- Taiwan

- /

- Auto Components

- /

- TWSE:1522

Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets respond to easing inflation and robust bank earnings, major indices like the S&P 500 and Dow Jones have seen notable gains, with value stocks outperforming growth shares. In this environment of cautious optimism, dividend stocks can offer a compelling option for investors seeking steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.47% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

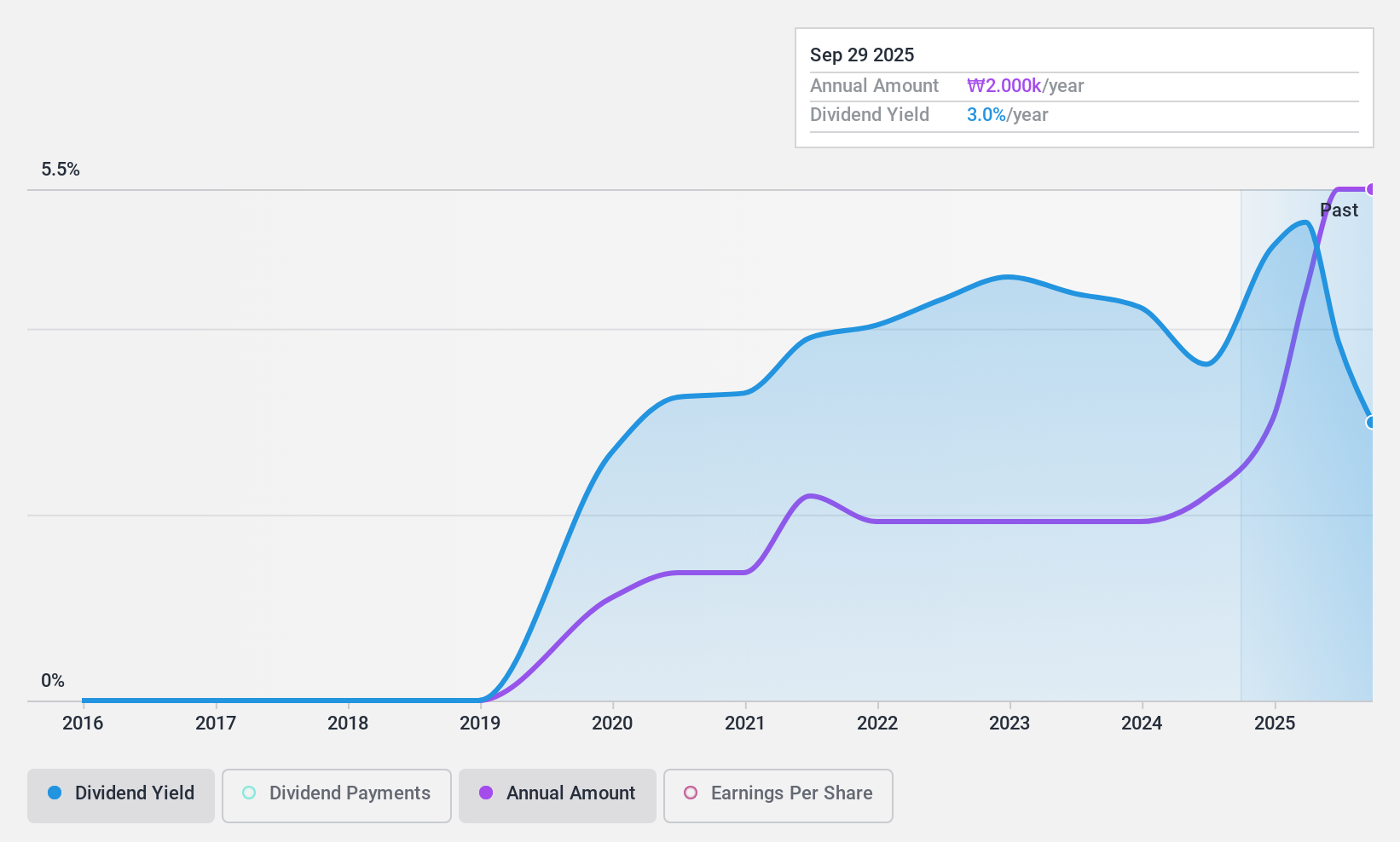

SNT Holdings (KOSE:A036530)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SNT Holdings CO., LTD operates in the auto parts and industrial facilities sectors, with a market cap of ₩327.51 billion.

Operations: SNT Holdings CO., LTD generates revenue from its Vehicle Parts segment at ₩1.27 billion and Industrial Equipment segment at ₩286.84 million.

Dividend Yield: 4.9%

SNT Holdings' dividend payments are well-covered by earnings and cash flows, with payout ratios of 10.1% and 15.3%, respectively, indicating sustainability despite its volatile and unreliable dividend history over the past five years. The company has seen significant earnings growth, reporting KRW 31.21 billion in net income for Q3 2024 compared to KRW 26.75 billion a year ago, suggesting potential for future dividend increases amidst its current top-tier yield in the Korean market.

- Get an in-depth perspective on SNT Holdings' performance by reading our dividend report here.

- Our valuation report here indicates SNT Holdings may be undervalued.

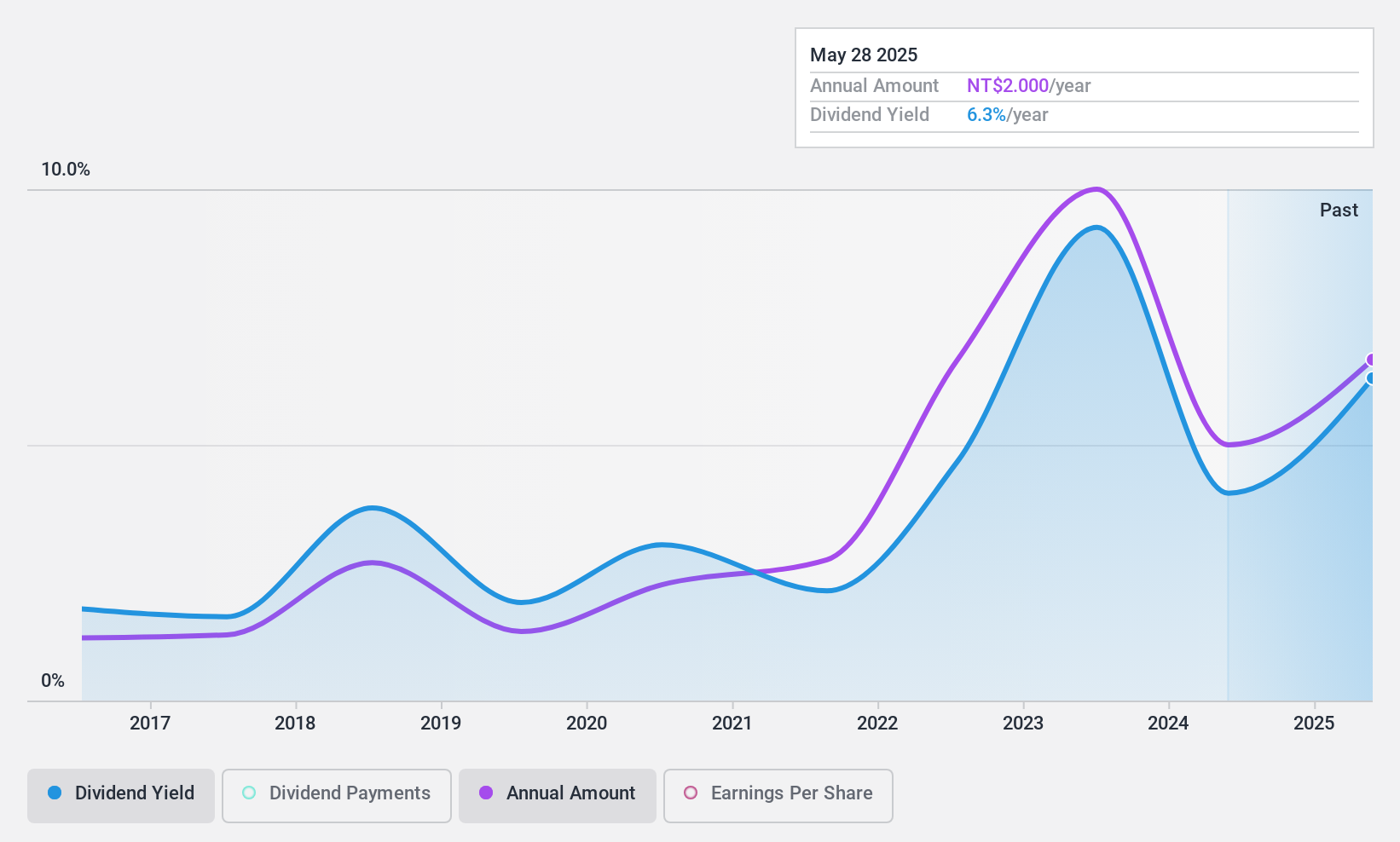

TYC Brother Industrial (TWSE:1522)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TYC Brother Industrial Co., Ltd. manufactures and sells vehicle lighting products in Taiwan, with a market cap of NT$19.75 billion.

Operations: TYC Brother Industrial Co., Ltd.'s revenue is derived from various regions, with NT$1.23 billion from Asia, NT$3.09 billion from Europe, NT$15.71 billion from Taiwan, and NT$9.14 billion from America.

Dividend Yield: 3.2%

TYC Brother Industrial's dividends are well-covered by earnings and cash flows, with payout ratios of 34.7% and 23.6%, respectively, despite a volatile dividend history over the past decade. The company's recent earnings growth, with net income rising to TWD 1.61 billion for the first nine months of 2024 from TWD 843.27 million a year ago, supports potential dividend sustainability, though its yield remains below top-tier levels in Taiwan's market.

- Unlock comprehensive insights into our analysis of TYC Brother Industrial stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of TYC Brother Industrial shares in the market.

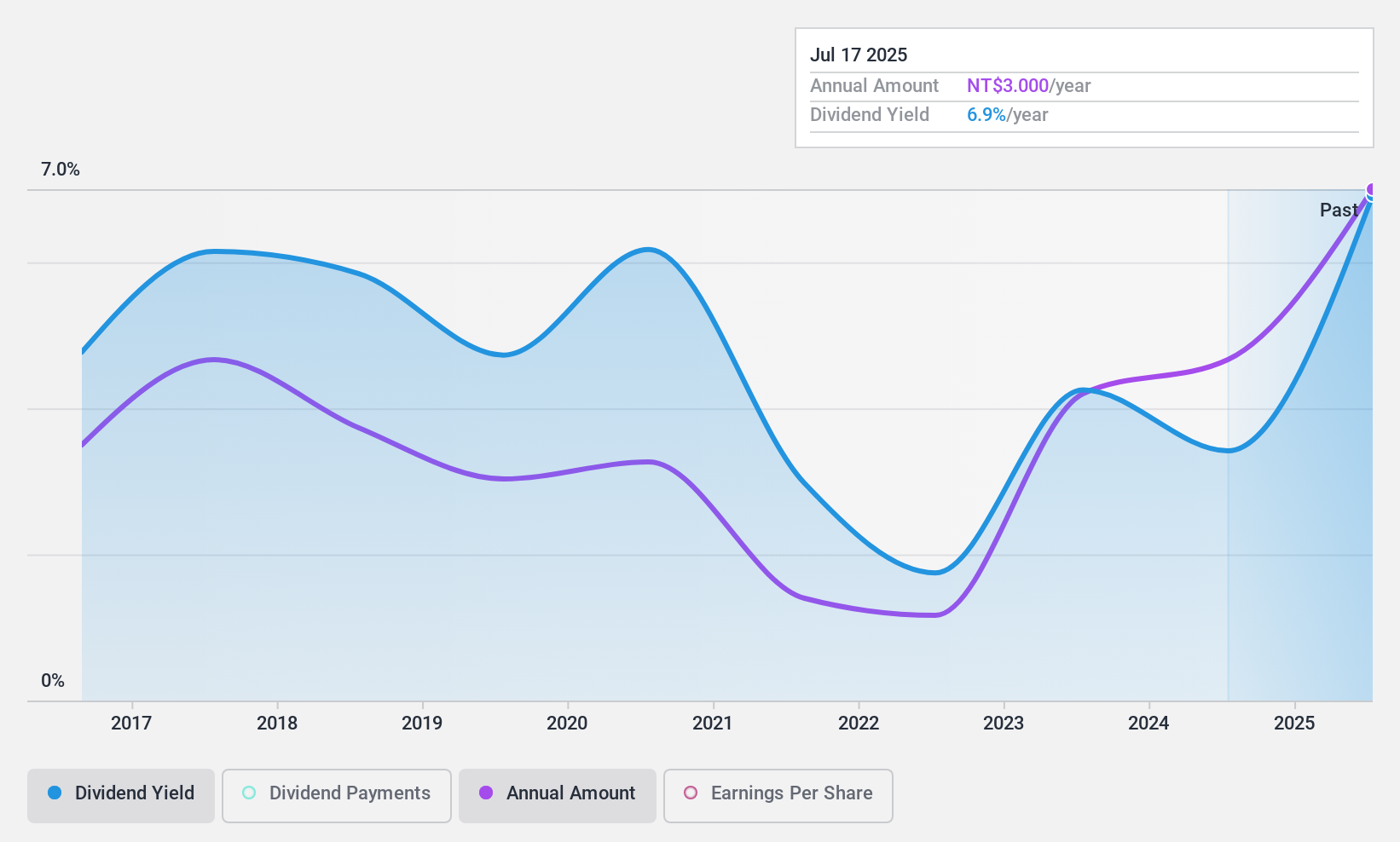

Sesoda (TWSE:1708)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sesoda Corporation manufactures and markets sulfate of potash (SOP) in Taiwan, with a market cap of NT$9.28 billion.

Operations: Sesoda Corporation's revenue segments include Catering (NT$33.11 million), Shipping (NT$1.81 billion), Motor Freight (NT$19.02 million), Textile Products - Export (NT$2.61 billion), and Textile Products - Domestic Sale (NT$1.70 billion).

Dividend Yield: 4%

Sesoda's dividend payments are well-covered by earnings and cash flows, with payout ratios of 42.6% and 27.9%, respectively, despite a volatile history over the past decade. The company's recent profitability boost is evident in its Q3 net income rising to TWD 291.24 million from TWD 105.71 million a year ago, enhancing dividend sustainability prospects, though its yield of 4.03% remains below Taiwan's top-tier market levels of 4.59%.

- Navigate through the intricacies of Sesoda with our comprehensive dividend report here.

- Our valuation report unveils the possibility Sesoda's shares may be trading at a discount.

Key Takeaways

- Access the full spectrum of 1981 Top Dividend Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TYC Brother Industrial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:1522

TYC Brother Industrial

Engages in manufacture and sale of vehicle lighting products in Taiwan.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives