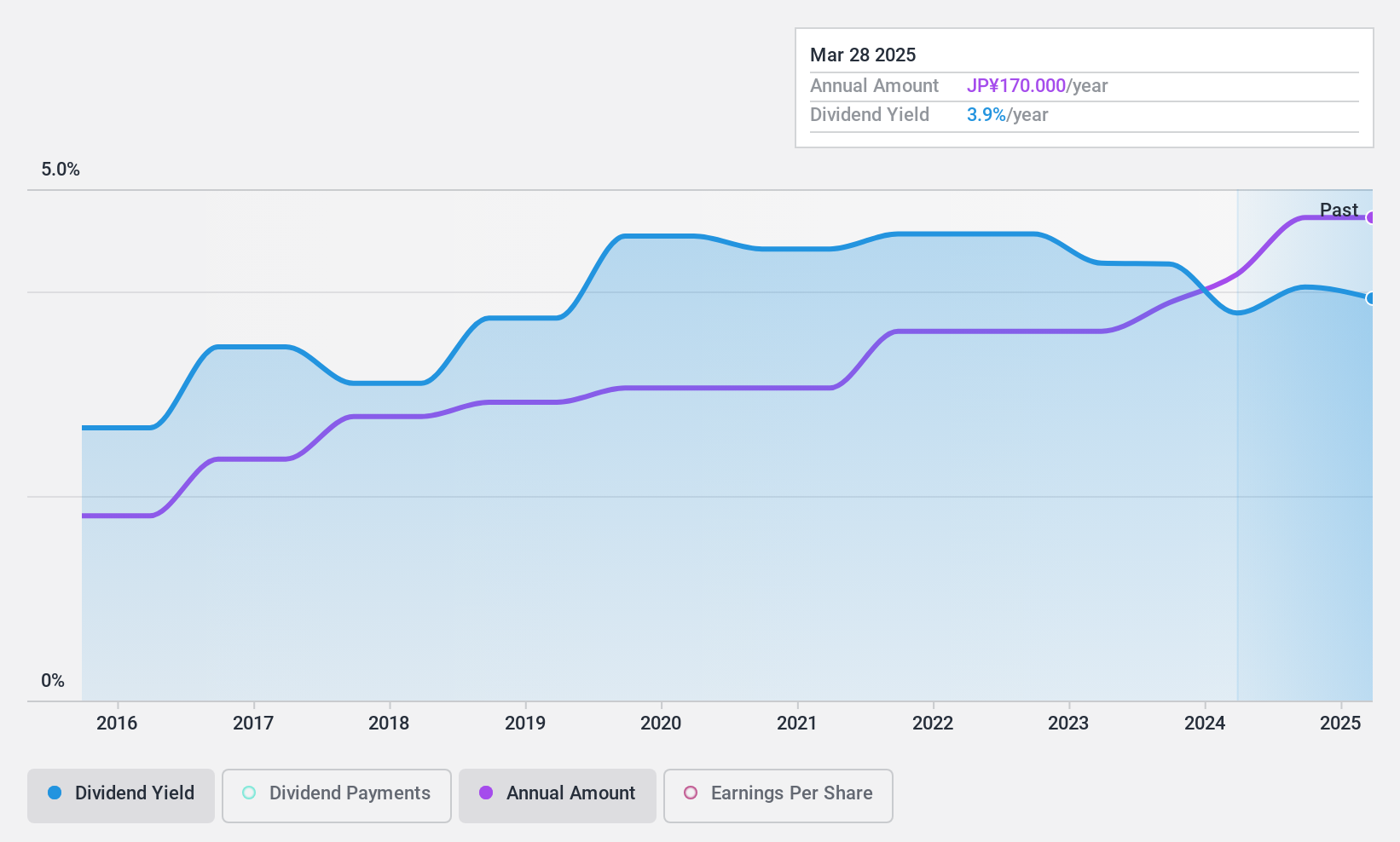

Dividend Yield: 4%

SRA Holdings offers a compelling dividend profile with stable and growing payments over the past decade, supported by a payout ratio of 66.7% and cash flow coverage at 87.9%. Its dividend yield of 4.01% ranks in the top quartile in Japan, reflecting its attractiveness among peers. The company's Price-To-Earnings ratio of 14.2x suggests it is undervalued compared to the industry average, enhancing its appeal for value-conscious investors seeking reliable income streams.

- Navigate through the intricacies of SRA Holdings with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of SRA Holdings shares in the market.

Laster Tech (TWSE:3346)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Laster Tech Co., Ltd. manufactures and sells LED chips and components across Taiwan, China, and Thailand with a market cap of NT$4.01 billion.

Operations: Laster Tech Co., Ltd.'s revenue primarily comes from the LASTER Department (NT$2.43 billion), Laser Tech (Shanghai) Segment (NT$6.76 billion), and Laser Tech (Dong Guan) Segment (NT$698.56 million).

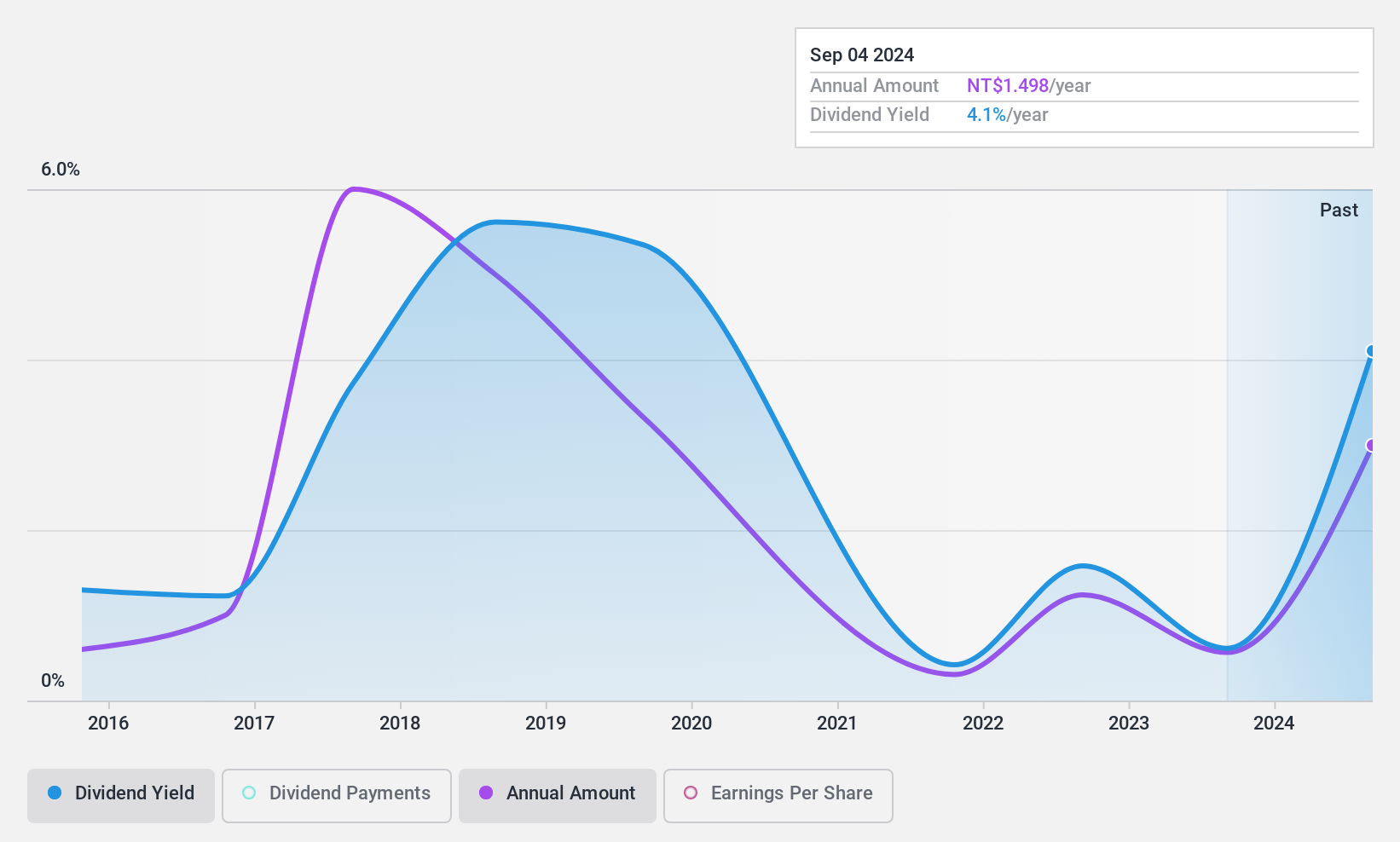

Dividend Yield: 4.3%

Laster Tech's dividend payments, though increasing over the past decade, have been unreliable and volatile. Despite this, dividends are well-covered by earnings (payout ratio of 55.7%) and cash flows (cash payout ratio of 32.9%). The dividend yield of 4.31% is slightly below the top quartile in Taiwan's market. Trading at a price-to-earnings ratio of 13x, Laster Tech appears undervalued compared to peers, but its high debt level warrants caution for investors prioritizing financial stability.

- Click to explore a detailed breakdown of our findings in Laster Tech's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Laster Tech shares in the market.

Turning Ideas Into Actions

- Embark on your investment journey to our 1997 Top Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3817

SRA Holdings

Engages in systems development, operation/administration, and product solutions marketing businesses in Japan and internationally.

Flawless balance sheet 6 star dividend payer.