- Taiwan

- /

- Electrical

- /

- TPEX:8038

We Think Changs Ascending Enterprise (GTSM:8038) Has A Fair Chunk Of Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Changs Ascending Enterprise Co., Ltd. (GTSM:8038) does carry debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Changs Ascending Enterprise

What Is Changs Ascending Enterprise's Net Debt?

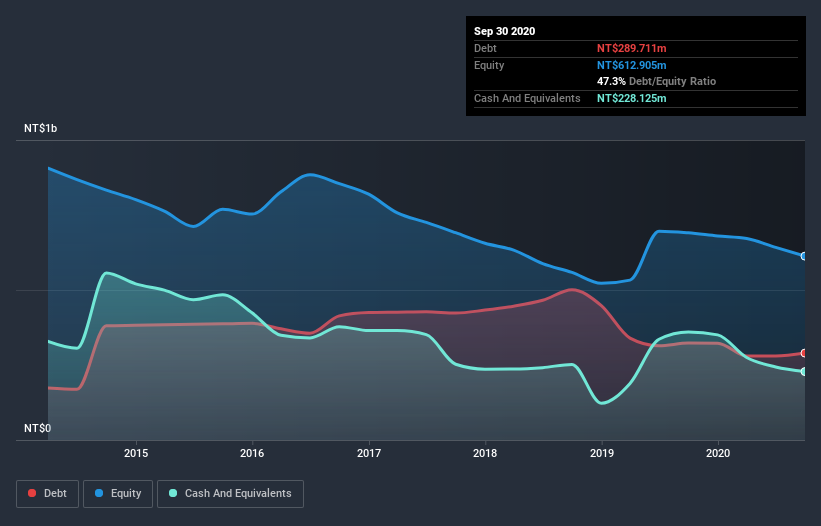

The image below, which you can click on for greater detail, shows that Changs Ascending Enterprise had debt of NT$289.7m at the end of September 2020, a reduction from NT$323.0m over a year. However, it also had NT$228.1m in cash, and so its net debt is NT$61.6m.

How Strong Is Changs Ascending Enterprise's Balance Sheet?

The latest balance sheet data shows that Changs Ascending Enterprise had liabilities of NT$53.9m due within a year, and liabilities of NT$494.7m falling due after that. Offsetting this, it had NT$228.1m in cash and NT$48.6m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by NT$271.9m.

Of course, Changs Ascending Enterprise has a market capitalization of NT$2.08b, so these liabilities are probably manageable. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. When analysing debt levels, the balance sheet is the obvious place to start. But it is Changs Ascending Enterprise's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Changs Ascending Enterprise had a loss before interest and tax, and actually shrunk its revenue by 34%, to NT$204m. That makes us nervous, to say the least.

Caveat Emptor

While Changs Ascending Enterprise's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost NT$62m at the EBIT level. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. Another cause for caution is that is bled NT$77m in negative free cash flow over the last twelve months. So to be blunt we think it is risky. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example - Changs Ascending Enterprise has 2 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you decide to trade Changs Ascending Enterprise, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TPEX:8038

Changs Ascending Enterprise

Engages in the research and development, manufacturing, and sale of lithium-iron batteries and its materials in Taiwan.

Excellent balance sheet very low.

Similar Companies

Market Insights

Community Narratives