Discovering Jiangxi Bestoo EnergyLtd And 2 Other Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

As global markets experience a rebound, driven by cooling inflation and robust bank earnings, small-cap stocks are capturing attention with the S&P MidCap 400 Index seeing notable gains. In this environment, investors are increasingly interested in companies with strong fundamentals that can weather economic fluctuations and capitalize on emerging opportunities. Identifying such stocks requires a focus on financial health, growth potential, and market positioning—qualities that Jiangxi Bestoo Energy Ltd and other promising small caps possess.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Suraj | 37.84% | 15.84% | 63.29% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

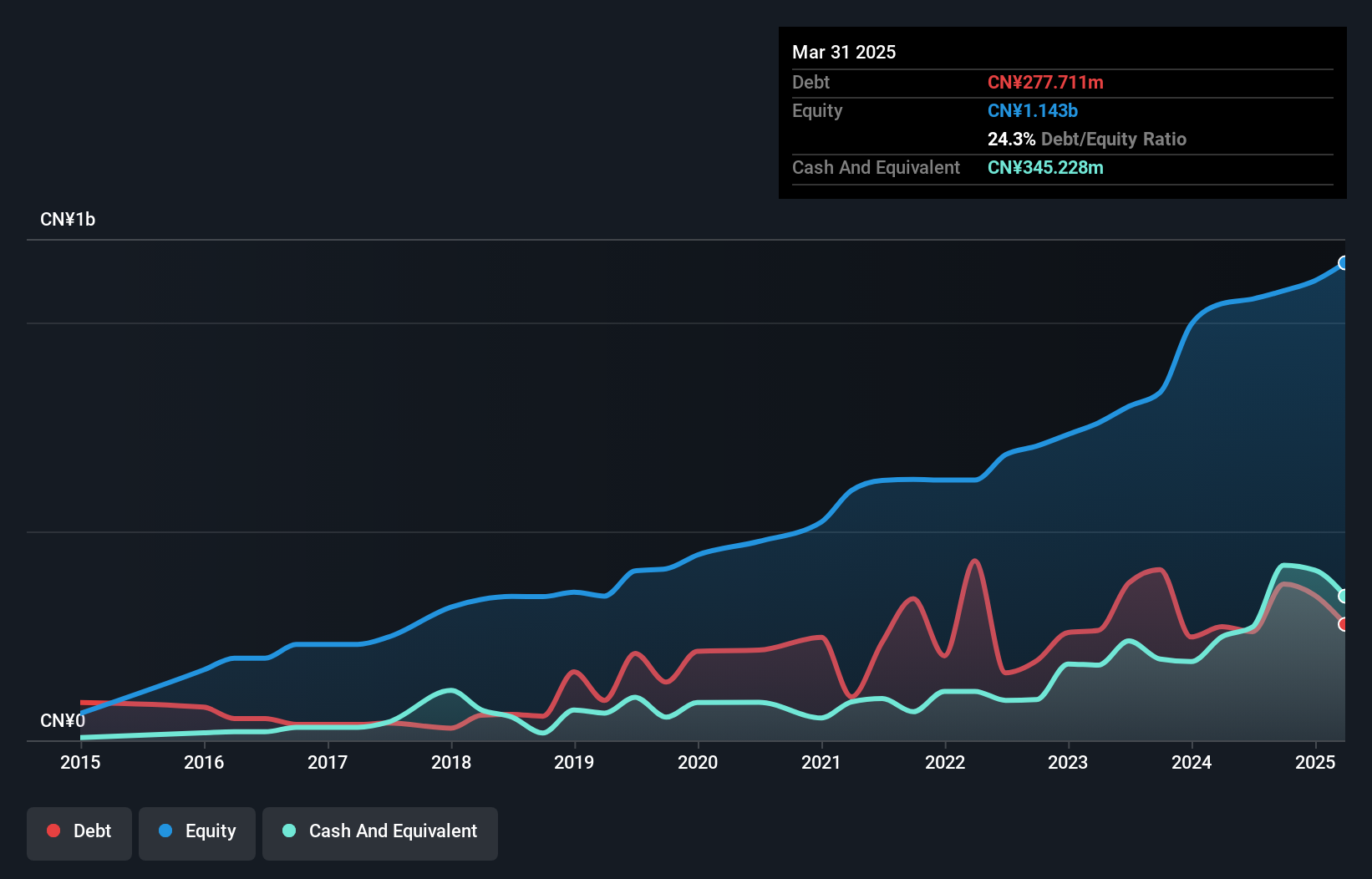

Jiangxi Bestoo EnergyLtd (SZSE:001376)

Simply Wall St Value Rating: ★★★★★☆

Overview: Jiangxi Bestoo Energy Co., Ltd. offers centralized heating services to industrial parks and downstream industrial customers in China, with a market capitalization of CN¥6.26 billion.

Operations: Jiangxi Bestoo Energy Co., Ltd. generates revenue primarily from providing centralized heating services to industrial parks and downstream industrial customers in China. The company's net profit margin is a key financial metric, reflecting its profitability relative to total revenue.

Jiangxi Bestoo Energy, a small yet promising player, has been making waves with its robust financial health and strategic moves. Over the past year, earnings surged by 39.7%, significantly outpacing the Water Utilities industry's modest 0.8% growth. The company boasts more cash than total debt, ensuring a solid financial footing while maintaining high-quality earnings and positive free cash flow. Recent buybacks saw 1.8 million shares repurchased for CNY 26.47 million to support employee stock ownership plans, reflecting confidence in its future trajectory despite a slight increase in the debt-to-equity ratio from 33.9% to 34.7%.

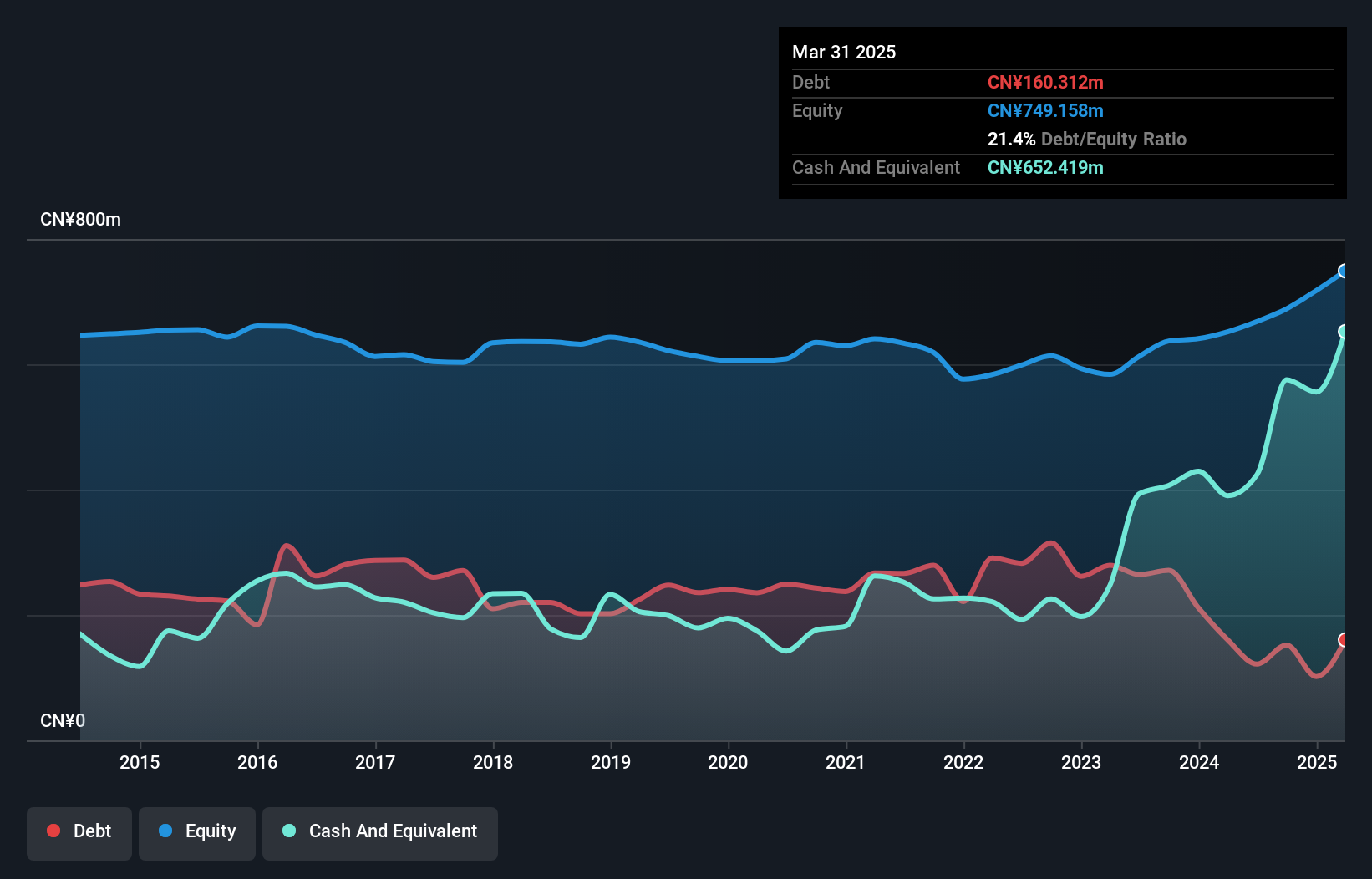

Guangzhou Tech-Long Packaging MachineryLtd (SZSE:002209)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangzhou Tech-Long Packaging Machinery Co., Ltd. specializes in manufacturing and supplying packaging machinery solutions, with a market cap of CN¥2.17 billion.

Operations: Revenue streams for Tech-Long primarily derive from its packaging machinery solutions. The company has a market cap of CN¥2.17 billion, indicating its scale in the industry.

Guangzhou Tech-Long, a modestly-sized player in the packaging machinery sector, shows promising signs despite some challenges. Over the past five years, its debt to equity ratio has impressively decreased from 38.5% to 22.1%, reflecting stronger financial health. The company trades at 63.1% below estimated fair value, suggesting potential undervaluation in the market. Recent earnings reveal sales of CNY 960 million compared to last year's CNY 910 million; however, net income dipped slightly to CNY 41.94 million from CNY 47.76 million previously reported. With high-quality earnings and strong EBIT covering interest payments by a factor of over 359x, it seems well-positioned within its industry context.

- Dive into the specifics of Guangzhou Tech-Long Packaging MachineryLtd here with our thorough health report.

Understand Guangzhou Tech-Long Packaging MachineryLtd's track record by examining our Past report.

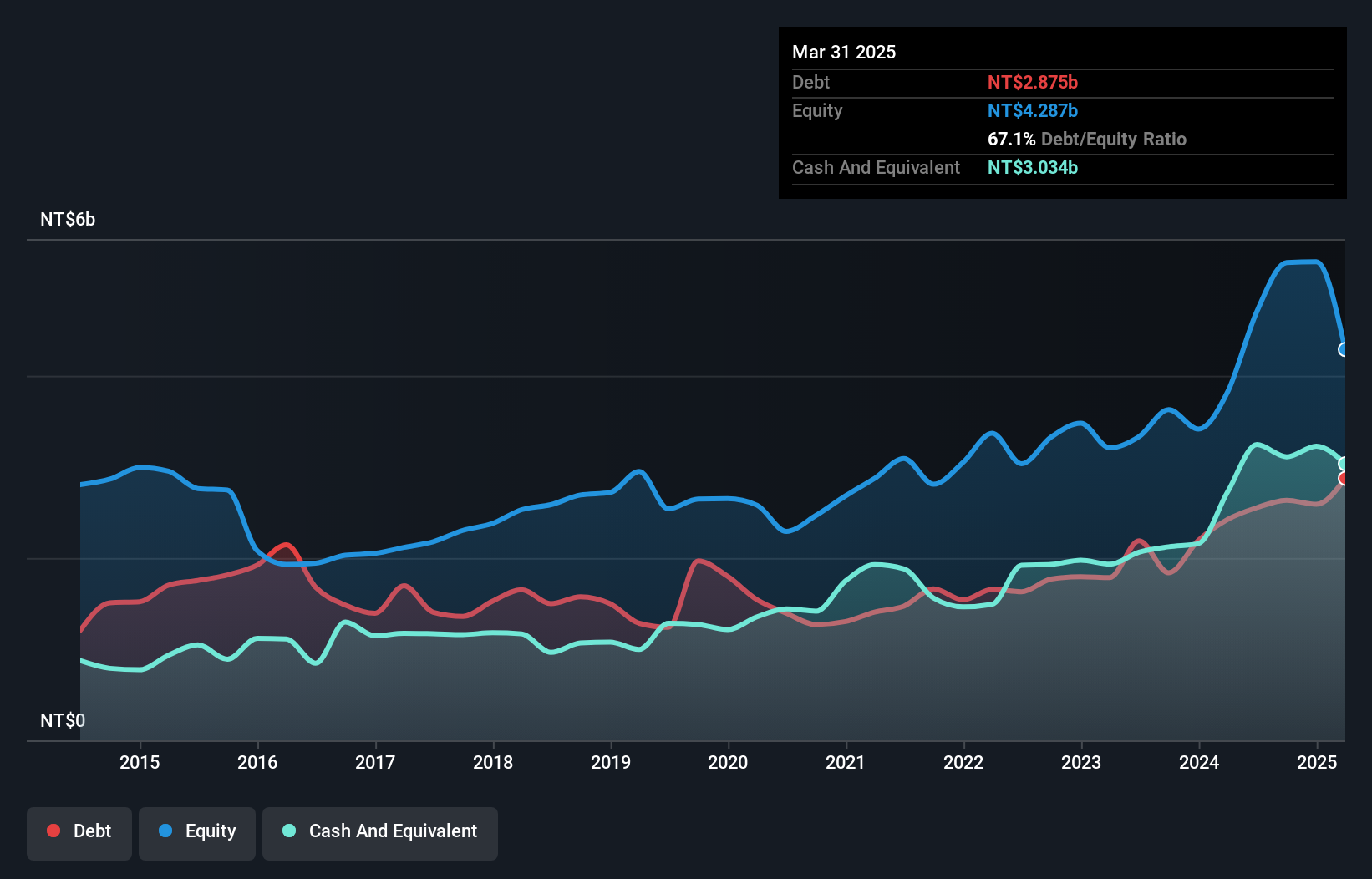

C Sun Mfg (TWSE:2467)

Simply Wall St Value Rating: ★★★★★★

Overview: C Sun Mfg Ltd., along with its subsidiaries, offers a range of processing equipment in Taiwan, China, and internationally, with a market capitalization of NT$29.17 billion.

Operations: C Sun Mfg Ltd. generates revenue primarily from its subsidiaries, with Zhisheng Industry contributing NT$2.46 billion and Suzhou Top Creation Machines Co Ltd. adding NT$1.44 billion to the total revenue streams.

C Sun Mfg, a smaller player in the machinery sector, has shown impressive growth with earnings jumping 23.5% over the past year, outpacing the industry average of 14.6%. The firm's debt to equity ratio has improved significantly from 74.4% to 50.2% over five years, indicating better financial health. Recently, C Sun completed a share buyback of 803,000 shares for TWD 184.63 million as part of its employee incentives plan. Despite a highly volatile share price recently, its net income for Q3 was TWD 164.98 million on sales of TWD 1 billion compared to last year's figures showing steady performance improvements.

Key Takeaways

- Gain an insight into the universe of 4651 Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2467

C Sun Mfg

Provides various processing equipment in Taiwan, China, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives