- Israel

- /

- Oil and Gas

- /

- TASE:DLEKG

Middle Eastern Dividend Stocks To Watch In August 2025

Reviewed by Simply Wall St

As Gulf stock markets navigate a mixed landscape marked by cautious trading and fluctuating oil prices, investors are keenly observing the impact of global monetary policy shifts on regional indices. In this context, dividend stocks emerge as an attractive option for those seeking steady income streams amidst market volatility and economic uncertainties.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.79% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.54% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.46% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) (DFM:NGI) | 7.03% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.21% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.82% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.80% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.07% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 5.88% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.86% | ★★★★★☆ |

Click here to see the full list of 68 stocks from our Top Middle Eastern Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

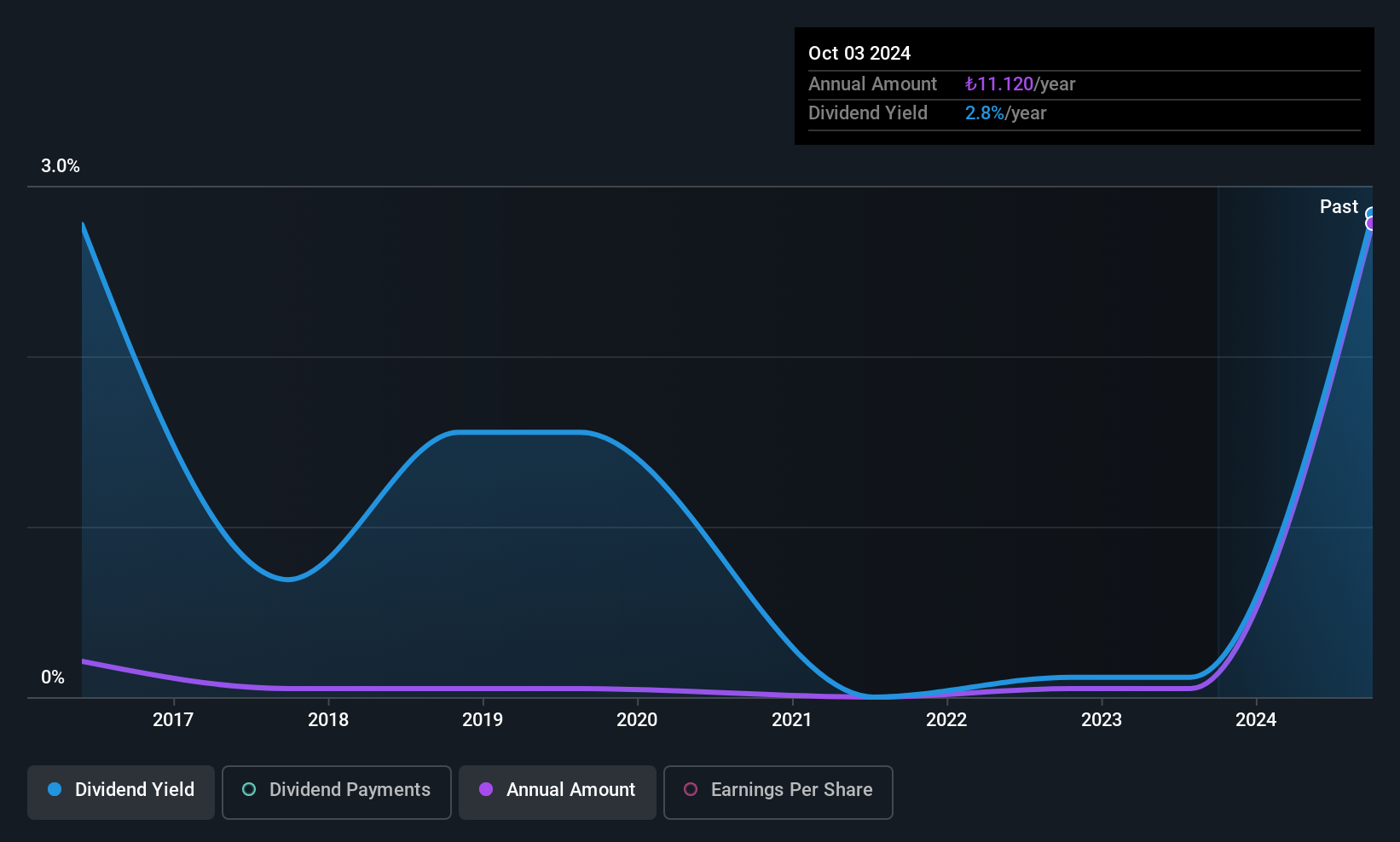

Göltas Göller Bölgesi Cimento Sanayi ve Ticaret (IBSE:GOLTS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Göltas Göller Bölgesi Cimento Sanayi ve Ticaret A.S. operates in the cement industry, focusing on the production and sale of cement products, with a market capitalization of TRY6.22 billion.

Operations: Göltas Göller Bölgesi Cimento Sanayi ve Ticaret's revenue is primarily derived from Construction and Building Materials at TRY5.49 billion, complemented by its Energy segment contributing TRY469.97 million.

Dividend Yield: 3.2%

Göltas Göller Bölgesi Cimento Sanayi ve Ticaret's dividend yield of 3.22% ranks in the top 25% of Turkish market payers. However, its dividend history is volatile, with payments dropping over 20% annually at times. Despite this, the dividends are well-covered by earnings with an 8.2% payout ratio and supported by cash flows at a higher cash payout ratio of 89.6%. The company's profit margins have significantly decreased from last year, posing potential concerns for future stability.

- Dive into the specifics of Göltas Göller Bölgesi Cimento Sanayi ve Ticaret here with our thorough dividend report.

- Our valuation report unveils the possibility Göltas Göller Bölgesi Cimento Sanayi ve Ticaret's shares may be trading at a premium.

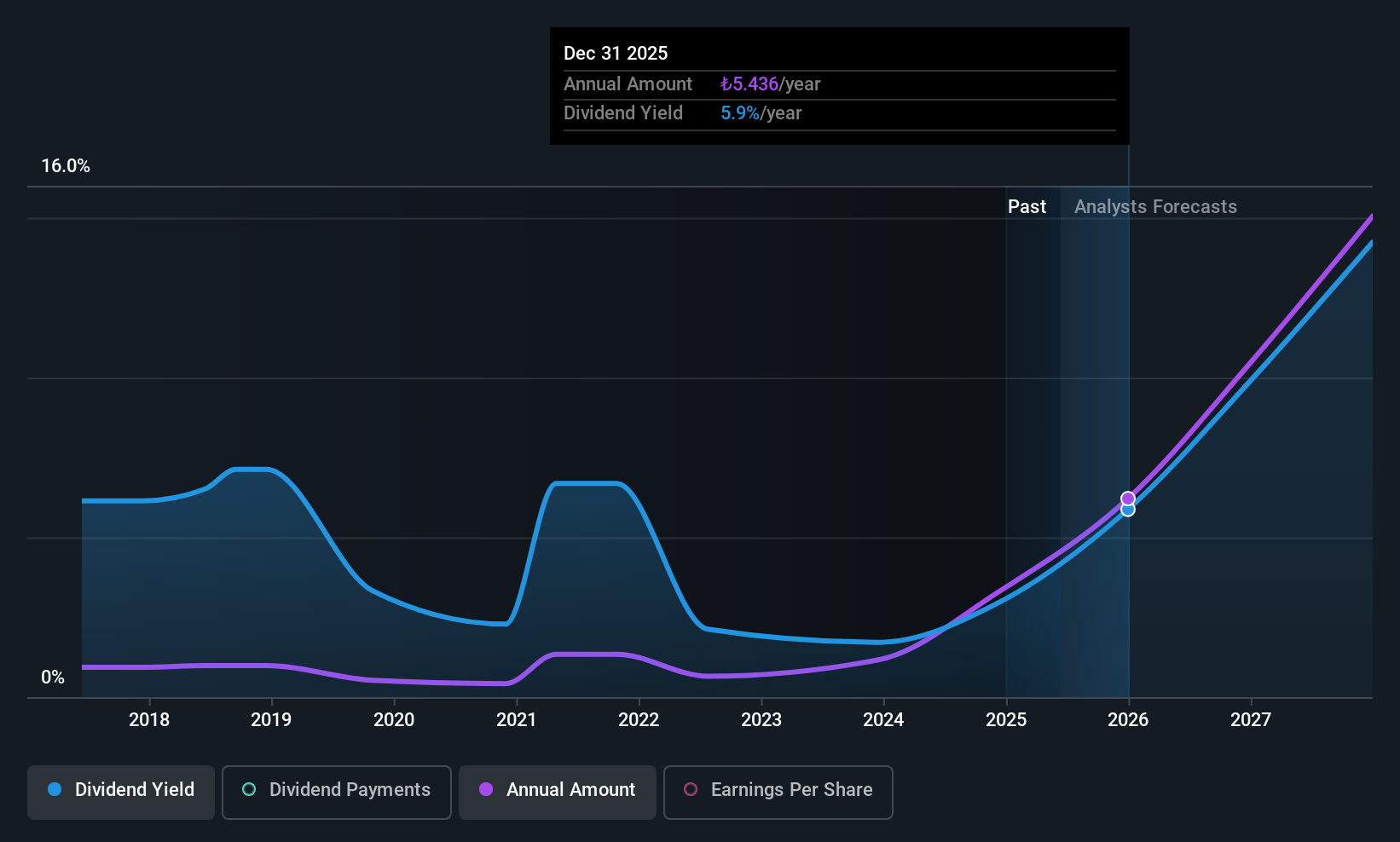

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Turkcell Iletisim Hizmetleri A.S., along with its subsidiaries, offers converged telecommunication and technology services in Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands, with a market cap of TRY215.68 billion.

Operations: Turkcell Iletisim Hizmetleri A.S. generates revenue primarily from Turkcell Turkey at TRY153.66 billion and Techfin at TRY9.88 billion.

Dividend Yield: 3.7%

Turkcell Iletisim Hizmetleri's dividend yield of 3.67% places it among the top 25% in the Turkish market. Despite a volatile dividend history, current payments are well-supported by earnings with a payout ratio of 63.5% and robust cash flows at a cash payout ratio of 20.8%. Recent earnings show growth, with second-quarter revenue reaching TRY 53 billion, indicating potential for sustained payouts if trends continue positively amidst strategic infrastructure investments and partnerships enhancing network capabilities.

- Click here to discover the nuances of Turkcell Iletisim Hizmetleri with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Turkcell Iletisim Hizmetleri shares in the market.

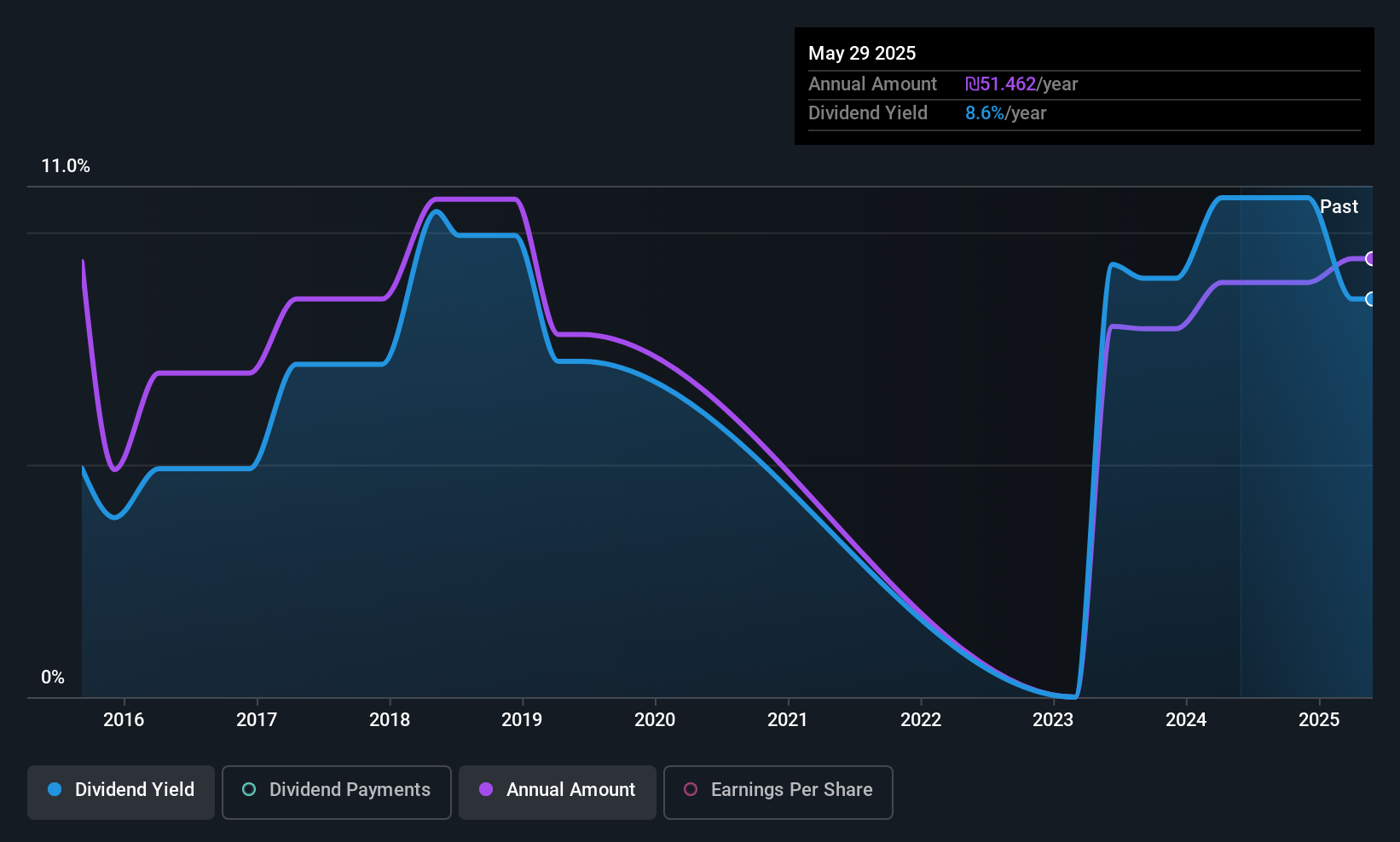

Delek Group (TASE:DLEKG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Delek Group Ltd. is an energy company involved in the exploration, development, production, and marketing of oil and gas both in Israel and internationally, with a market cap of ₪13.49 billion.

Operations: Delek Group Ltd. generates revenue from its segments including Development and Production of Oil and Gas Assets in The North Sea (₪8.12 billion) and Oil and Gas Exploration and Production in Israel and Its Surroundings (₪3.72 billion).

Dividend Yield: 7.0%

Delek Group's dividend yield of 6.98% ranks it in the top 25% of Israeli dividend payers, yet its high payout ratio (91.6%) indicates dividends are not well covered by earnings, though cash flow coverage is reasonable with a cash payout ratio of 31.8%. Despite past volatility and unreliability in payments, dividends have grown over the last decade. However, the company's financial position is pressured by significant debt levels.

- Click here and access our complete dividend analysis report to understand the dynamics of Delek Group.

- In light of our recent valuation report, it seems possible that Delek Group is trading beyond its estimated value.

Turning Ideas Into Actions

- Embark on your investment journey to our 68 Top Middle Eastern Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TASE:DLEKG

Delek Group

An energy company, engages in the exploration, development, production, and marketing of oil and natural gas in Israel and internationally.

Solid track record established dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026