In a week marked by cautious Federal Reserve commentary and looming political uncertainties, global markets experienced a decline, with U.S. stocks notably affected despite a late-week rally. Amid this backdrop of fluctuating market conditions and tempered expectations for interest rate cuts, investors may find stability in dividend stocks that offer reliable income streams. In the current environment, where interest rates and economic forecasts are key concerns, dividend stocks can provide consistent returns through regular payouts, making them an attractive option for those seeking to balance risk with steady income potential.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.96% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.81% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.53% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.87% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.28% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.87% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.73% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1968 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

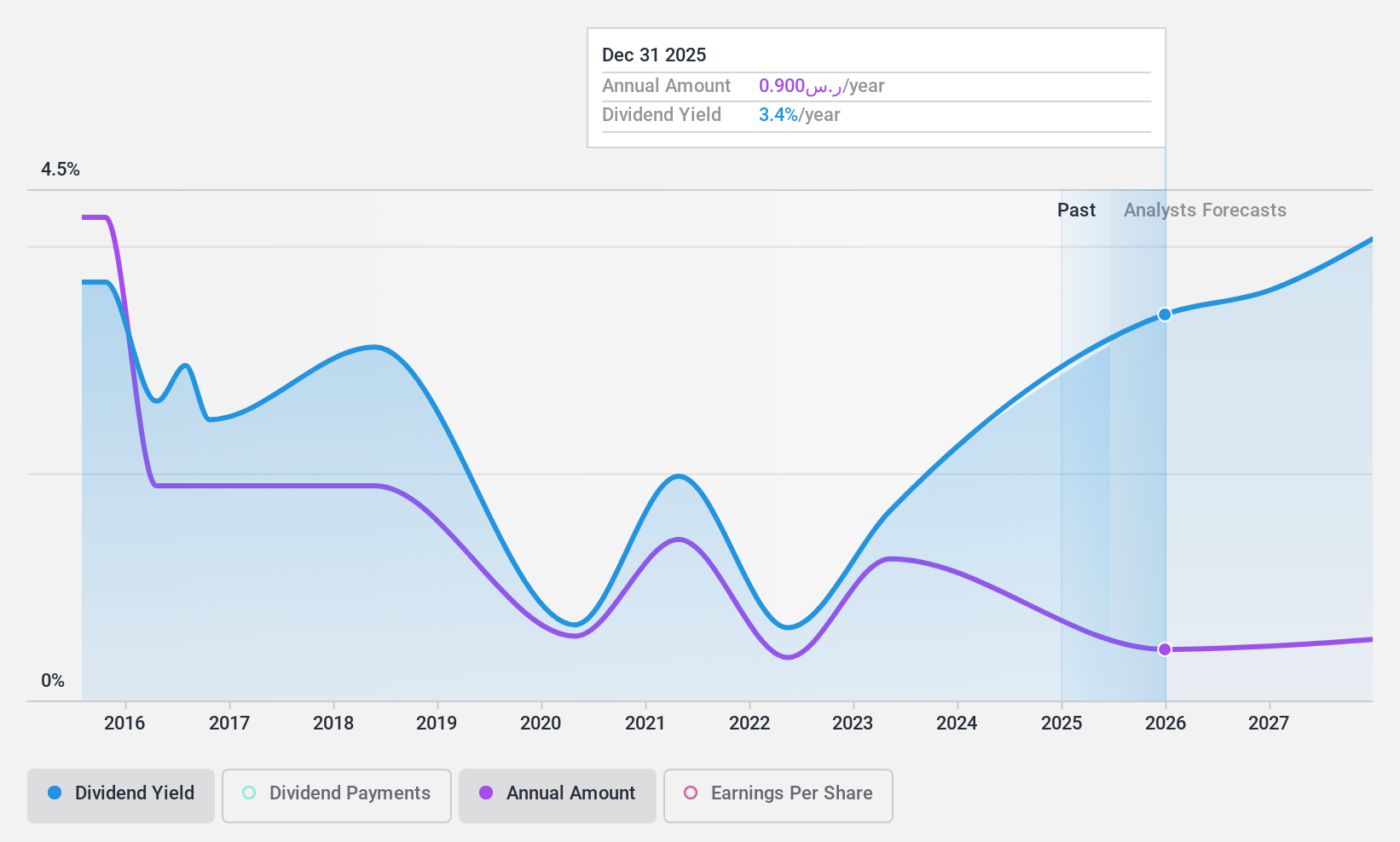

Savola Group (SASE:2050)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Savola Group Company, along with its subsidiaries, is involved in the production, marketing, and distribution of food products and has a market capitalization of SAR11.29 billion.

Operations: Savola Group's revenue segments are comprised of Retail (SAR10.49 billion), Investments (SAR28.30 million), Frozen Foods (SAR740.58 million), Food Services (SAR1.17 billion), and Food Processing (SAR13.82 billion).

Dividend Yield: 6.6%

Savola Group's dividend payments have been unreliable and volatile over the past decade, with a history of falling dividends. Despite this, the company offers a top-tier dividend yield of 6.62%, supported by a payout ratio of 45.8%, indicating coverage by earnings, though cash flow coverage is tighter at an 89.3% cash payout ratio. Recent stock splits may affect share price volatility, which has been high in recent months despite good relative value compared to peers.

- Take a closer look at Savola Group's potential here in our dividend report.

- The analysis detailed in our Savola Group valuation report hints at an deflated share price compared to its estimated value.

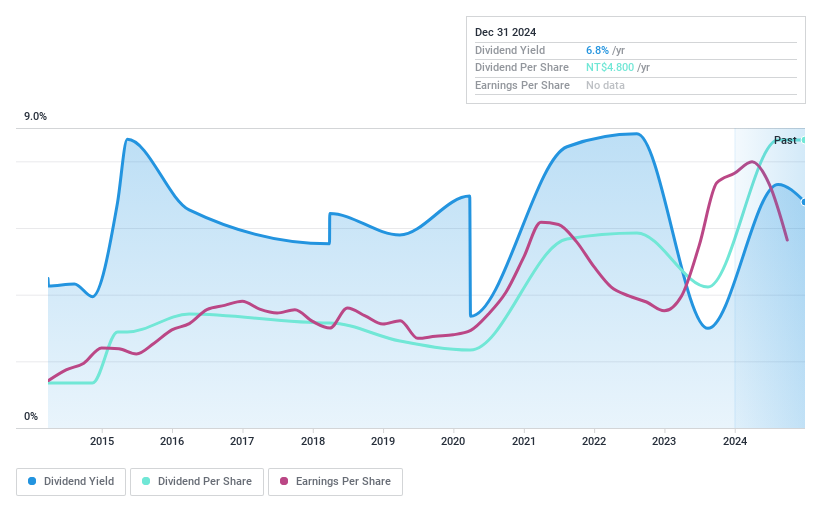

Channel Well TechnologyLtd (TPEX:3078)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Channel Well Technology Co., Ltd. engages in the manufacturing, processing, trading, and sale of power supplies and electronic components across Taiwan, Asia, the United States, Europe, and internationally with a market cap of NT$15.69 billion.

Operations: The company's revenue from processing, manufacturing, and trading of power supplies is NT$8.82 billion.

Dividend Yield: 7.0%

Channel Well Technology Ltd. offers a high dividend yield of 6.96%, ranking in the top 25% of Taiwan's market, but this is not well covered by earnings, with a payout ratio of 95.8%. Although dividends have grown over the past decade, they remain volatile and unreliable. Recent earnings results show declining sales and net income, with nine-month sales at TWD 6.34 billion and net income at TWD 930.61 million, potentially impacting future dividend sustainability.

- Click here to discover the nuances of Channel Well TechnologyLtd with our detailed analytical dividend report.

- According our valuation report, there's an indication that Channel Well TechnologyLtd's share price might be on the cheaper side.

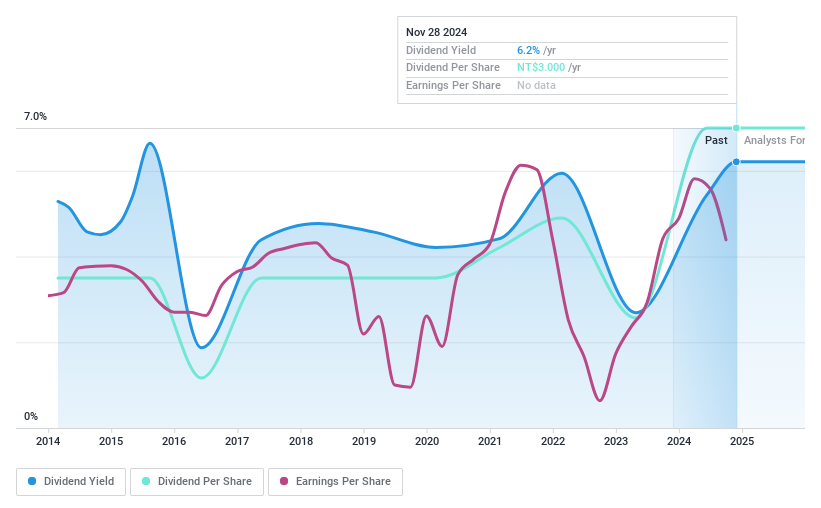

King's Town Bank (TWSE:2809)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: King's Town Bank Co., Ltd., along with its subsidiaries, offers a range of banking products and services in Taiwan, with a market cap of NT$56.78 billion.

Operations: King's Town Bank generates revenue through its branch sales, amounting to NT$7.65 billion, and its financial market operations, contributing NT$1.94 billion.

Dividend Yield: 5.9%

King's Town Bank offers a dividend yield of 5.87%, placing it among the top 25% in Taiwan, with a manageable payout ratio of 59.8%. However, its dividend history is marked by volatility and unreliability over the past decade. Recent earnings reports indicate net income for Q3 at TWD 628.3 million, significantly lower than the previous year, which may affect future dividends despite an increase in net interest income to TWD 1,498.71 million.

- Unlock comprehensive insights into our analysis of King's Town Bank stock in this dividend report.

- In light of our recent valuation report, it seems possible that King's Town Bank is trading behind its estimated value.

Summing It All Up

- Investigate our full lineup of 1968 Top Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if King's Town Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2809

King's Town Bank

Provides various banking products and services in Taiwan.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives