- South Korea

- /

- Retail Distributors

- /

- KOSDAQ:A121440

3 High-Yield Dividend Stocks Offering Up To 6.3% Yield

Reviewed by Simply Wall St

As global markets navigate a mix of geopolitical tensions and economic optimism, U.S. indexes have approached record highs with broad-based gains, driven by strong labor market data and positive sentiment in housing. In this climate, investors often seek stability through high-yield dividend stocks, which can provide regular income even amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.44% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.72% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.25% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.35% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.06% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.80% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.77% | ★★★★★★ |

Click here to see the full list of 1955 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

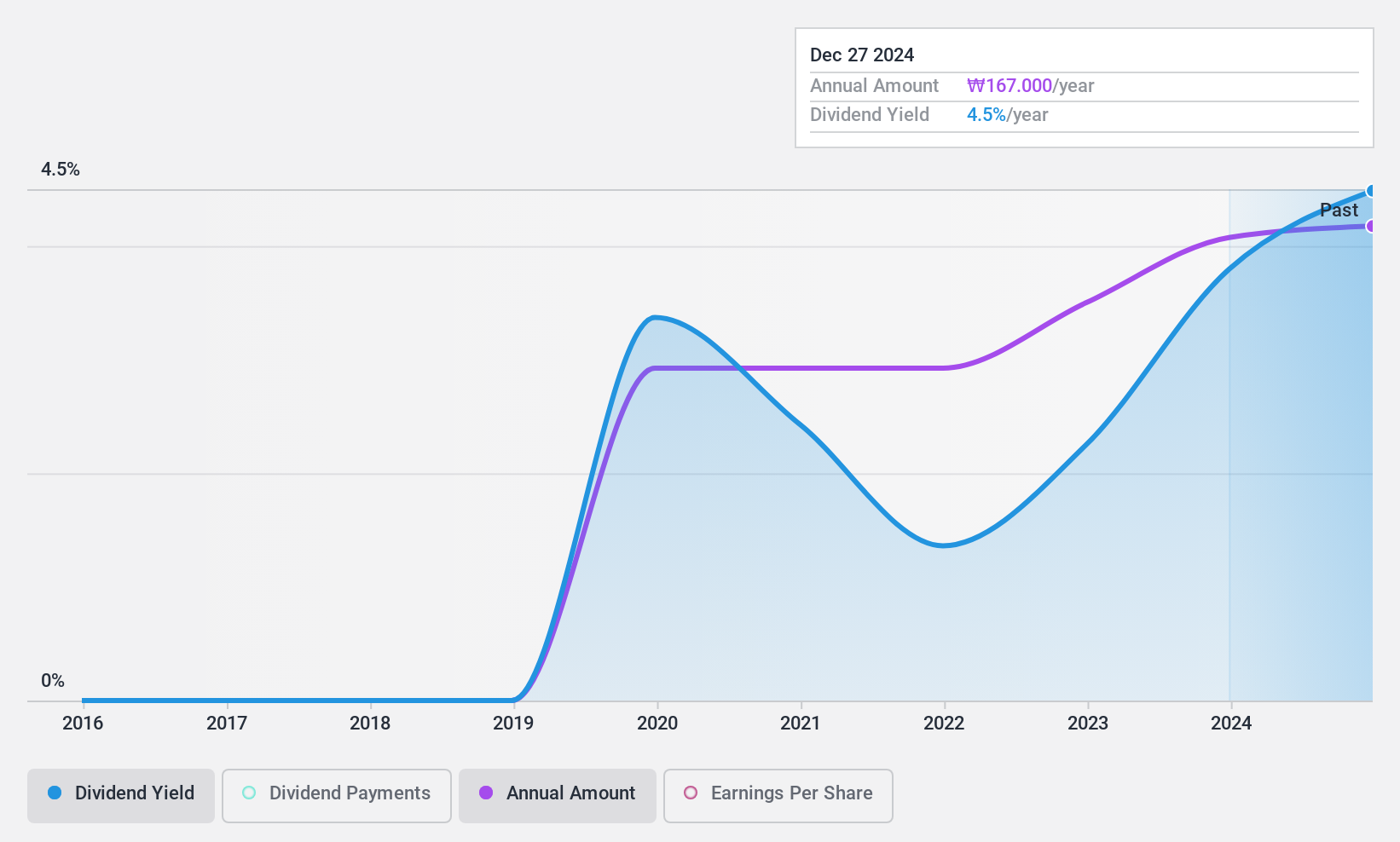

GOLFZON NEWDIN HOLDINGS (KOSDAQ:A121440)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GOLFZON NEWDIN HOLDINGS Co., Ltd. operates through its subsidiaries in the golf, sports, health, and lifestyle sectors both in South Korea and internationally, with a market cap of approximately ₩146.08 billion.

Operations: GOLFZON NEWDIN HOLDINGS Co., Ltd.'s revenue segments include Landlord with ₩55.41 billion, Golf Course Rental at ₩7.48 billion, and Distribution Business generating ₩340.01 billion.

Dividend Yield: 4.7%

GOLFZON NEWDIN HOLDINGS offers a compelling dividend profile with a payout ratio of 23%, ensuring dividends are well-covered by earnings. The cash payout ratio stands at 29.5%, indicating strong cash flow support. Although the company has only paid dividends for five years, they have been stable and growing, placing it in the top 25% of dividend payers in South Korea with a yield of 4.72%. Recent share buybacks suggest confidence in its valuation and future prospects.

- Click to explore a detailed breakdown of our findings in GOLFZON NEWDIN HOLDINGS' dividend report.

- The valuation report we've compiled suggests that GOLFZON NEWDIN HOLDINGS' current price could be quite moderate.

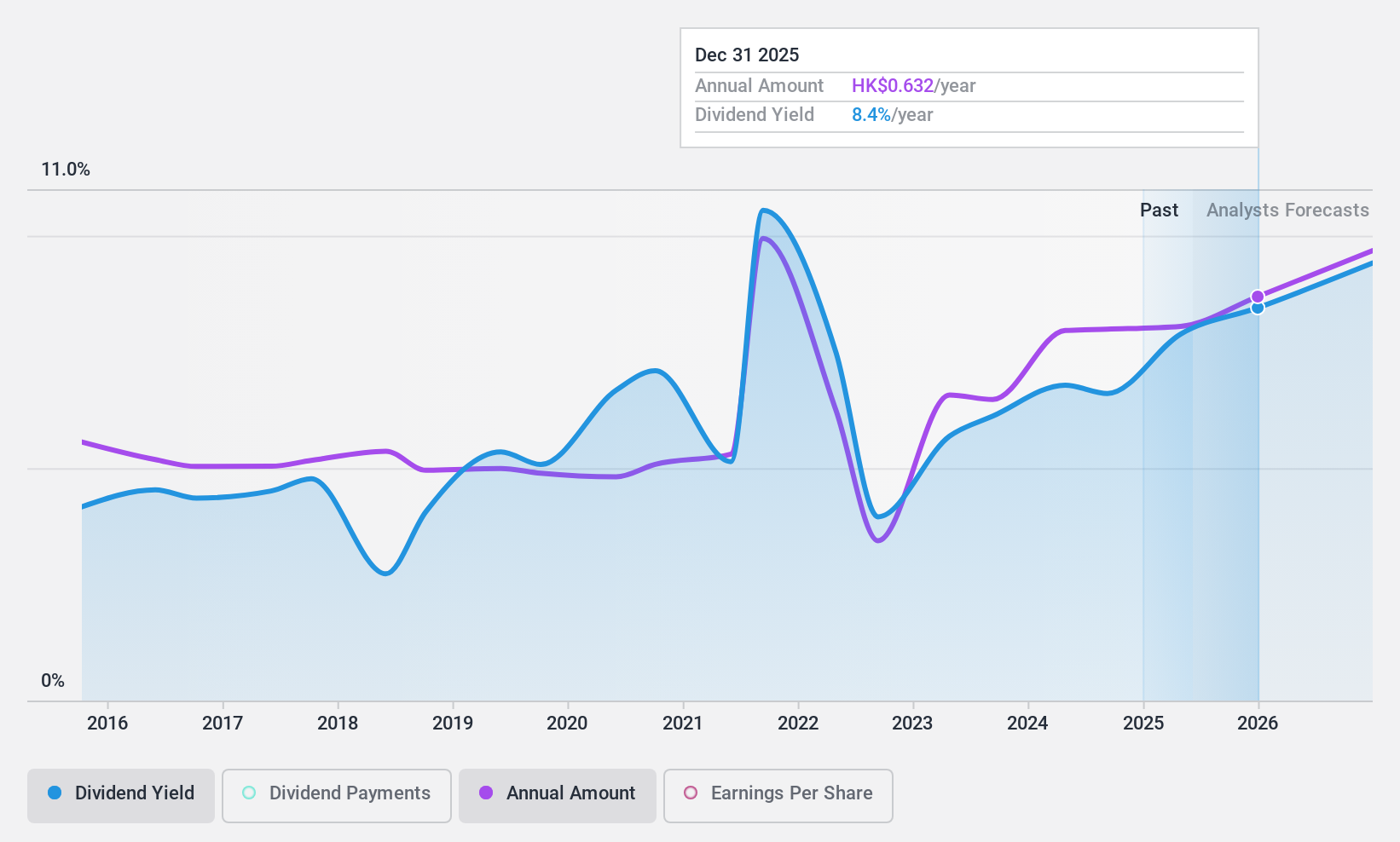

China Shineway Pharmaceutical Group (SEHK:2877)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Shineway Pharmaceutical Group Limited is an investment holding company involved in the research, development, manufacture, and trade of Chinese medicines in the People’s Republic of China and Hong Kong, with a market cap of HK$63 billion.

Operations: China Shineway Pharmaceutical Group Limited generates its revenue primarily from Chinese Pharmaceutical Products, amounting to CN¥4.20 billion.

Dividend Yield: 6.4%

China Shineway Pharmaceutical Group's dividend payments are well-covered by a low payout ratio of 36.9%, supported by both earnings and cash flows. Despite a history of volatile dividends, recent affirmations include an interim dividend of RMB 0.11 per share for 2024. The company reported increased net income of CNY 626.48 million for the first half of 2024, indicating robust profitability despite declining sales, and it trades at good value compared to peers.

- Click here to discover the nuances of China Shineway Pharmaceutical Group with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that China Shineway Pharmaceutical Group is trading behind its estimated value.

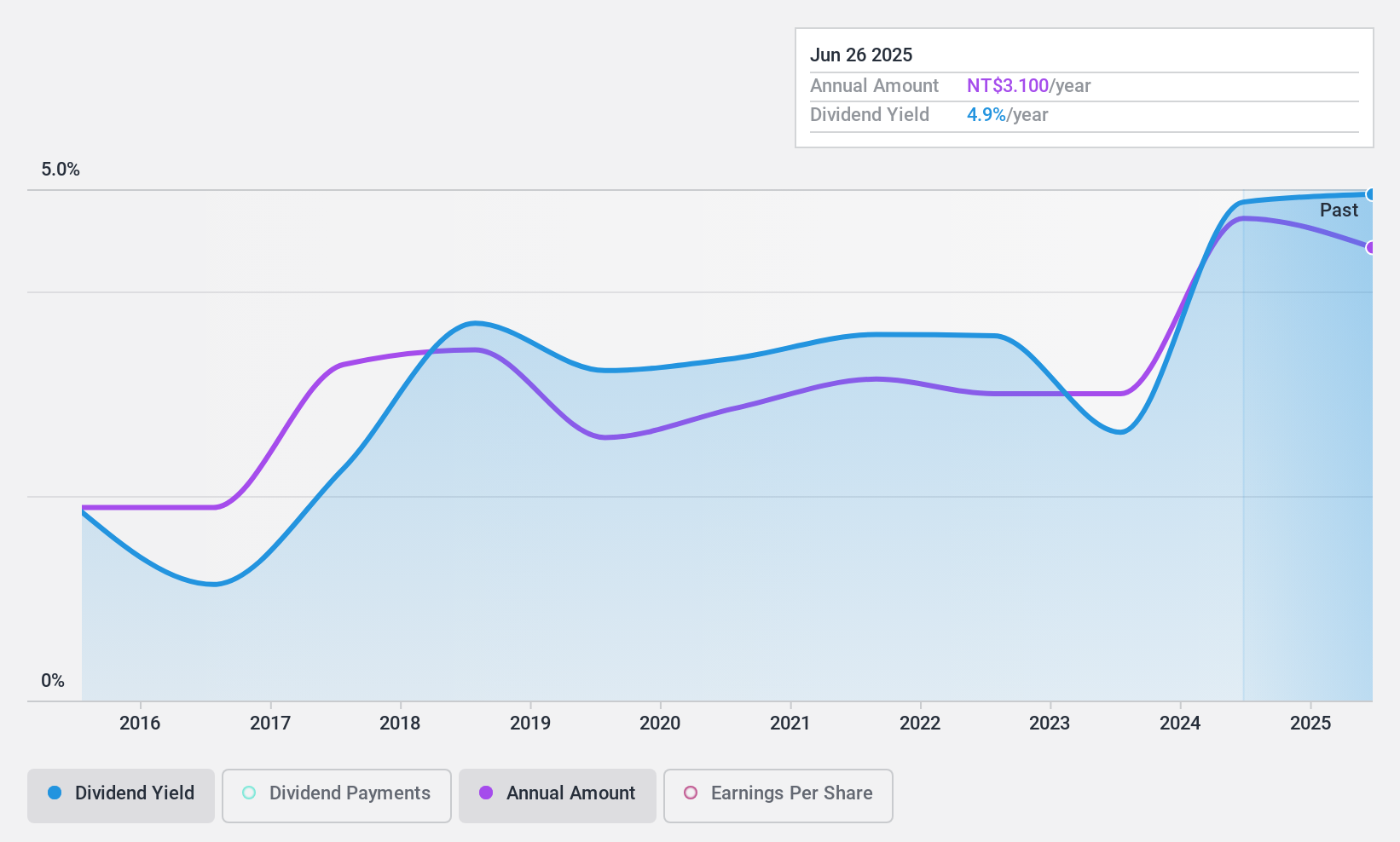

Kian Shen (TWSE:1525)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kian Shen Corporation manufactures and sells automobile parts in Taiwan, with a market cap of NT$4.83 billion.

Operations: Kian Shen Corporation generates its revenue primarily from the Manufacturing Segment, which accounts for NT$1.45 billion.

Dividend Yield: 4.9%

Kian Shen's dividend yield of 4.93% ranks in the top 25% of TW market payers but is not well-covered by free cash flows, raising sustainability concerns. Despite a low price-to-earnings ratio of 18.1x, indicating good value, dividends have been volatile with an unreliable growth history over the past decade. Recent earnings show stable quarterly sales at TWD 403.4 million but declining nine-month net income to TWD 200.25 million, impacting dividend reliability.

- Dive into the specifics of Kian Shen here with our thorough dividend report.

- According our valuation report, there's an indication that Kian Shen's share price might be on the expensive side.

Turning Ideas Into Actions

- Click this link to deep-dive into the 1955 companies within our Top Dividend Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A121440

GOLFZON NEWDIN HOLDINGS

Through its subsidiaries, engages in the golf, sports, health, and lifestyle businesses in South Korea and internationally.

Good value with adequate balance sheet and pays a dividend.