- Turkey

- /

- Infrastructure

- /

- IBSE:EGGUB

Emirates Driving Company P.J.S.C And 2 Other Undiscovered Gems in Middle East

Reviewed by Simply Wall St

As Gulf markets experience gains ahead of anticipated U.S. labor data, investor sentiment is buoyed by expectations of potential interest rate cuts, which could further stabilize regional economies closely tied to the U.S. dollar. In this dynamic environment, identifying stocks with solid fundamentals and growth potential becomes crucial for investors seeking opportunities in the Middle East's evolving market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| Nofoth Food Products | NA | 15.75% | 27.63% | ★★★★★★ |

| Qassim Cement | 0.30% | 0.78% | -14.65% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Emirates Driving Company P.J.S.C (ADX:DRIVE)

Simply Wall St Value Rating: ★★★★★★

Overview: Emirates Driving Company P.J.S.C., along with its subsidiaries, specializes in managing and developing motor vehicle driving training in the United Arab Emirates, with a market cap of AED3.43 billion.

Operations: Emirates Driving Company generates revenue primarily from car and related services, amounting to AED690.46 million. The company's net profit margin is a key indicator of its profitability.

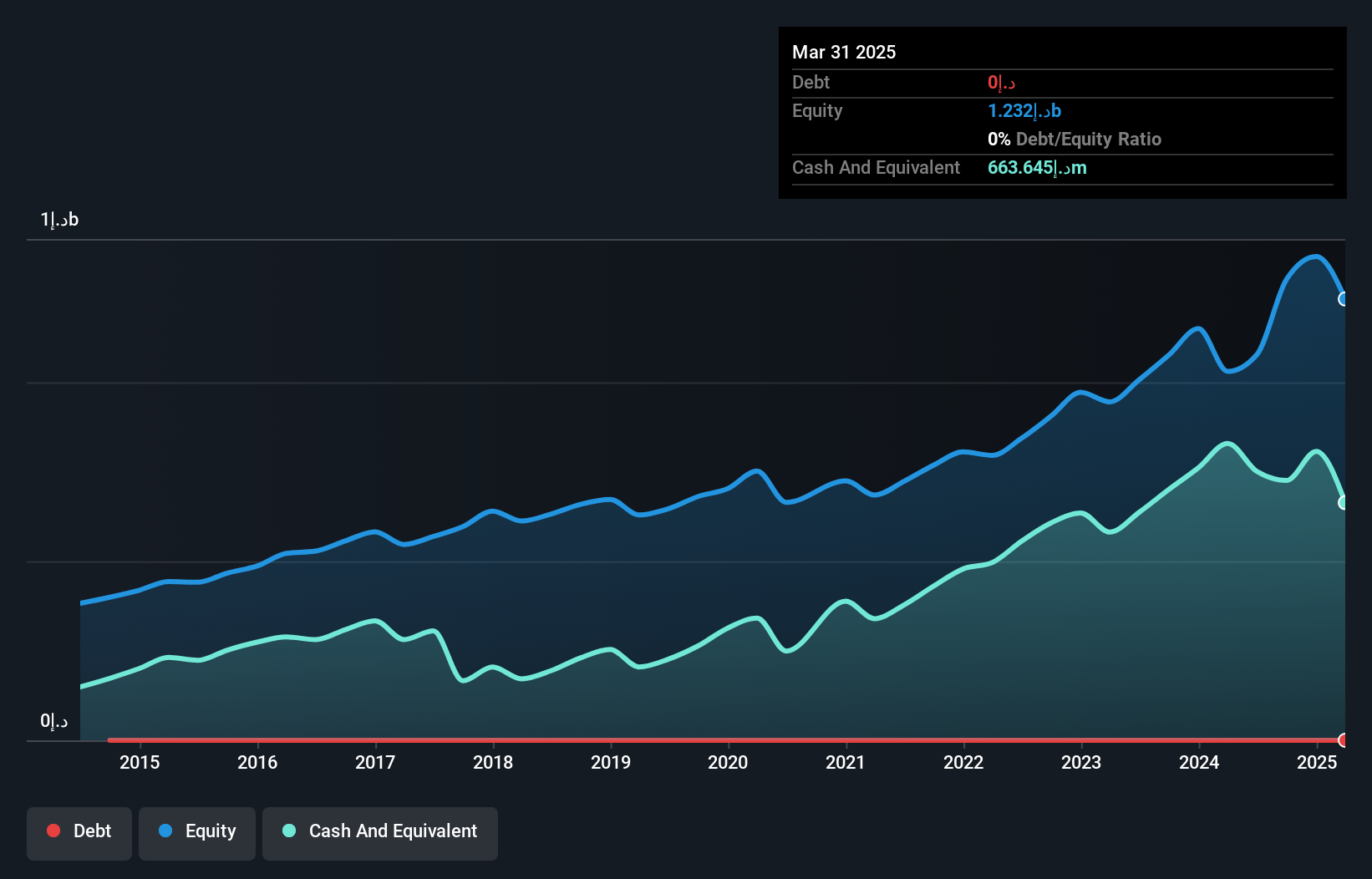

Emirates Driving Company P.J.S.C. showcases robust financial health, with no debt burden for the past five years and trading at 31% below its estimated fair value, suggesting potential undervaluation. Recent earnings results highlight significant growth, with second-quarter sales at AED 186.23 million, more than doubling from AED 85.66 million last year, and net income rising to AED 87.22 million from AED 55.33 million a year ago. Despite a dip in profit margins to 45% from last year's 72%, the company's earnings growth of nearly 19% outpaces the Consumer Services industry's average of about 6%.

Ege Gübre Sanayii (IBSE:EGGUB)

Simply Wall St Value Rating: ★★★★★★

Overview: Ege Gübre Sanayii A.S., along with its subsidiary TCE EGE Konteyner Terminal Isletmeleri A.S., offers port services in Turkey and has a market capitalization of TRY12.27 billion.

Operations: Ege Gübre Sanayii, with its subsidiary TCE EGE Konteyner Terminal Isletmeleri, generates revenue through port services in Turkey. The company has a market capitalization of TRY12.27 billion.

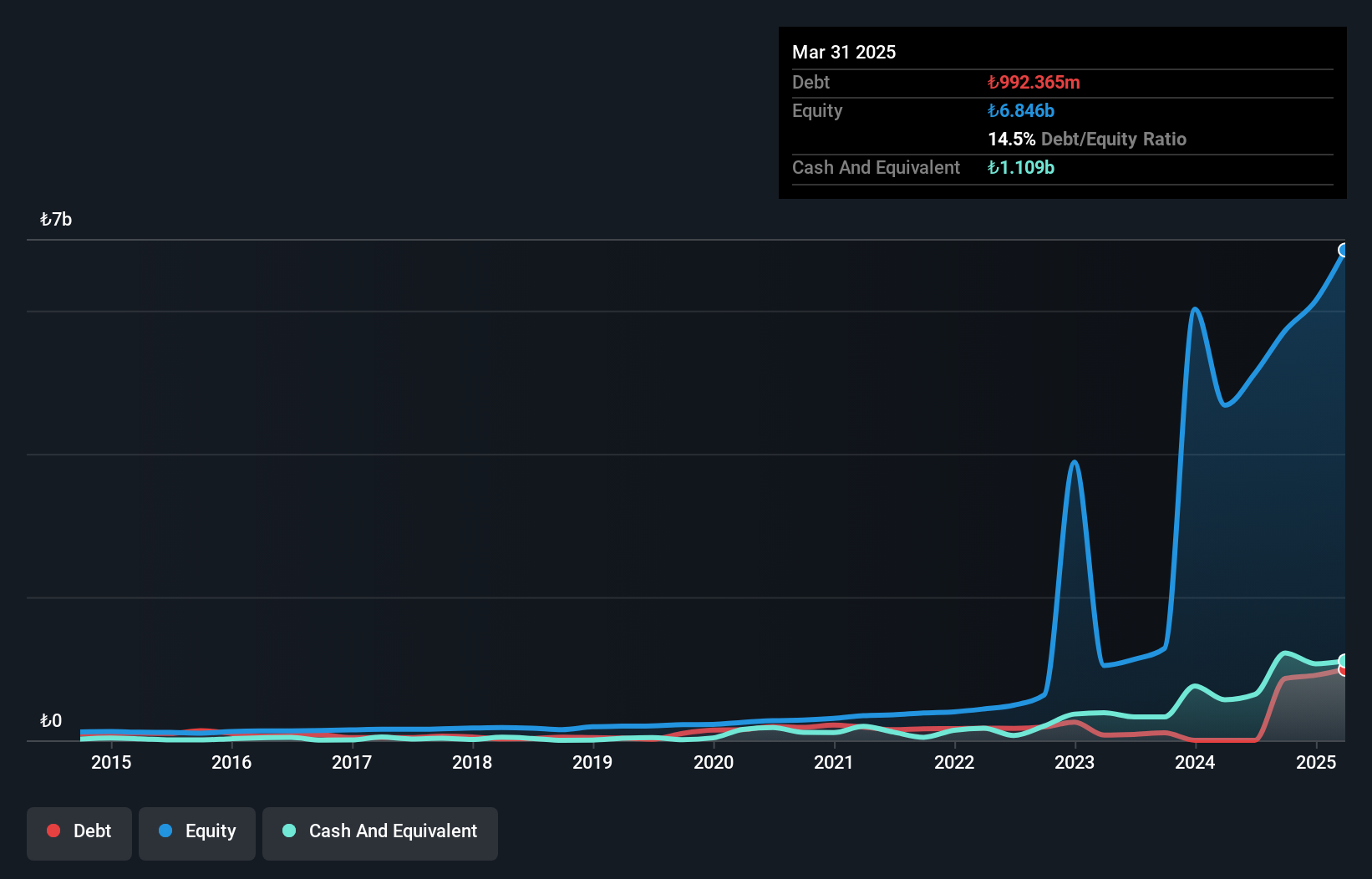

Ege Gübre Sanayii, a small player in the Middle East's industrial sector, shows mixed financial signals. The company trades at nearly 39% below its estimated fair value, suggesting potential undervaluation. Despite a notable drop in earnings growth by 21.5%, its debt management appears strong with a reduction in the debt-to-equity ratio from 70.6% to 16.3% over five years and a satisfactory net debt-to-equity ratio of 3.3%. Recent results show sales of TRY 738 million for Q2, down from TRY 817 million last year, yet six-month net income rose significantly to TRY 257 million from TRY 65 million previously.

- Take a closer look at Ege Gübre Sanayii's potential here in our health report.

Evaluate Ege Gübre Sanayii's historical performance by accessing our past performance report.

Aryt Industries (TASE:ARYT)

Simply Wall St Value Rating: ★★★★★★

Overview: Aryt Industries Ltd., with a market cap of ₪4.72 billion, operates through its subsidiaries to develop, produce, and market electronic thunderbolt systems for the defense sector in Israel.

Operations: The company generates revenue primarily from its electronic thunderbolt systems for the defense sector. It has a market cap of approximately ₪4.72 billion, reflecting its substantial presence in the industry.

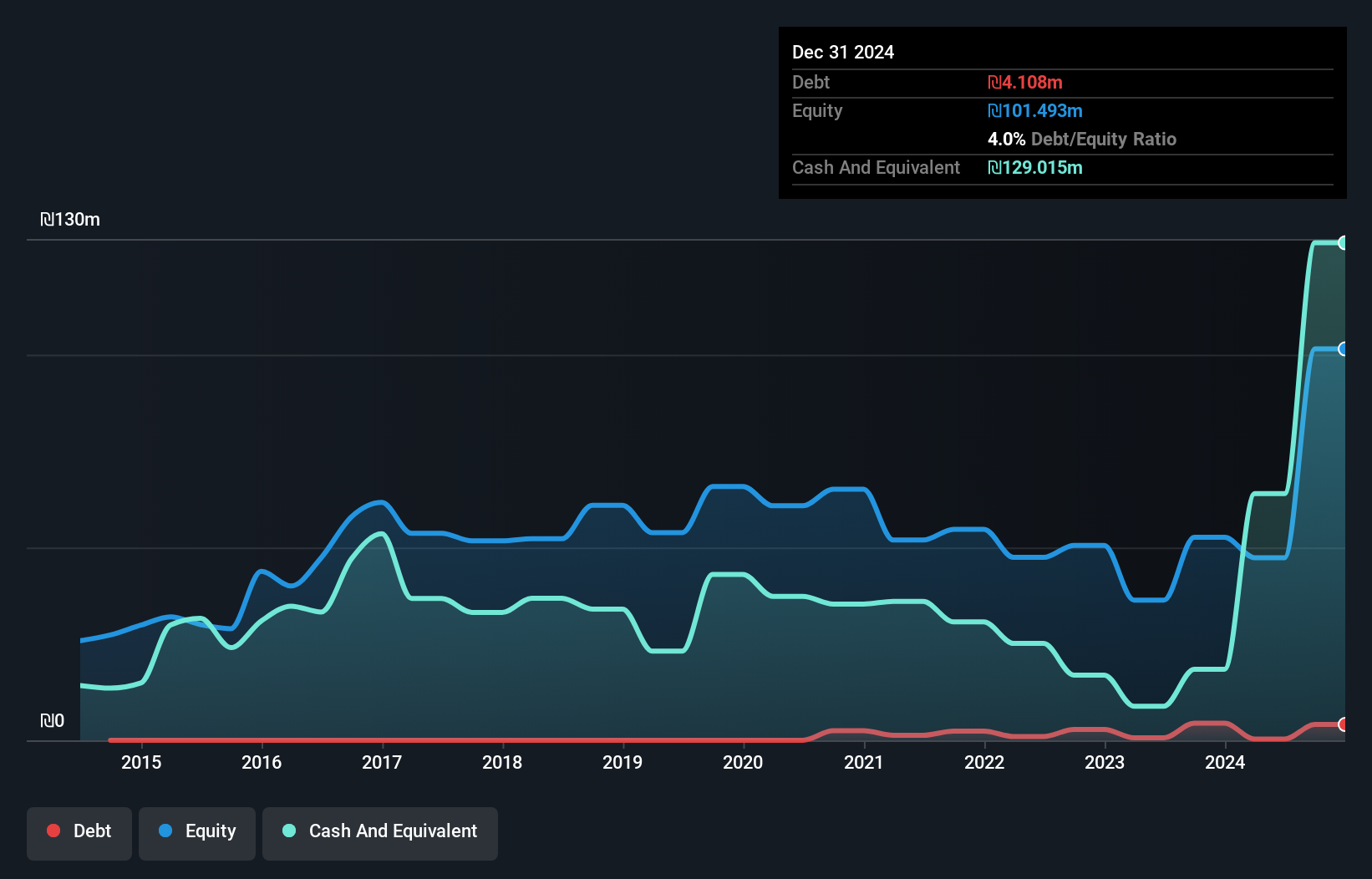

Aryt Industries, a nimble player in the Aerospace & Defense sector, has showcased remarkable growth with earnings surging 578.7% over the past year, outpacing industry averages. The company's recent half-year financials reveal sales jumping to ILS 155.04 million from ILS 29.22 million last year, and net income soaring to ILS 95.79 million from ILS 5.8 million. Trading at a significant discount of about 54.8% below its estimated fair value, Aryt appears undervalued despite its highly volatile share price in recent months and remains debt-free with positive free cash flow trends enhancing its financial stability.

- Click here to discover the nuances of Aryt Industries with our detailed analytical health report.

Understand Aryt Industries' track record by examining our Past report.

Next Steps

- Discover the full array of 199 Middle Eastern Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ege Gübre Sanayii might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:EGGUB

Ege Gübre Sanayii

Together with its subsidiary, TCE EGE Konteyner Terminal Isletmeleri A.S., provides port services in Turkey.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives