Is Xu Yuan Packaging Technology (GTSM:8421) Using Too Much Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Xu Yuan Packaging Technology Co., Ltd. (GTSM:8421) does carry debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Xu Yuan Packaging Technology

What Is Xu Yuan Packaging Technology's Debt?

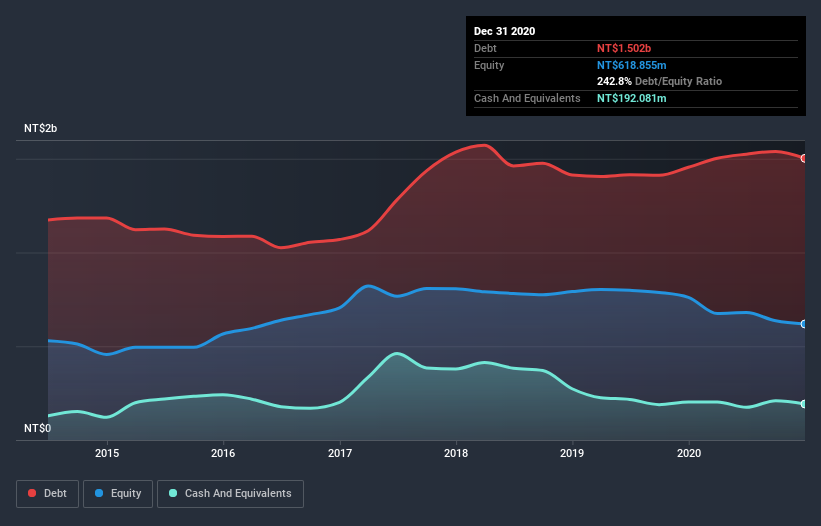

The chart below, which you can click on for greater detail, shows that Xu Yuan Packaging Technology had NT$1.50b in debt in December 2020; about the same as the year before. However, it also had NT$192.1m in cash, and so its net debt is NT$1.31b.

How Strong Is Xu Yuan Packaging Technology's Balance Sheet?

We can see from the most recent balance sheet that Xu Yuan Packaging Technology had liabilities of NT$1.71b falling due within a year, and liabilities of NT$52.0m due beyond that. Offsetting this, it had NT$192.1m in cash and NT$349.6m in receivables that were due within 12 months. So its liabilities total NT$1.22b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the NT$526.2m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Xu Yuan Packaging Technology would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Xu Yuan Packaging Technology's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year Xu Yuan Packaging Technology had a loss before interest and tax, and actually shrunk its revenue by 11%, to NT$1.2b. That's not what we would hope to see.

Caveat Emptor

While Xu Yuan Packaging Technology's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at NT$12m. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it burned through NT$99m in negative free cash flow over the last year. So suffice it to say we consider the stock to be risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for Xu Yuan Packaging Technology (1 is concerning) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you decide to trade Xu Yuan Packaging Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:8421

Xu Yuan Packaging Technology

Engages in the manufacture and retail of heat shrinkable film and tube-sleeping plastic packaging materials in Taiwan and internationally.

Good value with mediocre balance sheet.

Market Insights

Community Narratives