- Taiwan

- /

- Electrical

- /

- TPEX:6124

Is Now The Time To Put Yeh-Chiang Technology (GTSM:6124) On Your Watchlist?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Yeh-Chiang Technology (GTSM:6124). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for Yeh-Chiang Technology

How Fast Is Yeh-Chiang Technology Growing Its Earnings Per Share?

In the last three years Yeh-Chiang Technology's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Over twelve months, Yeh-Chiang Technology increased its EPS from NT$1.34 to NT$1.46. That amounts to a small improvement of 9.0%.

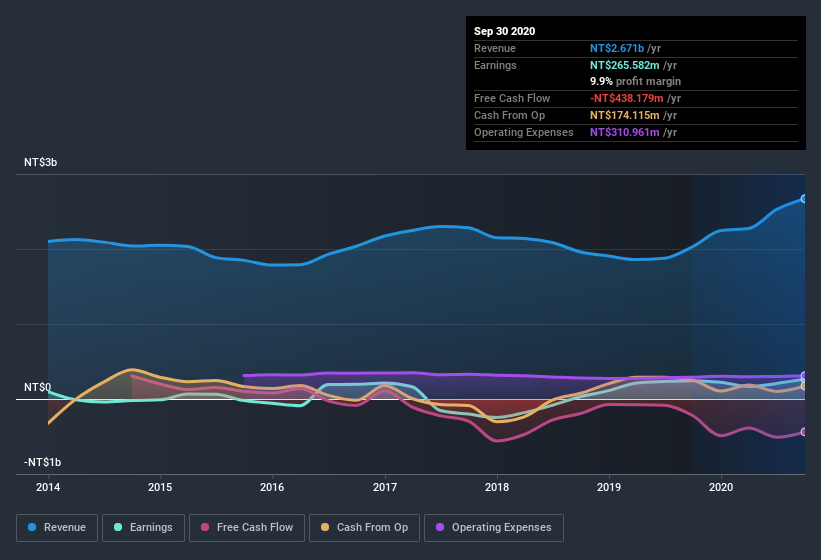

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. Yeh-Chiang Technology maintained stable EBIT margins over the last year, all while growing revenue 31% to NT$2.7b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Yeh-Chiang Technology isn't a huge company, given its market capitalization of NT$5.6b. That makes it extra important to check on its balance sheet strength.

Are Yeh-Chiang Technology Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. I discovered that the median total compensation for the CEOs of companies like Yeh-Chiang Technology with market caps between NT$2.9b and NT$11b is about NT$4.7m.

The CEO of Yeh-Chiang Technology was paid just NT$20k in total compensation for the year ending . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Yeh-Chiang Technology Worth Keeping An Eye On?

One positive for Yeh-Chiang Technology is that it is growing EPS. That's nice to see. On top of that, my faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So all in all I think it's worth at least considering for your watchlist. Still, you should learn about the 1 warning sign we've spotted with Yeh-Chiang Technology .

Although Yeh-Chiang Technology certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Yeh-Chiang Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TPEX:6124

Yeh Chiang Technology

Engages in the production and sale of heat pipe components in Taiwan and internationally.

Mediocre balance sheet with minimal risk.

Similar Companies

Market Insights

Community Narratives