- Taiwan

- /

- Auto Components

- /

- TWSE:2101

Earnings are growing at Nankang Rubber TireLtd (TWSE:2101) but shareholders still don't like its prospects

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Nankang Rubber Tire Corp.,Ltd. (TWSE:2101) shareholders for doubting their decision to hold, with the stock down 16% over a half decade. Unfortunately the share price momentum is still quite negative, with prices down 11% in thirty days.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

View our latest analysis for Nankang Rubber TireLtd

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Nankang Rubber TireLtd moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

It could be that the revenue decline of 3.4% per year is viewed as evidence that Nankang Rubber TireLtd is shrinking. This has probably encouraged some shareholders to sell down the stock.

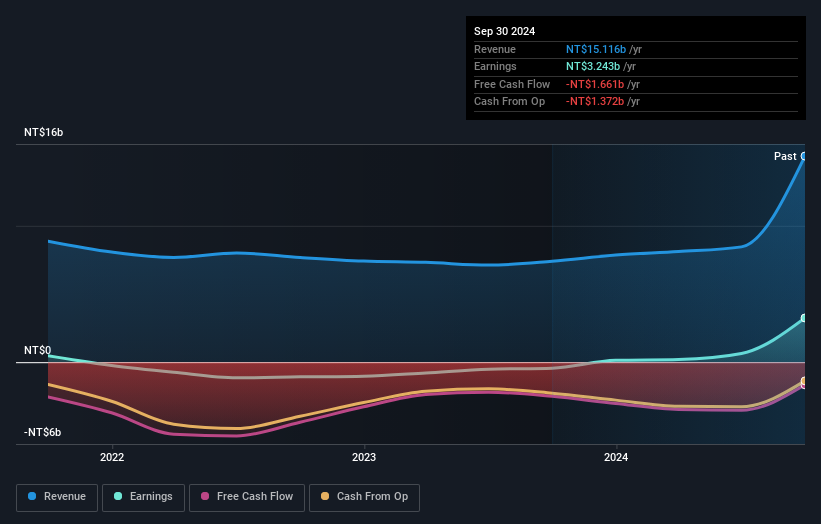

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Nankang Rubber TireLtd's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Nankang Rubber TireLtd's TSR of was a loss of 13% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market gained around 32% in the last year, Nankang Rubber TireLtd shareholders lost 2.0%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 2% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Nankang Rubber TireLtd better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Nankang Rubber TireLtd you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Taiwanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Nankang Rubber TireLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TWSE:2101

Nankang Rubber TireLtd

Engages in the manufacture and sale of tires under the Nankang brand name in Taiwan, Mainland China, the United States, Europe, rest of Asia, and internationally.

Mediocre balance sheet and slightly overvalued.