- Taiwan

- /

- Auto Components

- /

- TWSE:1339

Mitsubishi Chemical Group And 2 Other Excellent Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and political uncertainties, investors are increasingly seeking stability through dividend stocks. In such volatile times, companies like Mitsubishi Chemical Group offer potential resilience and income generation, making them attractive options for those looking to balance risk with steady returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.15% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.74% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.28% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.54% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.20% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.48% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

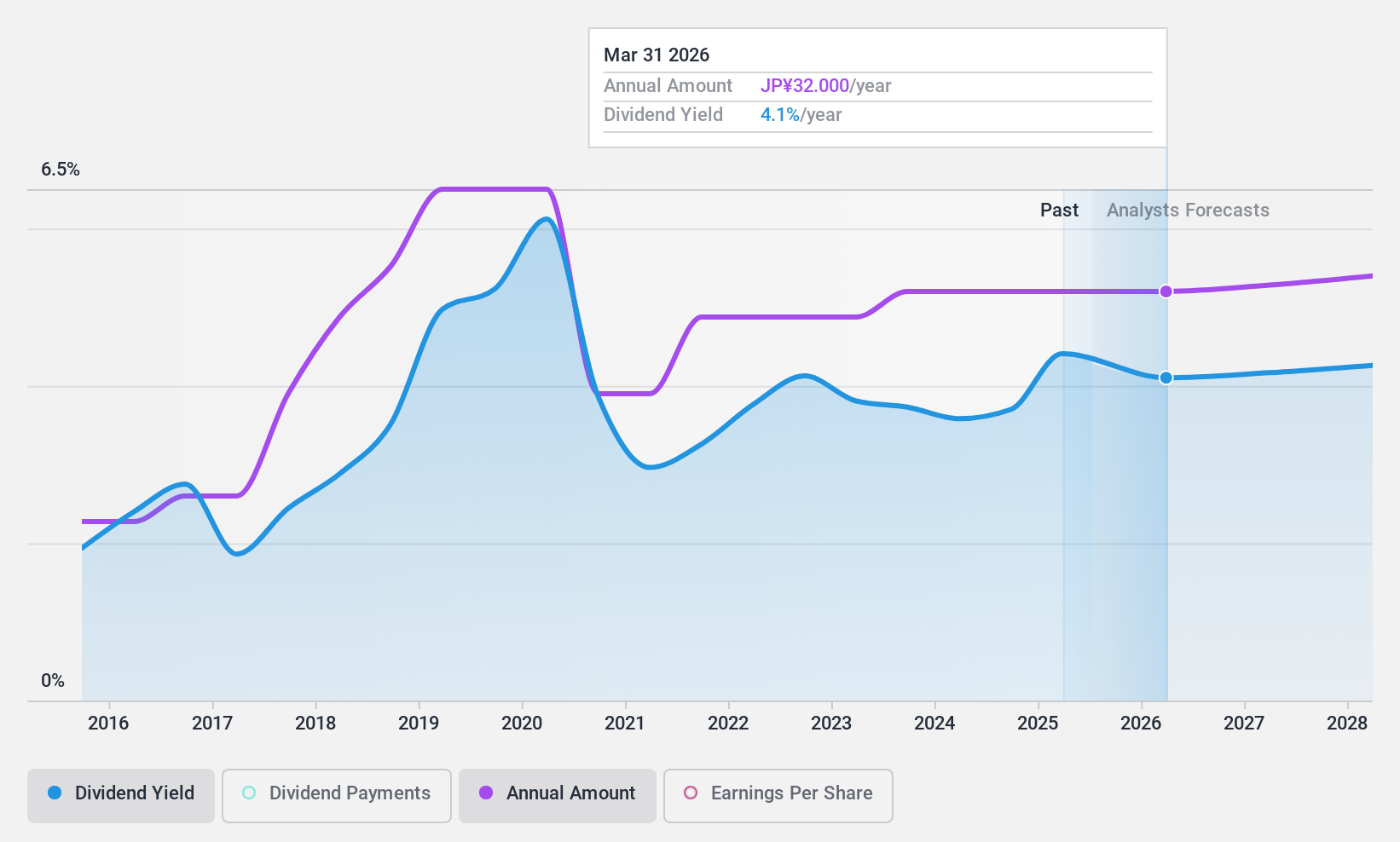

Mitsubishi Chemical Group (TSE:4188)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsubishi Chemical Group Corporation operates in the fields of performance products, chemicals, industrial gases, and health care products both in Japan and globally, with a market cap of ¥1.11 trillion.

Operations: Mitsubishi Chemical Group Corporation's revenue is segmented into Pharma (¥450.55 million), Industrial Gases (¥1.29 billion), MMA & Derivatives (¥383.82 million), Specialty Materials (¥1.17 billion), and Basic Materials & Polymers (¥1.08 billion).

Dividend Yield: 4.1%

Mitsubishi Chemical Group's dividend payments are well covered by earnings and cash flows, with a payout ratio of 48.8% and a cash payout ratio of 20.3%. Despite its top-tier dividend yield in Japan, the company's dividend history has been volatile over the past decade. Recent management changes and revised earnings guidance highlight operational challenges, particularly in specialty materials. However, analysts see growth potential, forecasting a 19.32% annual increase in earnings while maintaining stable dividends for now.

- Click here to discover the nuances of Mitsubishi Chemical Group with our detailed analytical dividend report.

- Our valuation report unveils the possibility Mitsubishi Chemical Group's shares may be trading at a discount.

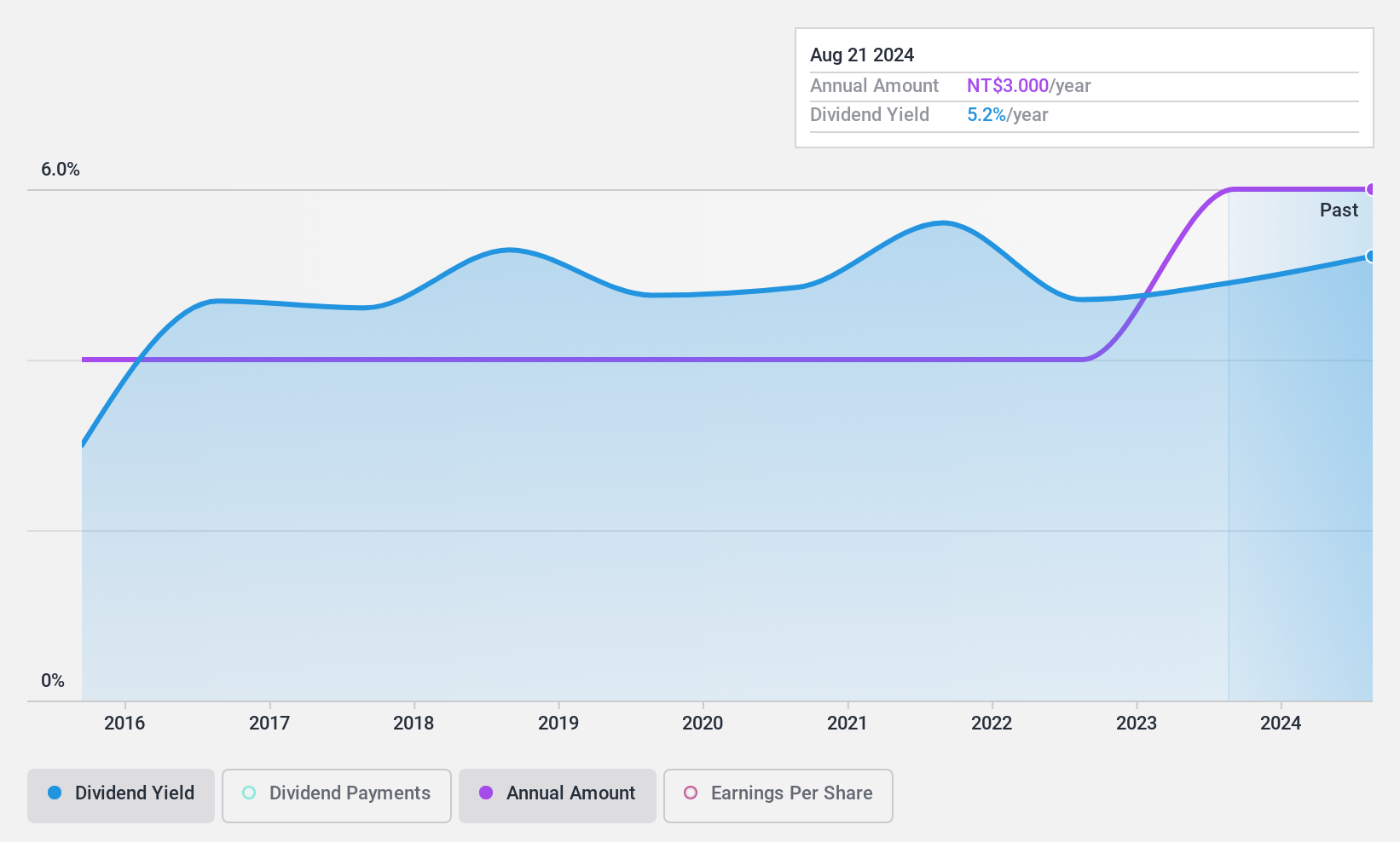

Y.C.C. Parts Mfg (TWSE:1339)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Y.C.C. Parts Mfg. Co., Ltd. manufactures and sells automotive plastic parts across North America, Central America, South America, Europe, Asia, and Taiwan with a market cap of approximately NT$4.08 billion.

Operations: Y.C.C. Parts Mfg. Co., Ltd.'s revenue is derived from NT$491.17 million in foreign operations and NT$1.50 billion in domestic operations.

Dividend Yield: 5.5%

Y.C.C. Parts Mfg.'s dividend yield of 5.45% ranks in the top 25% of Taiwan's market, supported by stable and growing payments over the past decade. Despite a decline in recent earnings, with net income dropping to TWD 77.82 million for Q3 2024 from TWD 150.71 million a year ago, dividends remain covered by earnings and cash flows with payout ratios of 55.5% and 87.5%, respectively, ensuring sustainability amidst board changes and operational challenges.

- Click to explore a detailed breakdown of our findings in Y.C.C. Parts Mfg's dividend report.

- Our valuation report here indicates Y.C.C. Parts Mfg may be undervalued.

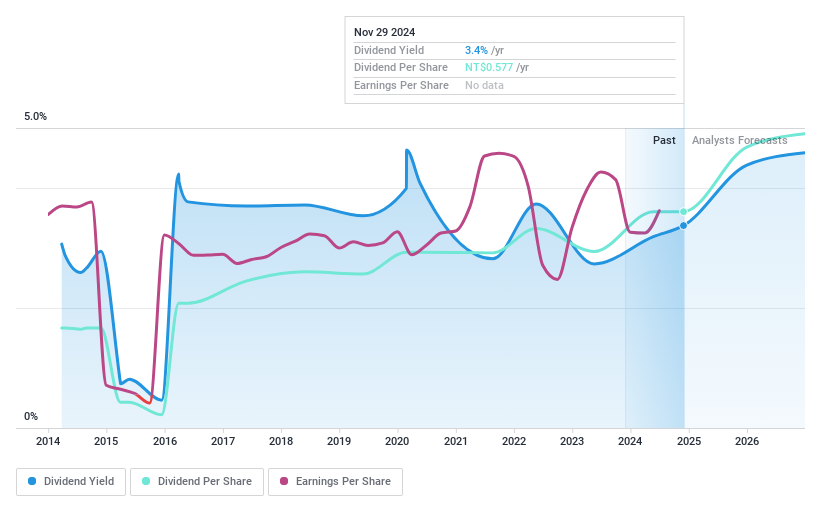

Taishin Financial Holding (TWSE:2887)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taishin Financial Holding Co., Ltd. offers a range of financial products and services both in Taiwan and internationally, with a market cap of NT$230.33 billion.

Operations: Taishin Financial Holding Co., Ltd.'s revenue segments include NT$26.37 billion from Taishin Life, NT$5.93 billion from Taishin Securities Merger, NT$3.82 billion from Taishin Bank's Financial Market Business Headquarters, NT$30.56 billion from Personal Finance Business Headquarters, and NT$15.68 billion from Corporate Financial Business Headquarters.

Dividend Yield: 3.3%

Taishin Financial Holding's dividend yield of 3.26% is below Taiwan's top 25% threshold, and its dividend history has been volatile with significant annual drops. However, dividends are well covered by earnings, with a current payout ratio of 43.6%, expected to rise modestly to 53.9% in three years. Recent earnings growth is notable; Q3 net income increased significantly to TWD 6.08 billion from TWD 3.22 billion a year ago, supporting potential future dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Taishin Financial Holding.

- Upon reviewing our latest valuation report, Taishin Financial Holding's share price might be too pessimistic.

Taking Advantage

- Click this link to deep-dive into the 1937 companies within our Top Dividend Stocks screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1339

Y.C.C. Parts Mfg

Manufactures and sells automotive plastic parts in North America, Central America, South America, Europe, Asia, and Taiwan.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives