As global markets navigate the early days of President Trump's administration, U.S. stocks are reaching new heights, buoyed by optimism surrounding potential trade policy shifts and advancements in artificial intelligence. With major indices like the S&P 500 hitting record highs, investors are increasingly looking toward dividend stocks as a stable source of income amid fluctuating economic conditions. Dividend stocks can offer a reliable income stream and may provide some cushion against market volatility, making them an attractive option for those seeking to balance growth with stability in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.04% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.66% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.11% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.54% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

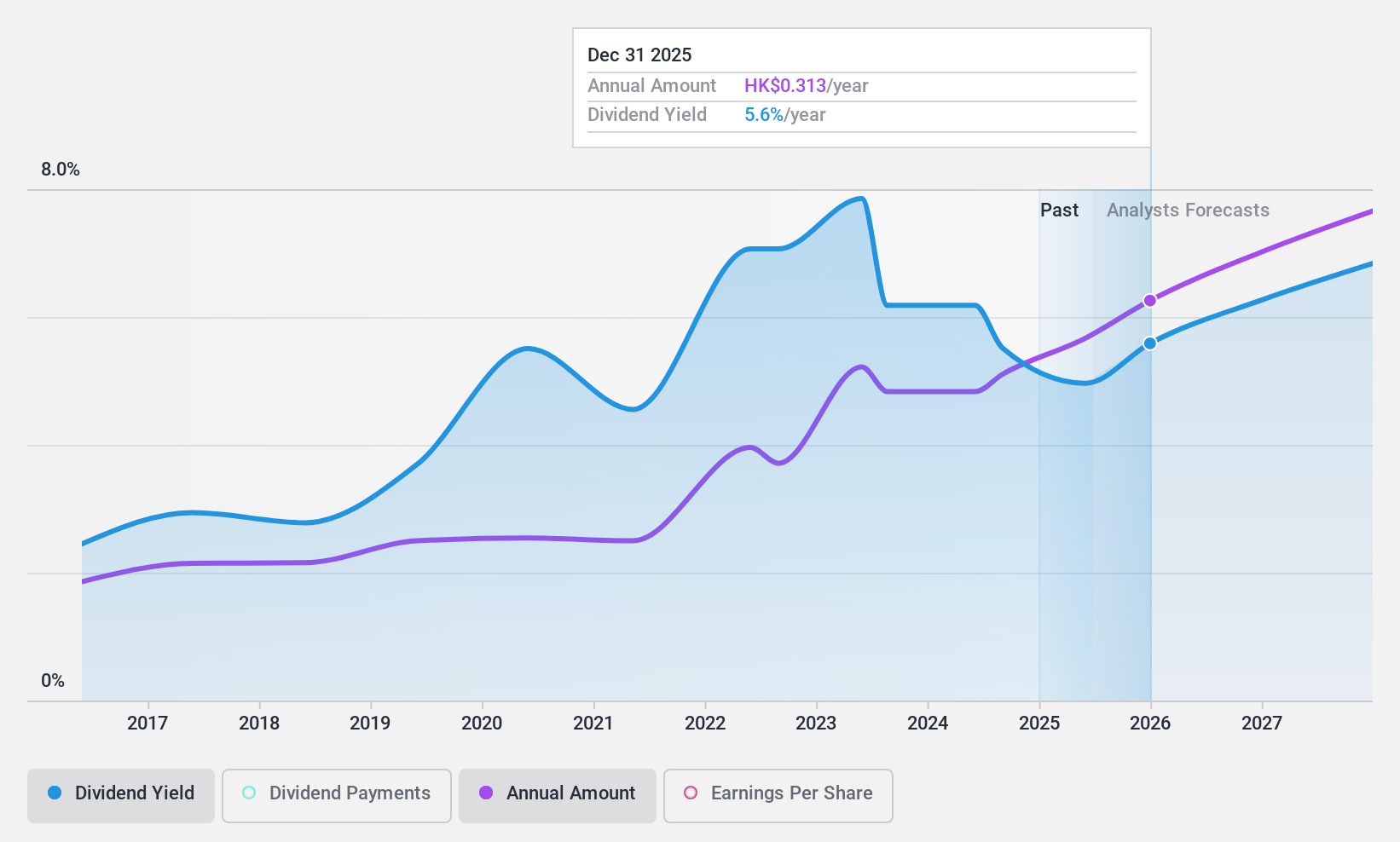

China Telecom (SEHK:728)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Telecom Corporation Limited, along with its subsidiaries, offers wireline and mobile telecommunications services mainly in the People’s Republic of China and has a market cap of approximately HK$644.14 billion.

Operations: China Telecom's revenue is primarily derived from its wireline and mobile telecommunications services within the People’s Republic of China.

Dividend Yield: 5.7%

China Telecom trades at a significant discount to its estimated fair value and offers a dividend yield that, while lower than the top 25% in Hong Kong, is supported by earnings and cash flows with payout ratios of 25.5% and 66.6%, respectively. Despite growth in dividends over the past decade, payments have been inconsistent, reflecting volatility. Recent executive changes are unlikely to impact dividend policy directly but may influence future strategic decisions.

- Delve into the full analysis dividend report here for a deeper understanding of China Telecom.

- Our expertly prepared valuation report China Telecom implies its share price may be lower than expected.

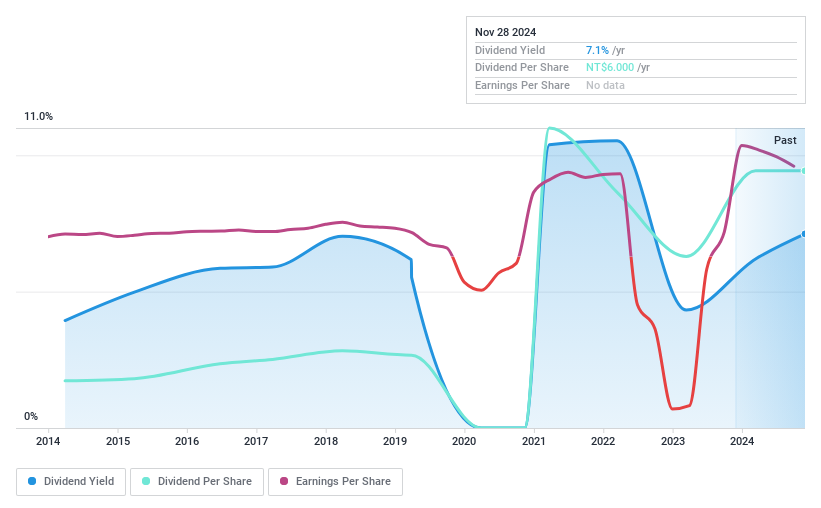

China Motor (TWSE:2204)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Motor Corporation manufactures and sells automobiles and related parts both in Taiwan and internationally, with a market cap of NT$44.84 billion.

Operations: China Motor Corporation's revenue primarily comes from its Manufacturing segment, which accounts for NT$41.30 billion, followed by the Channel segment at NT$2.46 billion.

Dividend Yield: 7.4%

China Motor's dividend yield of 7.41% ranks in the top 25% of Taiwan market payers, yet it is not well supported by free cash flows, indicating sustainability concerns. The payout ratio is reasonable at 71.1%, suggesting earnings coverage despite volatile and unreliable dividend history over the past decade. Recent financials show a decline in net income and revenue for Q3 compared to last year, which may impact future dividend stability and growth prospects.

- Dive into the specifics of China Motor here with our thorough dividend report.

- The analysis detailed in our China Motor valuation report hints at an inflated share price compared to its estimated value.

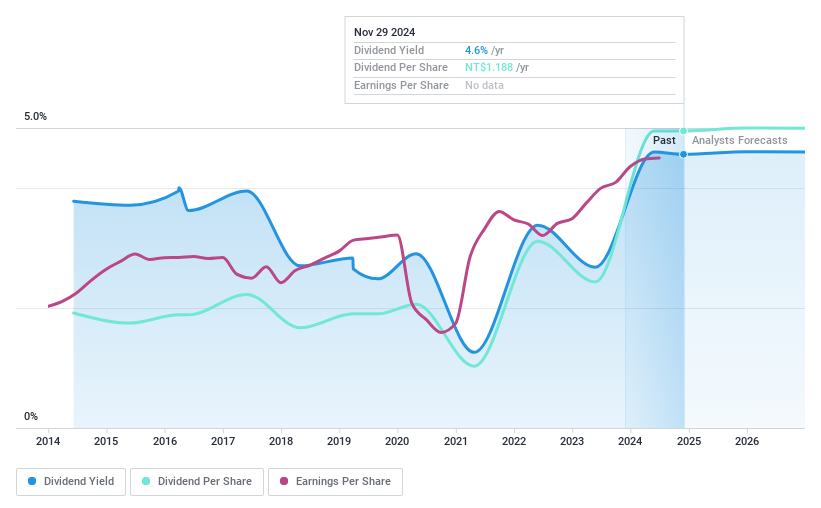

Hua Nan Financial Holdings (TWSE:2880)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hua Nan Financial Holdings Co., Ltd. and its subsidiaries offer a range of financial services both in Taiwan and internationally, with a market capitalization of approximately NT$385.82 billion.

Operations: Hua Nan Financial Holdings Co., Ltd. generates its revenue primarily from its Banking Business, which accounts for NT$51.87 billion, supplemented by Other Activities totaling NT$9.46 billion.

Dividend Yield: 4.2%

Hua Nan Financial Holdings' dividend yield of 4.24% is below the top tier in Taiwan, and its history shows volatility with over 20% annual drops at times. Despite this, a payout ratio of 72.5% indicates dividends are currently covered by earnings and forecasted to remain so in three years. Recent earnings for Q3 show slight growth in net income to TWD 6,640.33 million from TWD 6,386.2 million year-on-year, supporting potential dividend sustainability amidst executive changes.

- Click here and access our complete dividend analysis report to understand the dynamics of Hua Nan Financial Holdings.

- According our valuation report, there's an indication that Hua Nan Financial Holdings' share price might be on the expensive side.

Key Takeaways

- Embark on your investment journey to our 1981 Top Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hua Nan Financial Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2880

Hua Nan Financial Holdings

Provides financial services in Taiwan and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives