- Israel

- /

- Real Estate

- /

- TASE:AFRE

3 Undiscovered Gems In Middle East With Promising Potential

Reviewed by Simply Wall St

As the Middle East markets navigate mixed signals from easing U.S.-China trade tensions and tepid earnings reports, investors are keenly observing how these dynamics influence small-cap stocks in the region. In this context, identifying promising stocks involves looking for companies with strong fundamentals that can weather economic fluctuations and leverage regional growth opportunities effectively.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 3.53% | 16.38% | 21.65% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

LDR Turizm (IBSE:LIDER)

Simply Wall St Value Rating: ★★★★☆☆

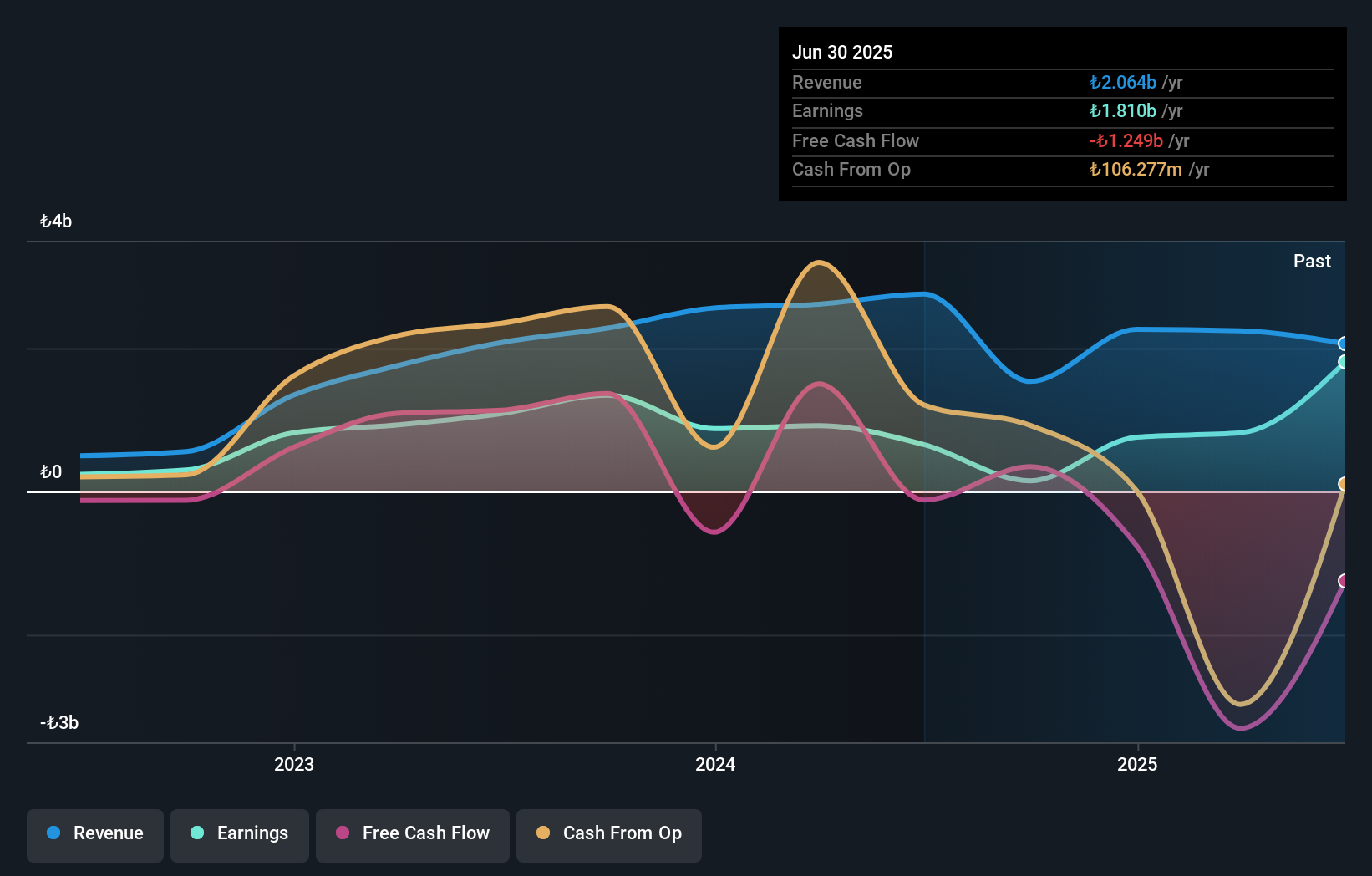

Overview: LDR Turizm A.S. specializes in providing long-term car rental services, with a market capitalization of TRY53.71 billion.

Operations: The primary revenue stream for LDR Turizm comes from its rental and leasing segment, generating TRY2.06 billion. The company focuses on long-term car rental services.

LDR Turizm, a notable player in the Middle East's transportation sector, has shown remarkable financial agility. Over the past year, earnings surged by 176.5%, outpacing the industry growth of 80.1%. The company's debt-to-equity ratio impressively decreased from 354.9% to just 21% over five years, indicating effective debt management. Despite a dip in sales for Q2 and six months ending June 2025 (TRY 442 million and TRY 1 billion respectively), net income skyrocketed to TRY 1,012 million for Q2 and TRY 1,267 million for six months compared to previous figures of TRY 21 million and TRY 215 million respectively.

- Unlock comprehensive insights into our analysis of LDR Turizm stock in this health report.

Gain insights into LDR Turizm's historical performance by reviewing our past performance report.

Africa Israel Residences (TASE:AFRE)

Simply Wall St Value Rating: ★★★★☆☆

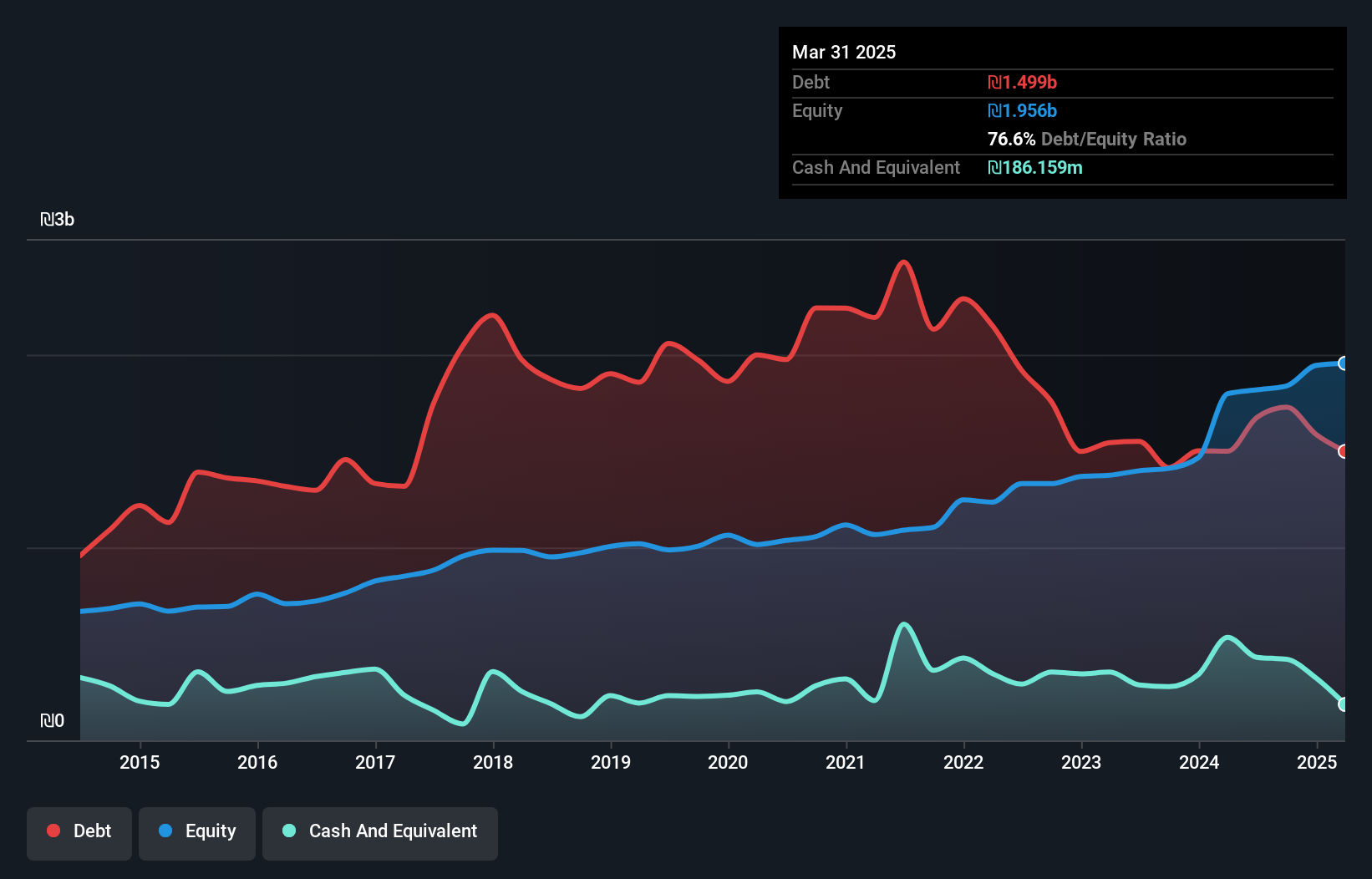

Overview: Africa Israel Residences Ltd focuses on the development and sale of residential units under the Savyonim brand in Israel, with a market capitalization of ₪3.72 billion.

Operations: Africa Israel Residences Ltd generates revenue primarily through the promotion of projects, contributing ₪1.13 billion, and initiation of rental housing at ₪22.56 million. The company's market capitalization stands at approximately ₪3.72 billion.

Africa Israel Residences, a relatively smaller player in the real estate sector, has shown consistent earnings growth of 10% annually over five years. Despite a recent one-off gain of ₪80.3M impacting its financials, the company managed to reduce its debt to equity ratio significantly from 190.5% to 83.9%. However, their net income for Q2 was ₪21.06M compared to ₪33.92M last year, with sales dropping from ₪244.37M to ₪216.16M during the same period. The company's interest payments are well covered by EBIT at 3.6 times coverage, indicating sound financial management despite high net debt levels at 72.4%.

- Click here to discover the nuances of Africa Israel Residences with our detailed analytical health report.

Assess Africa Israel Residences' past performance with our detailed historical performance reports.

Neto Malinda Trading (TASE:NTML)

Simply Wall St Value Rating: ★★★★★☆

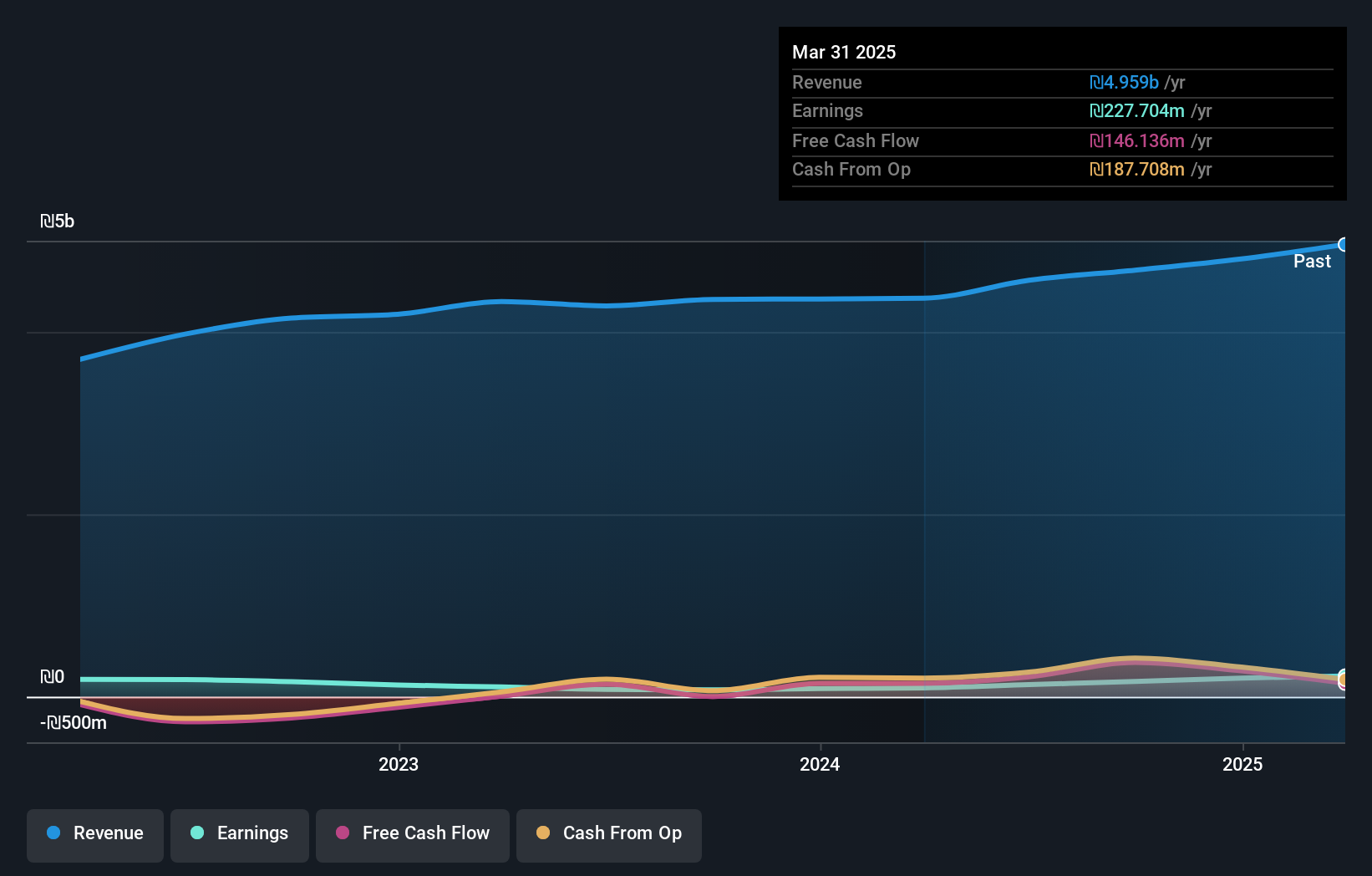

Overview: Neto Malinda Trading Ltd. is involved in the manufacturing, importing, marketing, and distribution of kosher food products with a market cap of ₪2.83 billion.

Operations: Neto Malinda Trading generates revenue primarily from three segments: import (₪1.86 billion), local market sales (₪2.32 billion), and Neto Group factories (₪757.57 million). The company's net profit margin shows a notable trend, reflecting its operational efficiency in managing costs relative to its revenue streams.

Neto Malinda Trading, a dynamic player in the food industry, has shown impressive earnings growth of 71% over the past year, outpacing the sector's 42.1%. With a price-to-earnings ratio of 12.6x below the IL market average of 15.9x, it offers good value for investors. The company's net debt to equity ratio is a satisfactory 9%, indicating prudent financial management. Recent inclusion in the S&P Global BMI Index highlights its growing recognition. Despite slightly decreased quarterly sales and income compared to last year, six-month results show improved net income at ILS 104.41 million from ILS 83.51 million previously.

Seize The Opportunity

- Access the full spectrum of 210 Middle Eastern Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:AFRE

Africa Israel Residences

Develops and sells residential units under the Savyonim brand in Israel.

Proven track record with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)