- Japan

- /

- Food and Staples Retail

- /

- TSE:8142

Asian Dividend Stocks To Consider In March 2025

Reviewed by Simply Wall St

As global markets grapple with trade policy uncertainties and inflationary pressures, Asian markets present unique opportunities for investors seeking stability through dividend stocks. In the current climate of economic unpredictability, a good dividend stock is characterized by its ability to offer consistent returns and financial resilience, making it an appealing consideration for those looking to navigate these challenging times.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.54% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.81% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.08% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.85% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.39% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

| Chudenko (TSE:1941) | 3.85% | ★★★★★★ |

Click here to see the full list of 1150 stocks from our Top Asian Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

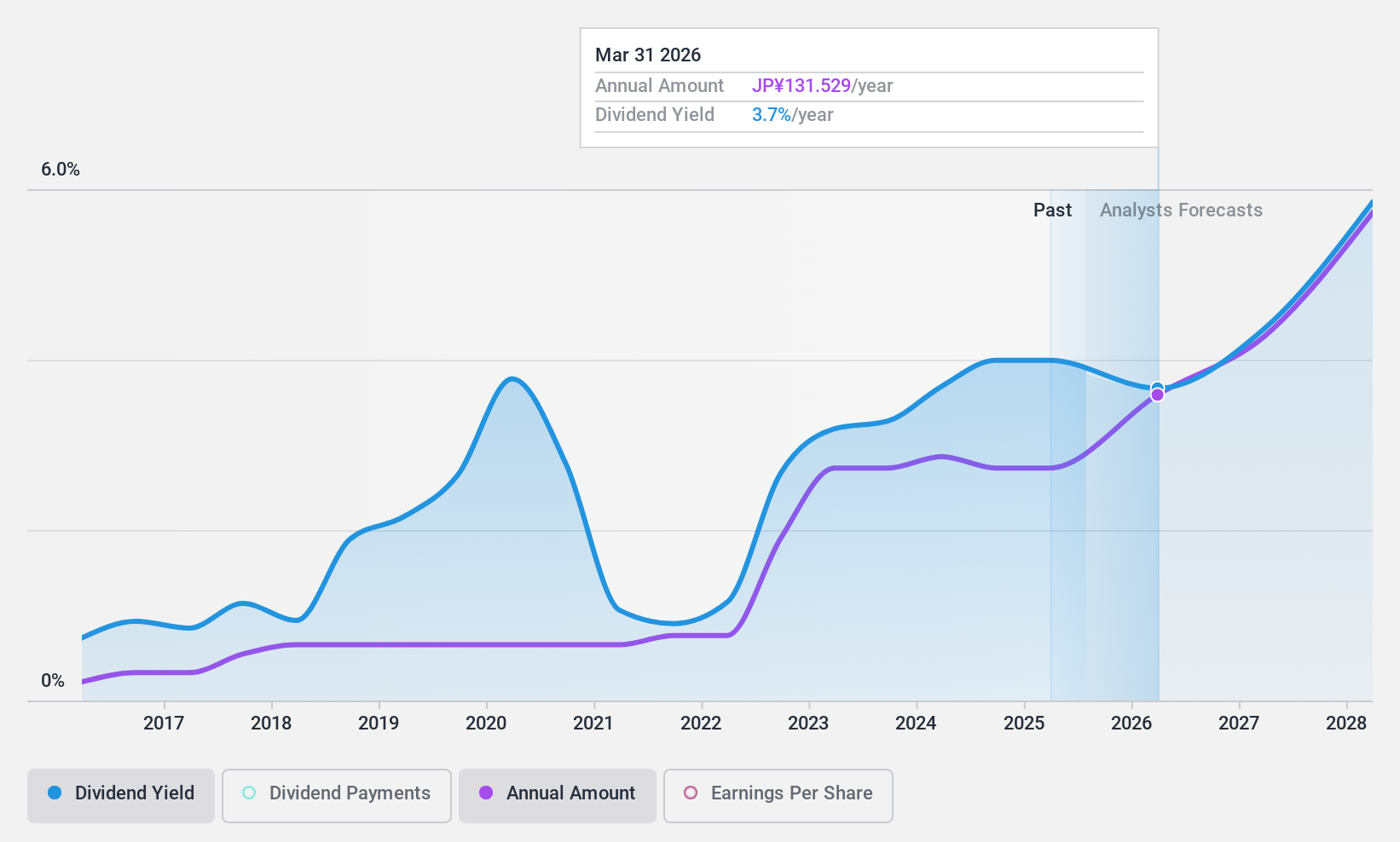

Ferrotec Holdings (TSE:6890)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ferrotec Holdings Corporation operates in semiconductor equipment-related and electronic device businesses both in Japan and internationally, with a market cap of ¥116.54 billion.

Operations: Ferrotec Holdings Corporation's revenue is derived from its semiconductor equipment-related and electronic device segments, operating both domestically in Japan and on an international scale.

Dividend Yield: 4%

Ferrotec Holdings offers a dividend yield of 4.02%, placing it in the top 25% of Japanese dividend payers, though its dividends have been volatile over the past decade. The company maintains a low payout ratio of 16.4%, suggesting earnings cover dividends well, but lacks free cash flow to support them sustainably. Despite recent share buybacks totaling ¥495.11 million, profit margins have declined from last year, and future earnings growth is anticipated at 22.48% annually.

- Delve into the full analysis dividend report here for a deeper understanding of Ferrotec Holdings.

- According our valuation report, there's an indication that Ferrotec Holdings' share price might be on the cheaper side.

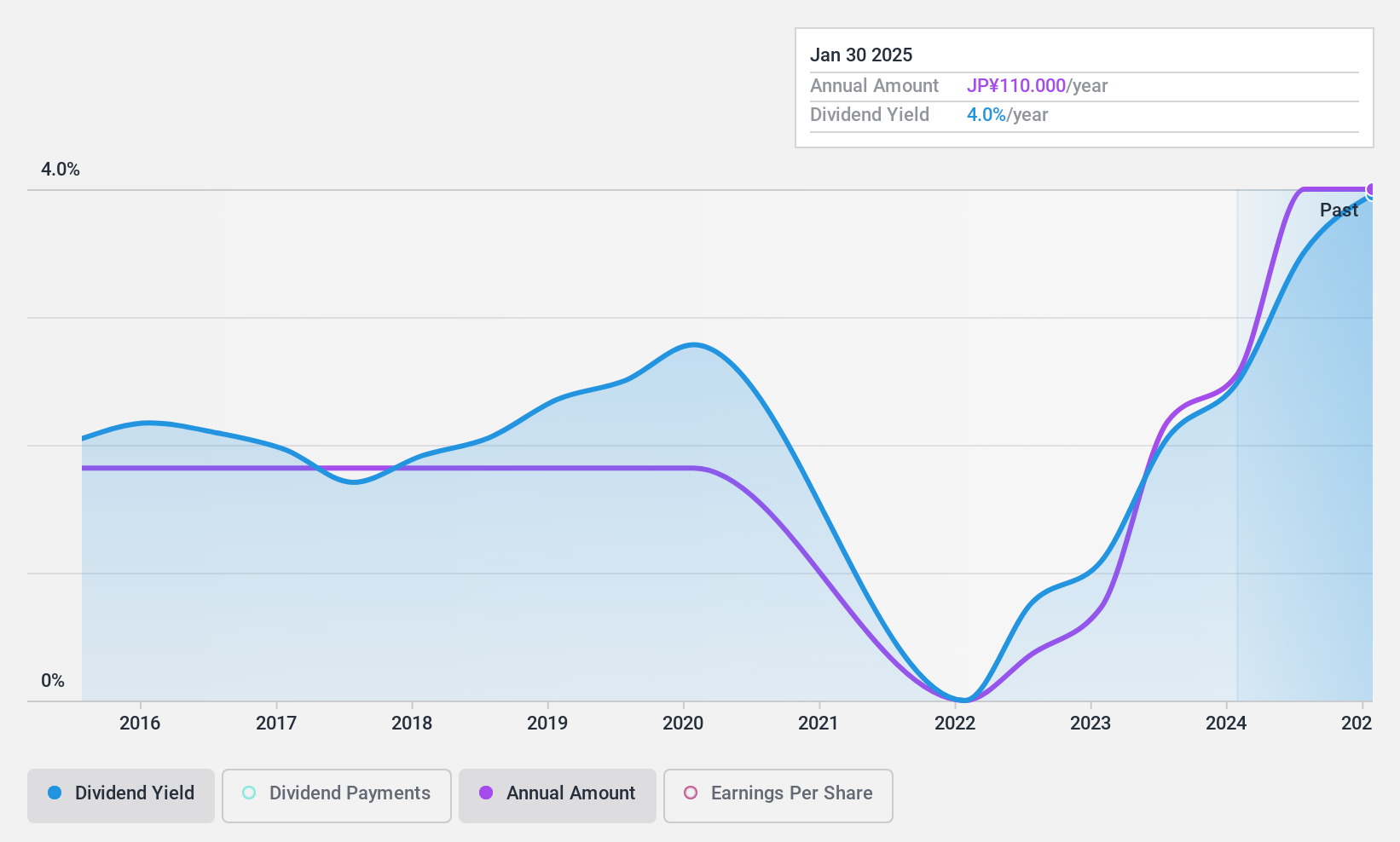

Toho (TSE:8142)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Toho Co., Ltd. operates in Japan through its subsidiaries, focusing on food wholesale, cash and carry, and supermarket businesses, with a market cap of ¥29.49 billion.

Operations: Toho Co., Ltd. generates its revenue primarily from food wholesale, cash and carry, and supermarket operations in Japan.

Dividend Yield: 4%

Toho's dividend yield of 4.01% ranks in the top 25% among Japanese dividend payers, supported by a low payout ratio of 32.4%, indicating solid earnings coverage. The cash payout ratio is also low at 20%, suggesting strong free cash flow backing. However, dividends have been volatile over the past decade, with significant annual drops exceeding 20%. Recent guidance projects net sales of ¥246 billion and operating profit of ¥7.3 billion for fiscal year ending January 2025.

- Get an in-depth perspective on Toho's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Toho's share price might be too pessimistic.

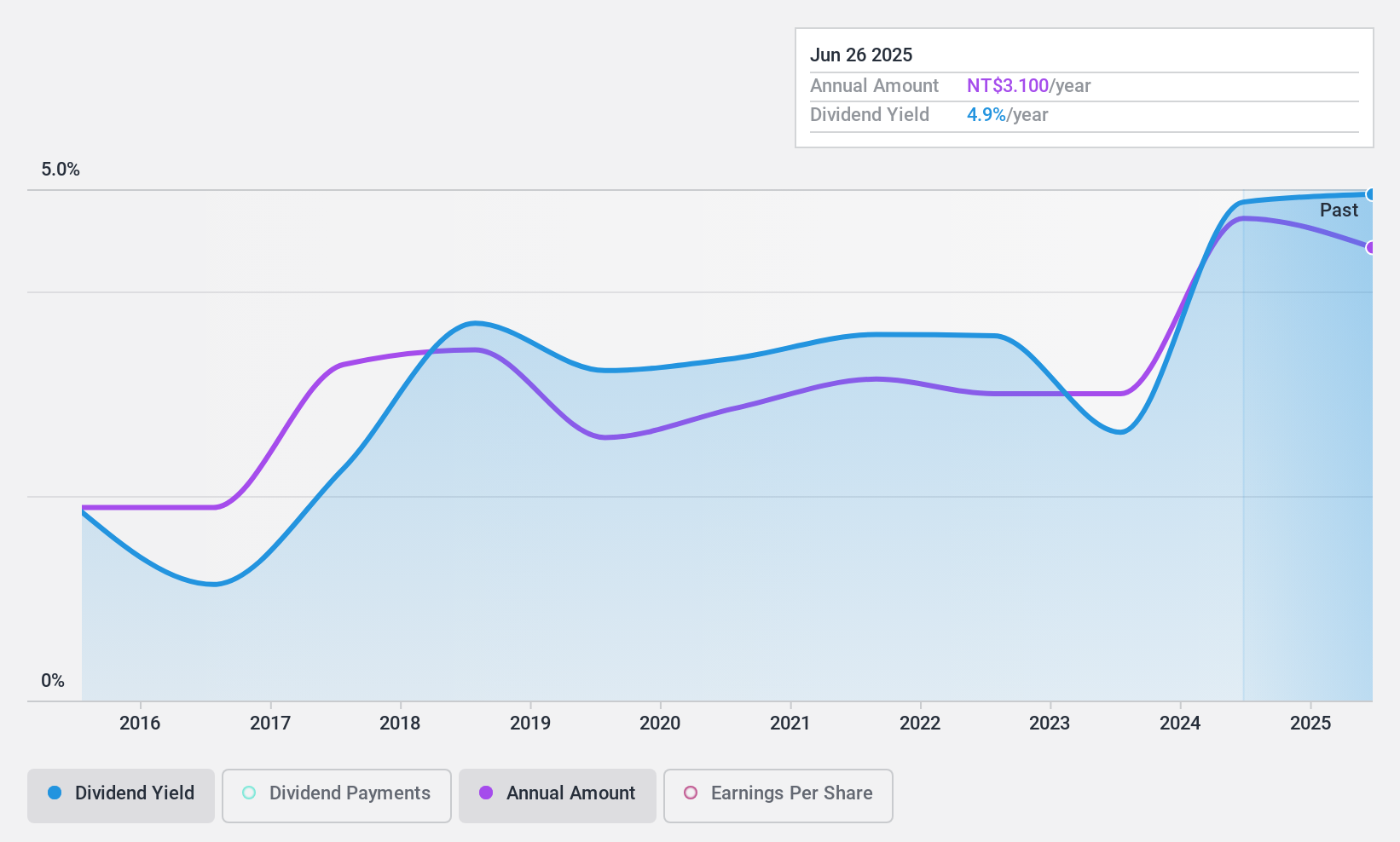

Kian Shen (TWSE:1525)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kian Shen Corporation, with a market cap of NT$4.76 billion, manufactures and sells automobile body frames, stamping dies, and woodworking products in Taiwan.

Operations: Kian Shen Corporation's revenue is derived from its Manufacturing Segment, which totals NT$1.45 billion.

Dividend Yield: 5.1%

Kian Shen's dividend yield of 5.08% places it in the top 25% of Taiwan's market, but its sustainability is questionable due to a payout ratio of 89.5% and lack of free cash flow coverage. Despite past increases, dividends have been volatile over the last decade. Recent earnings show a decline with net income at TWD 302.16 million compared to TWD 403.82 million previously, potentially impacting future dividend reliability.

- Click here to discover the nuances of Kian Shen with our detailed analytical dividend report.

- Our valuation report here indicates Kian Shen may be overvalued.

Summing It All Up

- Navigate through the entire inventory of 1150 Top Asian Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toho might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8142

Toho

Through its subsidiaries, engages in the food wholesale, cash and carry, and supermarket businesses primarily in Japan.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives