In a global market environment characterized by declining major stock indexes and expectations of further interest rate cuts from the Federal Reserve, investors are increasingly seeking stability amidst volatility. With growth stocks recently outperforming value stocks and inflationary pressures persisting, dividend stocks present an appealing option for those looking to generate income while potentially benefiting from long-term capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.05% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.22% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.32% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

Click here to see the full list of 1849 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

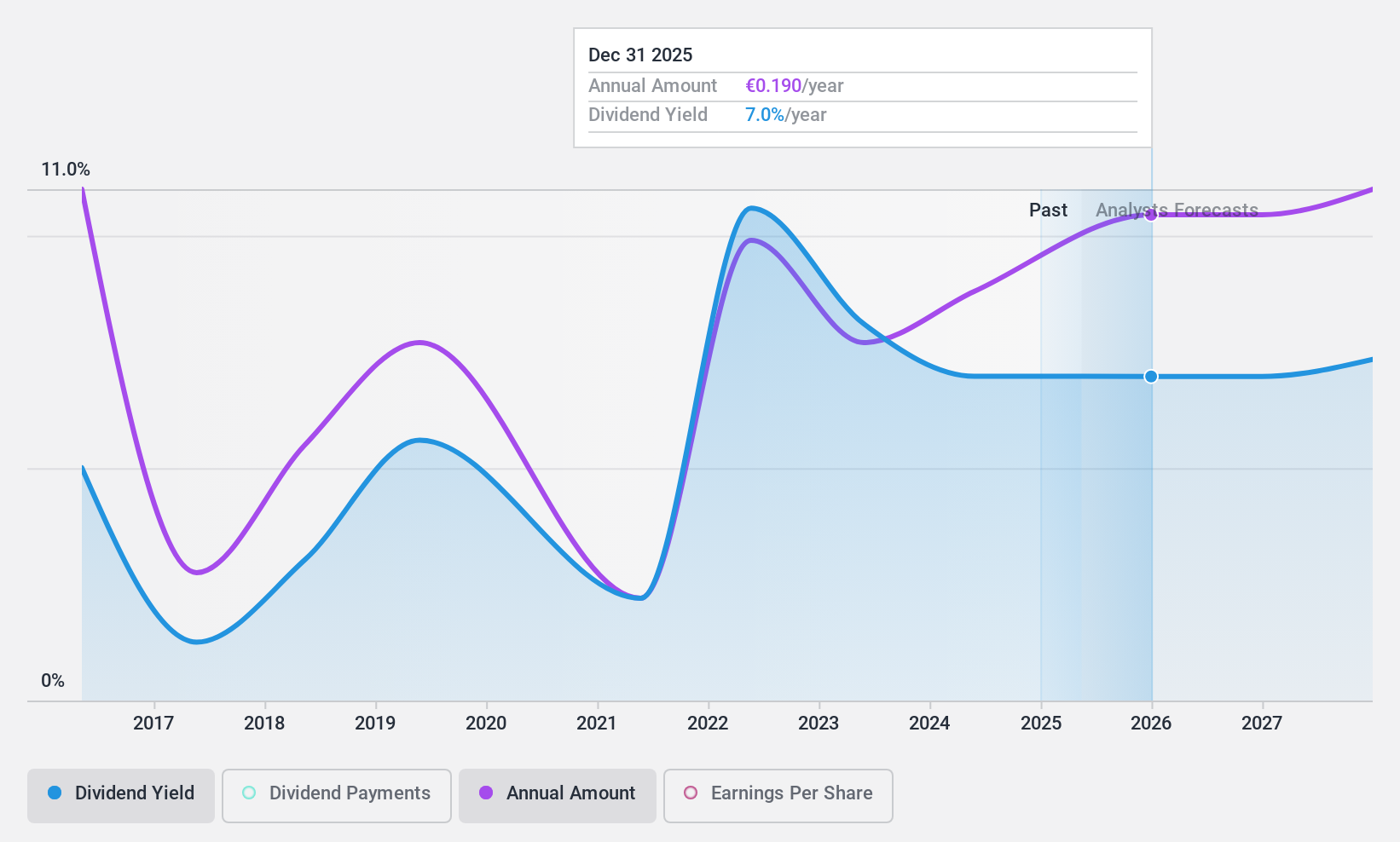

Cairo Communication (BIT:CAI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cairo Communication S.p.A. is a communication company operating mainly in Italy and Spain, with a market cap of €344.78 million.

Operations: Cairo Communication S.p.A.'s revenue segments include RCS at €861.70 million, Advertising at €357.40 million, Magazine Publishing Cairo Editore at €81.40 million, and TV Publishing La7 and Network Operator at €120 million.

Dividend Yield: 6.2%

Cairo Communication's dividend payments have been volatile over the past decade, with significant annual drops. Despite this, dividends are well covered by earnings and cash flows, with a payout ratio of 50.2% and a cash payout ratio of 23.8%. The company's dividend yield is in the top 25% of Italian market payers but remains unreliable due to its unstable track record. Recent earnings show improved net income despite slight revenue decline.

- Click here and access our complete dividend analysis report to understand the dynamics of Cairo Communication.

- Our valuation report here indicates Cairo Communication may be undervalued.

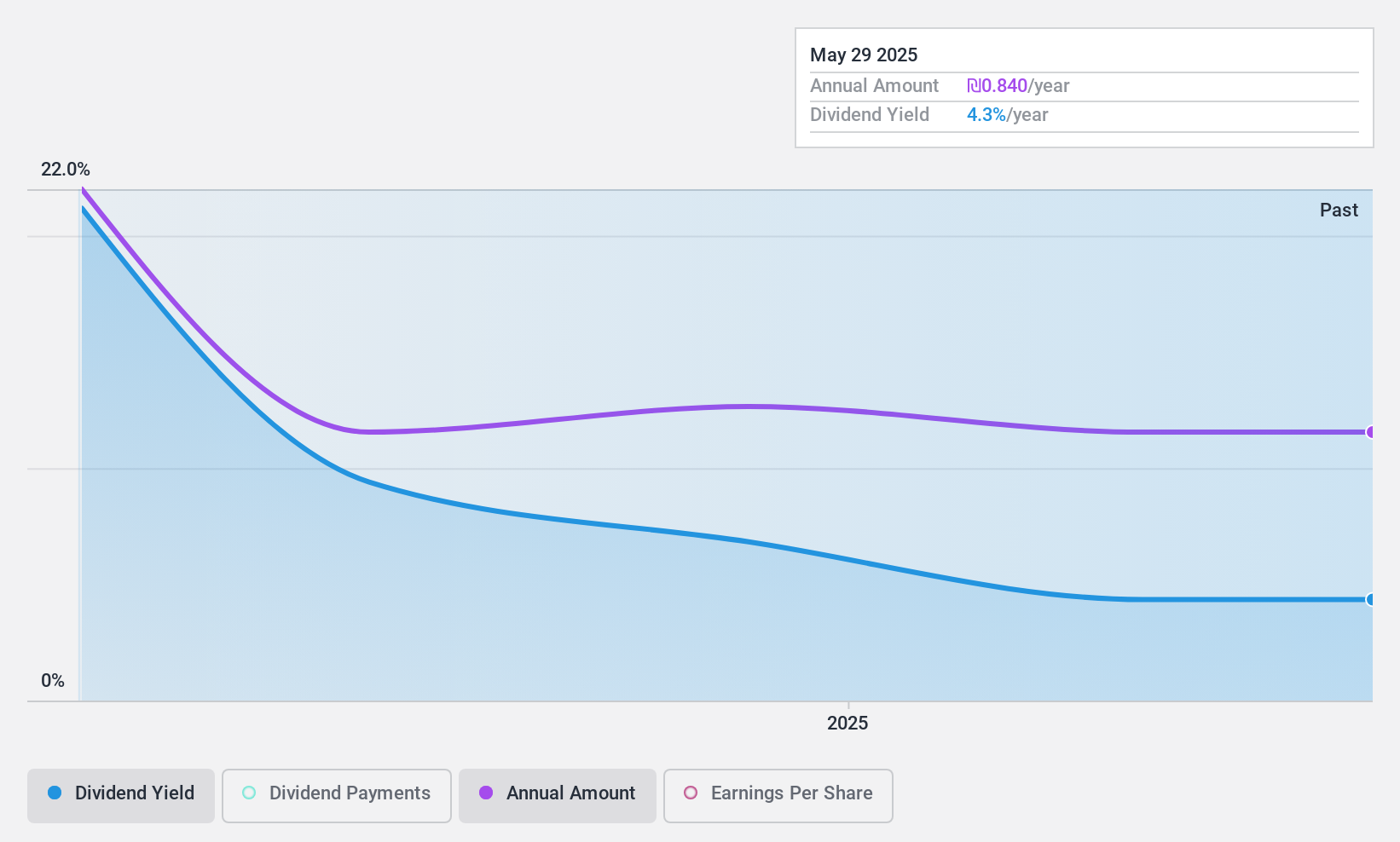

Meitav Trade Investments (TASE:MTRD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Meitav Trade Investments Ltd offers financial investment services and has a market cap of ₪432.65 million.

Operations: Meitav Trade Investments Ltd generates revenue from its asset management segment, totaling ₪175.70 million.

Dividend Yield: 8.3%

Meitav Trade Investments recently initiated dividend payments, with a cash payout ratio of 69.2% and earnings coverage at 45.6%, indicating sustainability. The dividend yield is notably high, ranking in the top 25% of the Israeli market. Recent financials show increased revenue to ILS 46.12 million and net income of ILS 11.74 million for Q3, suggesting solid performance despite a slight decline in earnings per share from continuing operations compared to last year.

- Click to explore a detailed breakdown of our findings in Meitav Trade Investments' dividend report.

- Our comprehensive valuation report raises the possibility that Meitav Trade Investments is priced lower than what may be justified by its financials.

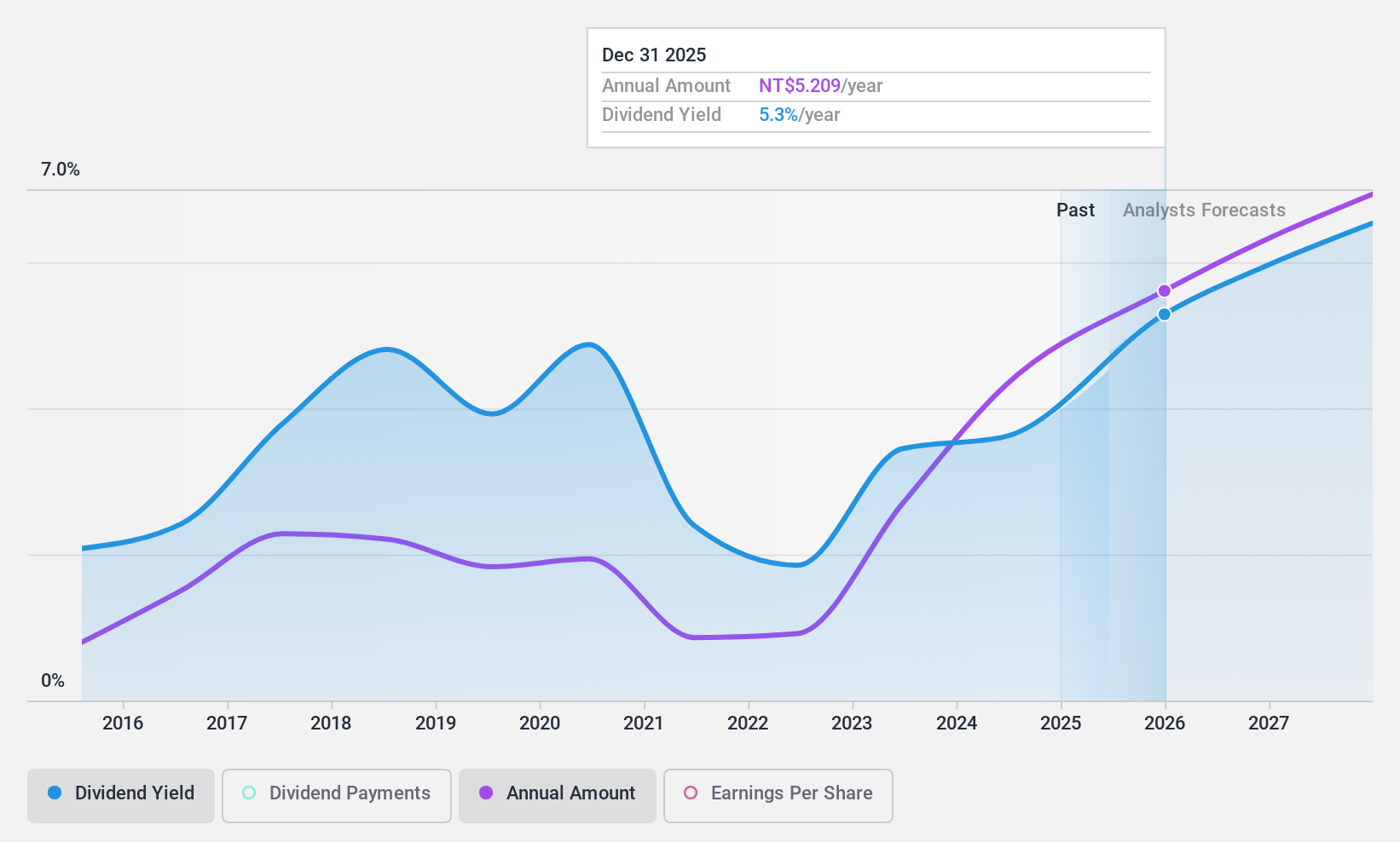

Tong Yang Industry (TWSE:1319)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tong Yang Industry Co., Ltd. manufactures and sells automobile and motorcycle parts, components, and models in Taiwan, China, the United States, and internationally with a market cap of NT$67.13 billion.

Operations: Tong Yang Industry Co., Ltd. generates revenue from the production and distribution of automotive and motorcycle parts, components, and models across various markets including Taiwan, China, the United States, and other international regions.

Dividend Yield: 3.5%

Tong Yang Industry's dividend payments are covered by both earnings and cash flows, with payout ratios of 60.8% and 79.8% respectively, yet the dividends have been volatile over the past decade. Recent earnings for Q3 showed a slight decline in net income to TWD 882.78 million despite increased sales, indicating a mixed financial picture. The dividend yield of 3.52% is below the top tier in Taiwan's market, suggesting room for improvement in attractiveness to dividend investors.

- Navigate through the intricacies of Tong Yang Industry with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Tong Yang Industry's share price might be too pessimistic.

Seize The Opportunity

- Navigate through the entire inventory of 1849 Top Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:CAI

Cairo Communication

Operates as a communication company primarily in Italy and Spain.

Undervalued with solid track record and pays a dividend.